HOFV Stock News: Hall of Fame Resort & Entertainment trades flat after NFT surge

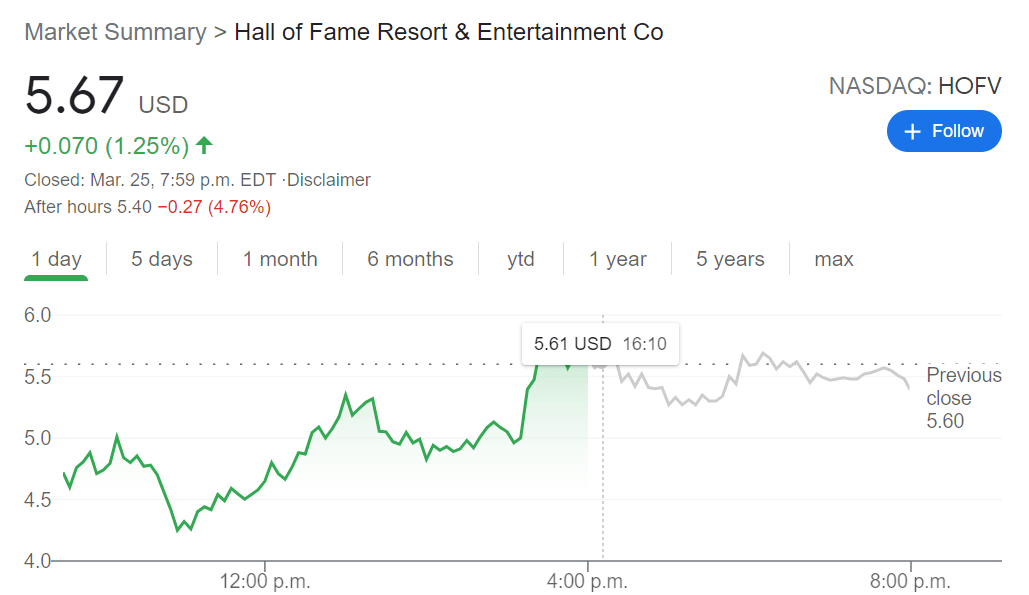

- NASDAQ:HOFV added 1.25% during Thursday's session but dropped in after hours trading.

- Hall of Fame Resort & Entertainment announced a new partnership with Dolphin Entertainment Inc.

- HOFV will attempt to repeat the NBA’s NFT success with the NFL.

NASDAQ:HOFV nearly doubled in price on Wednesday as the company became the latest to join into the digital collectible market. NFTs or Non Fungible Tokens allow collectors to own unique works of art or memorabilia that are digitally encrypted onto the Ethereum Blockchain. Hall of Fame Resort gained 1.25% but mostly traded flat on Thursday as growth stocks took a hit during the ongoing market correction. After hours trading saw HOFV drop 4.76% to erase any gains made during the trading session.

Stay up to speed with hot stocks' news!

The partnership with Dolphin Entertainment Inc. (NASDAQ:DLPN) will allow Hall of Fame Resort’s digitally created NFTs to be sold via Dolphin’s newly created NFT division. Dolphin saw its stock surge alongside HOFV’s as the announcement was the latest to hit the red-hot NFT industry, as companies begin to pile into the crypto-related sector. There has been such a fever pitch around NFT related stocks that some analysts are attributing it to the FOMO or fear of missing out that investors have over the bull-run that Bitcoin and Ethereum have had over the past year.

HOFV stock price forecast

Hall of Fame Resort and Entertainment is attempting to capitalize on the current success of NBA Top Shots, an officially licensed NBA NFT collectible. NBA Top Shots are created and sold by Vancouver’s Dapper Labs, and HOFV is hoping to replicate its success when it offers collectors NFL NFTs. The partnership with Dolphin Entertainment will allow these NFL related collectibles to be created and sold in the same way that NBA Top Shots are. Dapper has already made well over $200 million from its NBA Top Shot product, and HOFV is banking on the NFL’s global appeal to attain similar revenue figures.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Stocks Reporter

FXStreet