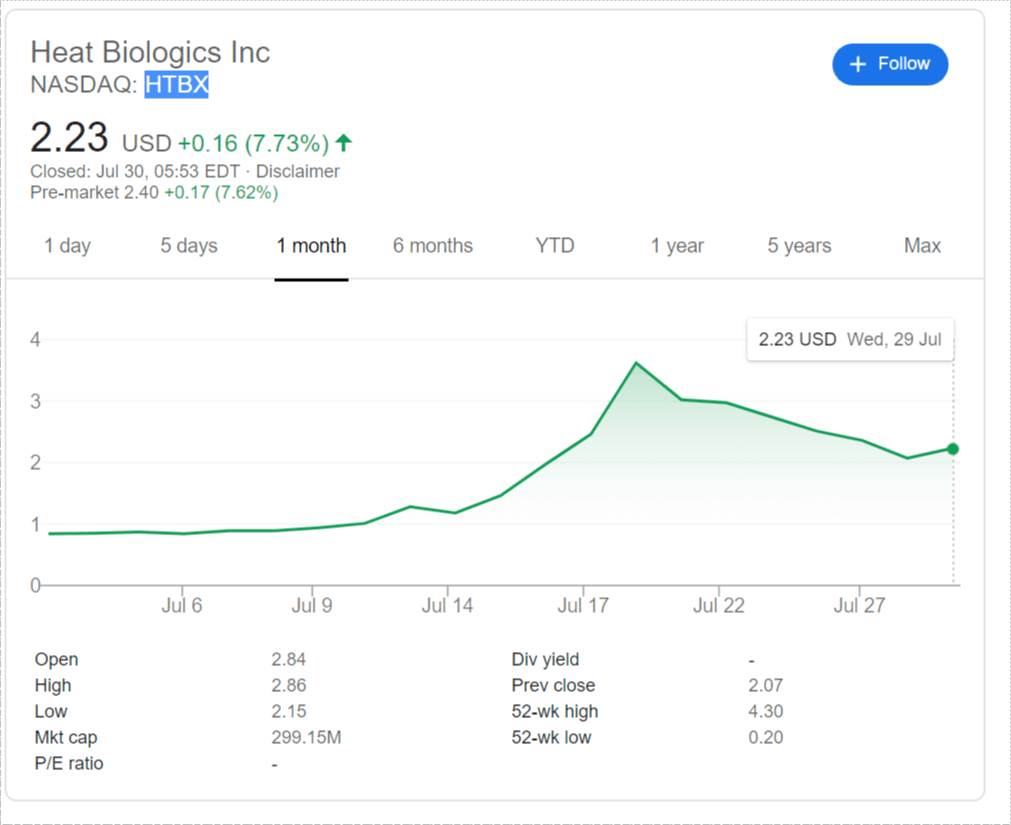

HTBX Stock Price: Heat Biologics set to jump amid speculation of federal funding for coronavirus vaccine (7/30/2020)

- NASDAQ: HTBX is set for a 7% increase on Thursday, following Wednesday's leap of the same scale.

- Speculation that Heat Biologics may receive a government grant may continue fueling the rally.

- Promising pre-clinical data in its coronavirus-vaccine candidate is keeping the stock bid.

The race to develop immunization for coronavirus vaccine is warming up – with Heat Biologics (NASDAQ: HTBX) gaining speed. The Morrisville, North Carolina based firm has yet to generate revenue – but it may receive support from Uncle Sam. The US government has been generously awarding funds to firms working on immunization to COVID-19 – including Kodak, a company that filed for Chapter 11.

Pre-revenue Heat Biologics may be the next in line and that is one of the reasons for the stock's rise. The biotechnology company reported substantial progress in its pre-clinical trial for its coronavirus vaccine candidate. Using animals, HTBX showed that subjects have developed high immunogenicity, opening the door to clinical trials.

Other firms are significantly ahead, conducting Phase 1, 2, and 3 trials. A joint venture between the University of Oxford and AstraZeneca has succeeded in generating double protection in its Phase 1/2 tests in the UK. It is set to enter Phase 3 in September.

Stateside Moderna has kicked off its Phase 3 trial among 30,000 subjects. Nevertheless, both efforts may prove futile and even if they are successful – the government is not waiting. Under Operation Warp Speed (OWS), the federal authorities have been granting money at an impressive pace indeed.

Heat Biologics could accelerate development if it receives a cash injection from the government. Hopes for such a boost are probably already impacting the stock price.

HTBX stock forecast

NASDAQ: HTBX is changing hands at around $2.40 in pre-market trading – up some 7% but still below the 52-week high of $4.07 – giving it ample room to rise. The recent trough of $2.07 serves as a support and is followed by $1.18, another resting point on the way up.

Looking ahead of the 52-week high, the $3 is another stepping stone on the way up – a psychologically significant level.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.