Gold surges near $3,830 as US government shutdown fears spurs haven demand

- Gold jumps almost 2% as government shutdown risks weigh on the US Dollar.

- Fed’s Musalem and Hammack warn of sticky inflation, while Williams highlights a weakening labor market.

- Russia’s advance in Donetsk stirs geopolitical jitters, adding momentum to safe-haven flows.

Gold price advances close to 2% on Monday and trades near record highs of $3,833 as market participants seeking safety bought the yellow metal amid fears of a government shutdown in the United States. XAU/USD trades at $3,827 at the time of writing.

Precious metal rallies to fresh record highs as Treasury yields plunge

The precious metal refreshed the all-time high of $3,791 hit on September 23, as the Greenback and US Treasury bond yields dive. Pessimism over an extension of government funding could trigger a federal shutdown and delay US economic reports like Friday’s Nonfarm Payrolls report, which is compiled by the Bureau of Labor Statistics (BLS).

Bloomberg revealed that the BLS plans not to release economic data during a government shutdown as it would suspend operations.

Federal Reserve (Fed) officials are grabbing the headlines amid a scarce docket in the US. St. Louis Fed Alberto Musalem reiterated his hawkish stance, saying that inflation expectations “are somewhat high,” but acknowledged that risks of the labor market weakness have increased.

New York Fed John Williams said that policy is restrictive, but in a position to put downward pressure on inflation, and that the resilient labor market is gradually softening.

Earlier, Cleveland Fed Beth Hammack reiterated her hawkish stance, saying that inflation is too high and the trend is in the wrong direction. She added that tariffs are a big part of the pause in the disinflation process.

Geopolitics boost Gold prices

Russia’s defense ministry said that it had taken control of the village of Shandryholove in Ukraine's eastern Donetsk region.

Ahead of the docket will feature a flurry of Fed speakers, US ADP National Employment Change, the ISM Manufacturing PMI, Initial Jobless Claims and Nonfarm Payrolls for September.

Daily market movers: Gold underpinned by falling US yields, Dollar

- Bullion prices advance as the Greenback edges down, as shown by the US Dollar Index (DXY). DXY, which tracks the buck’s value against a basket of six currencies, is down 0.27% at 97.91.

- US Treasury yields are falling, with the 10-year Treasury note down three bps at 4.141%. US real yields—calculated by subtracting inflation expectations from the nominal yield—, which correlate inversely to Gold prices, drop three and a half basis points to 1.761%.

- Second-tier data in the US revealed that Pending Home Sales improved in August, rising by 4% MoM, up from an upwardly revised -0.3% contraction in July and above forecasts of a 0.3% expansion.

- Bloomberg revealed that Switzerland has offered to invest in the US gold-refining industry, as part of its efforts to persuade the Trump administration to lower the 39% import tariff imposed last month.

- Last week’s US core Personal Consumption Expenditures (PCE) Price Index for August was aligned with estimates, reinforcing the chances for further easing by the Fed.

- Investors now see an 89% probability of a 25 bps rate cut in October versus a slim chance of 11% for a 50 bps cut, according to Prime Market Terminal interest rate probability tool.

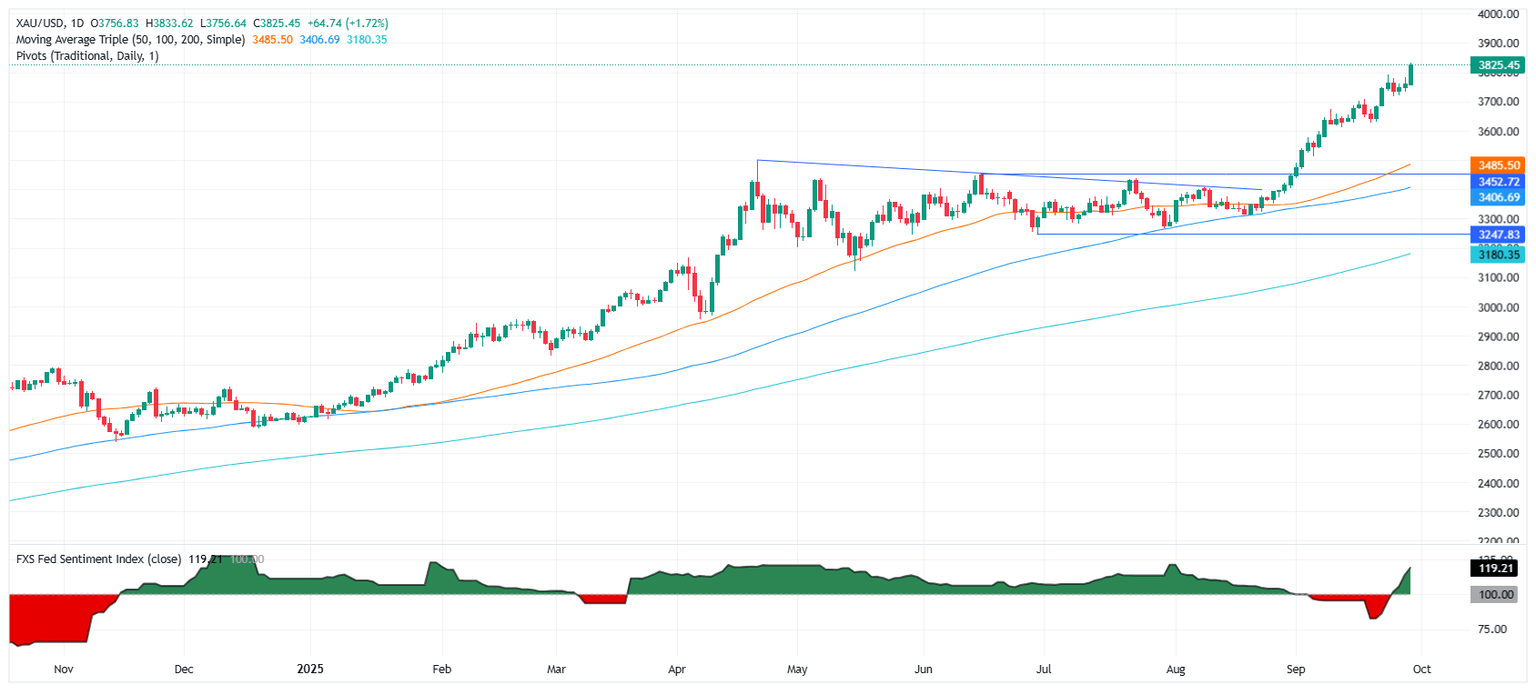

Technical outlook: Gold price poised to challenge $3,800

Gold price uptrend resumed on Monday, though buyers remain reluctant to test $3,850 in the near term. Despite gaining over 1.70%, it seems that bulls are taking a breather as traders eye the next key support level found at $3,800.

The Relative Strength Index (RSI), although overbought, remains stuck within the 70-80 level, an indication that bulls remain in charge.

On the other hand, if XAU/USD tumbles below $3,800, further downside is expected. The next support would be the $3,750 mark, followed by $3,700 and the 20-day Simple Moving Average (SMA) at $3,666.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.