Gold Technical Analysis: Metal remains under precious below $1465/oz

- The yellow metal remains under selling pressure on the last day of the month.

- The 1445 level remains on the sellers’ radar.

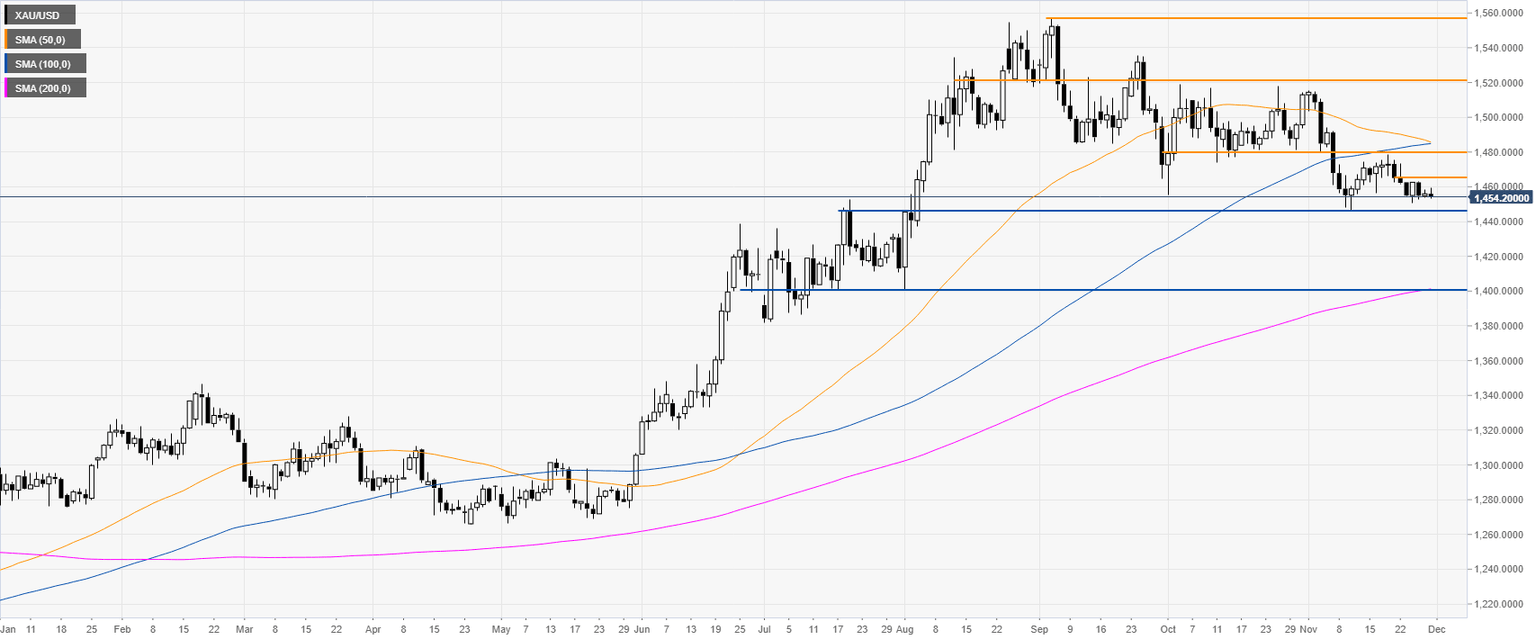

Gold daily chart

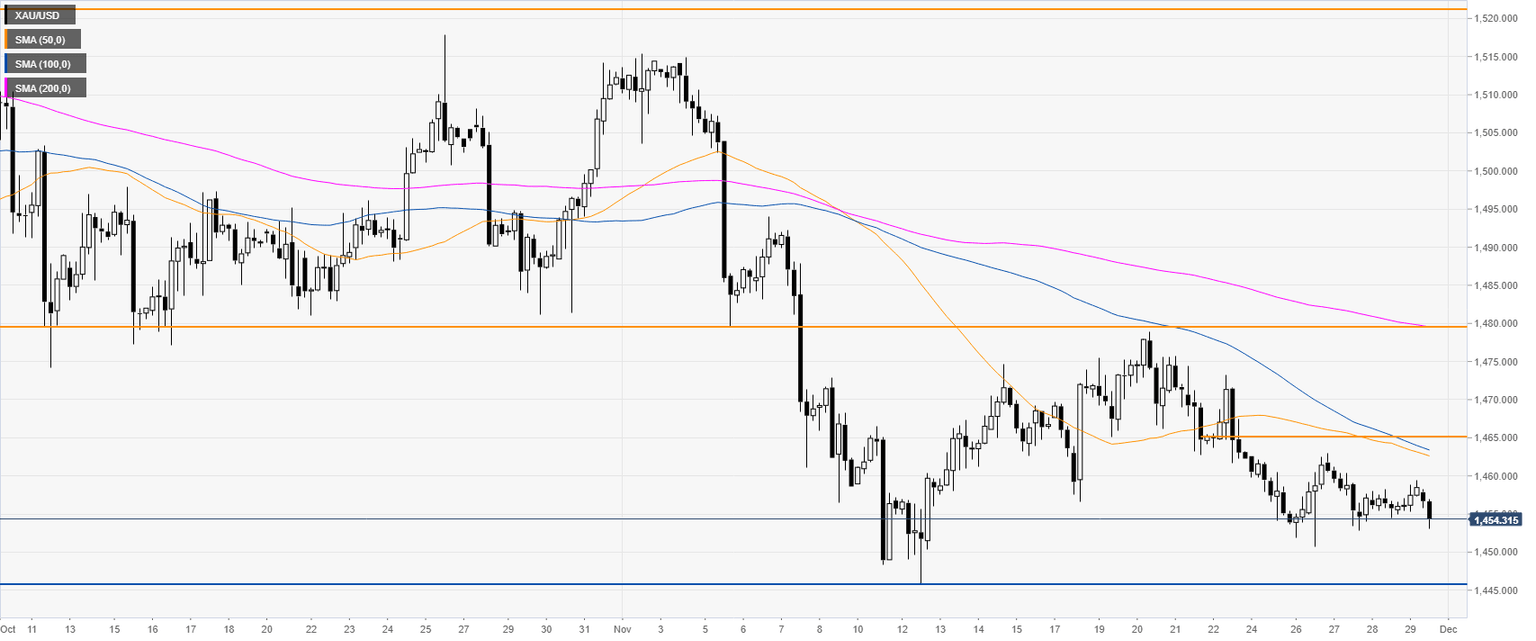

Gold four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst