How the S&P 500 reacts to the mysterious dance of the ten-year yield [Video]

![How the S&P 500 reacts to the mysterious dance of the ten-year yield [Video]](https://editorial.fxstreet.com/images/Markets/Equities/SP500/wall_street_nyse1-637299020939878938_XtraLarge.jpg)

Watch the video above extracted from the WLGC session before the market open on 16 Apr 2024 below to find out the following:

-

How does the 10-year yield impact the behavior of the S&P 500, particularly during a market correction

-

The downside target for the S&P 500 should the 10-year yield test the previous high

-

Under what circumstances could the 10-year yield be used as a leading indicator?

-

And a lot more…

Market environment

The bullish vs. bearish setup is 38 to 320 from the screenshot of my stock screener below.

There is a significant change in the market and there is only 1 quality long entry setup and many of the short entry setup with the leveraged ETF and the underlying.

The market was spooked by the inflation and this was discussed during last week’s session.

Watch this 2-min video — 2-Year Yield Futures Surge Spells Trouble

Market comment

1 “low-hanging fruits” TECS (XLK Bear 3X) trade entries setup + 11 actionable setups DRV (XLRE Bear 3X), TSLS (TSLA Bear) were discussed during the live session before the market open (BMO).

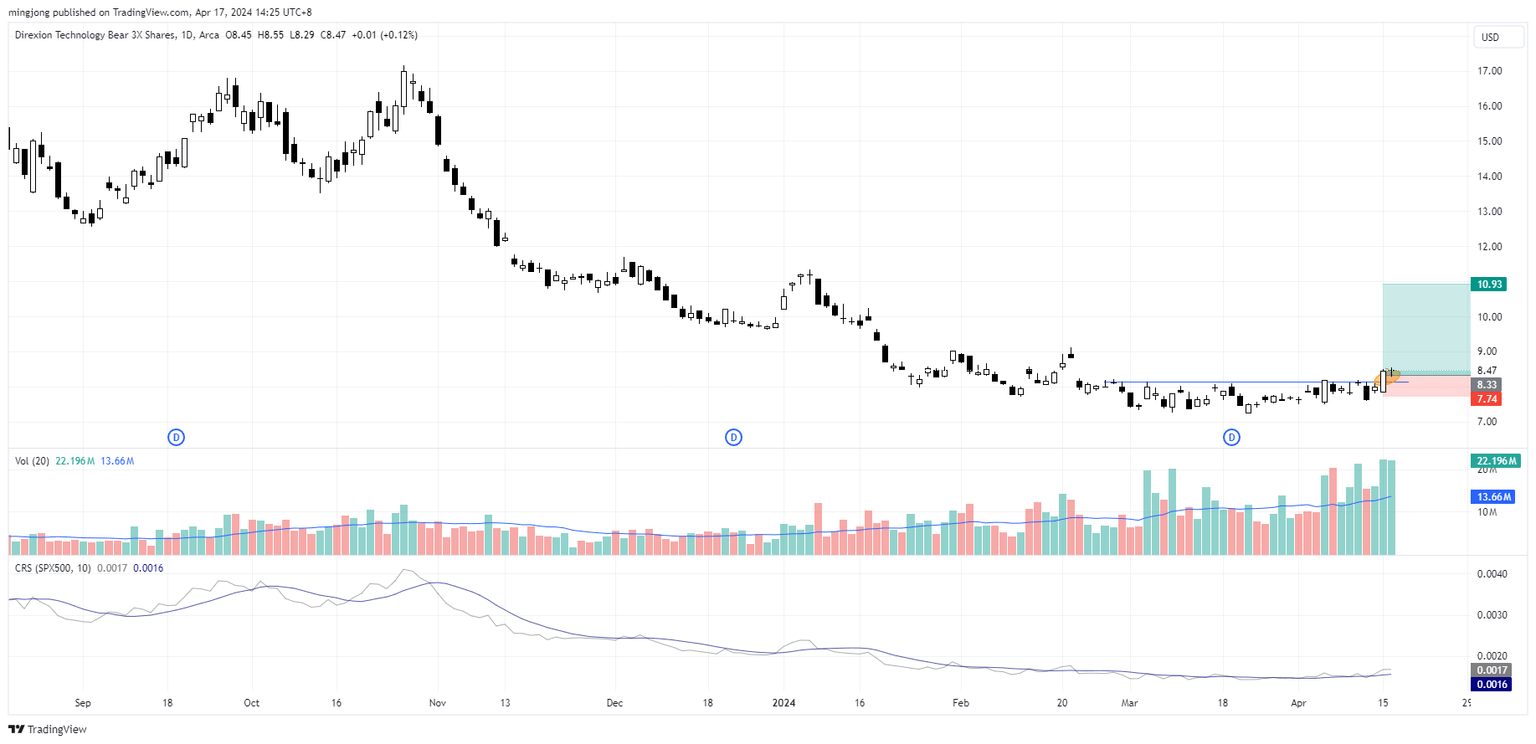

TECS (XLK Bear 3X)

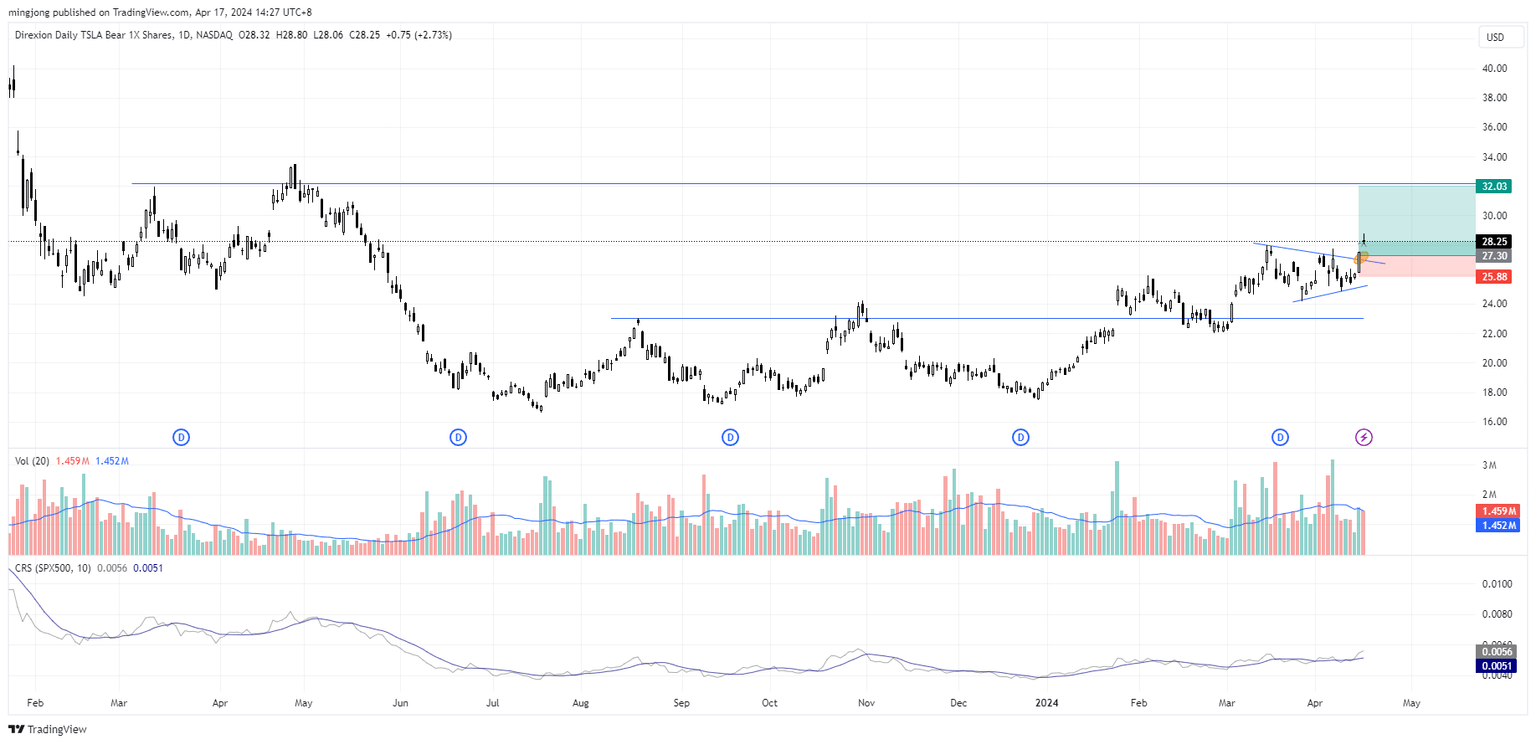

TSLS (TSLA Bear)

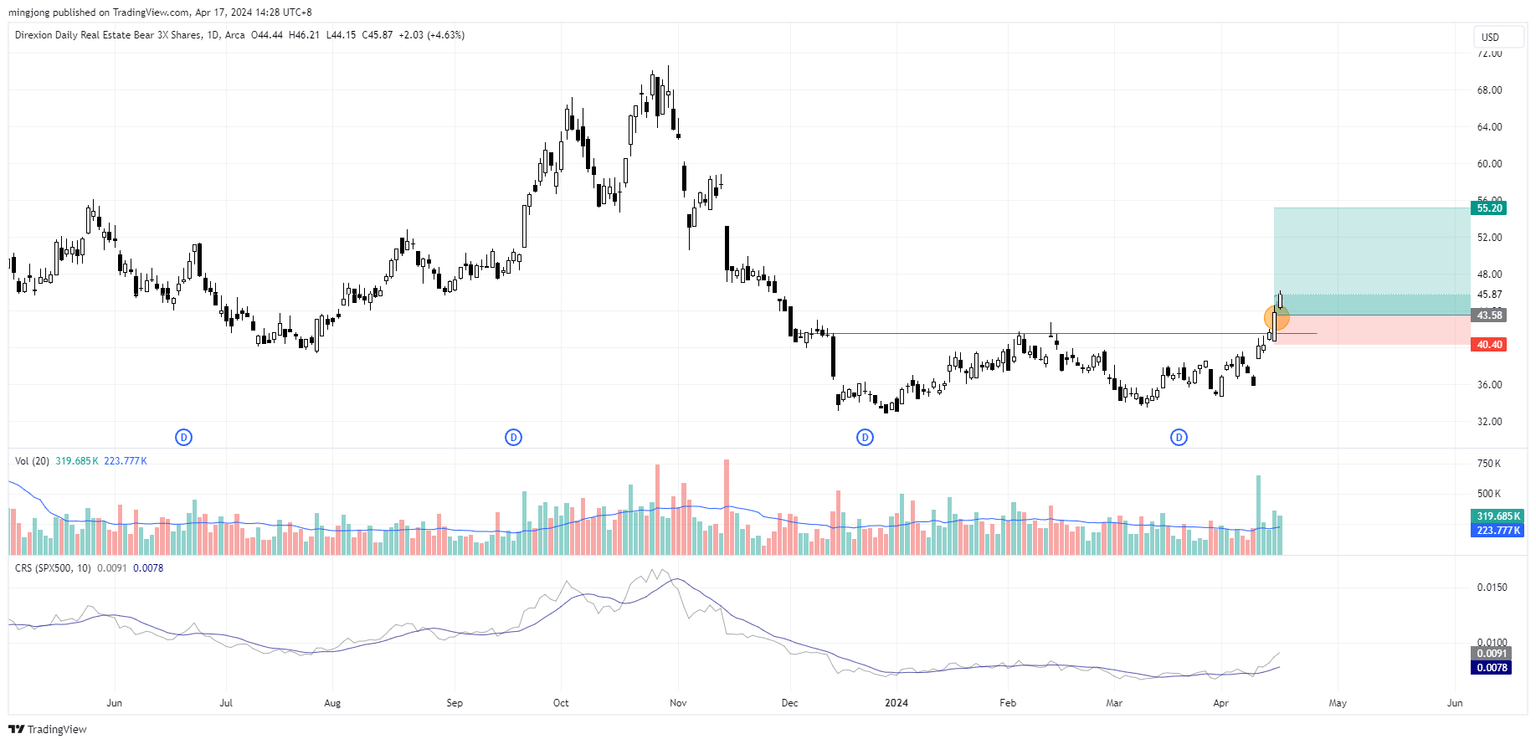

DRV (XLRE Bear 3X)

Author

Ming Jong Tey

Independent Analyst

Ming Jong Tey has been trading since 2008. He started his learning journey from technical analysis (indicators, Fibonacci, etc...) to value investing. Throughout his journey, he develops an interest in price action with chart pattern trading.