Gold finds feet after diving three percent on Trump victory

- Gold finds its feet on Thursday after experiencing a 3.0% fall following the news of Donald Trump’s victory in the presidential race.

- A stronger US Dollar, capital pivoting into riskier assets, and potential unwinding of geopolitical risks were all bearish drivers.

- Technically, XAU/USD extends its short-term downtrend although the RSI momentum indicator is oversold.

Gold (XAU/USD) bounces back into the $2,670s on Thursday after falling three percent on the previous day when now President-elect Donald Trump secured a victory in the US presidential election.

Gold falls 3.0% as Donald Trump wins election

Gold's steep decline on Wednesday was partly a result of the US Dollar (USD) strengthening due to Trump’s Dollar-positive economic agenda and preference for pro-tariff protectionism. Since Gold is mainly priced and traded in USD, the stronger Dollar had an immediate negative impact on its price.

Trump won the presidency by passing the 270 electoral votes threshold. On Thursday, Trump has 295 votes to Harris’ 226, according to the Associated Press. The Republican party also has a majority in the United States (US) Senate – 52 over 44 – and is in the lead to win a majority in the US Congress, with 206 seats versus the Democrat’s 191 so far, although 38 have still to be called.

The precious metal may have been further hit by investors’ preference for alternative, riskier assets, such as Bitcoin (BTC), which hit a new all-time high due to expectations that Trump would relax crypto regulation. Stocks also rose to record heights due to anticipated tax cuts and a looser regulatory environment overall. These all came at the cost of Gold, which saw outflows as investors rebalanced portfolios.

Gold also rises during geopolitical crises and wars from increased safe-haven demand. Trump’s claims that he can end the conflicts in the Middle East and Ukraine, though seemingly exaggerated (“I will have that (Ukraine-Russia) war settled in one day – 24hrs,” Trump said once), however, probably also hit safe-haven flows.

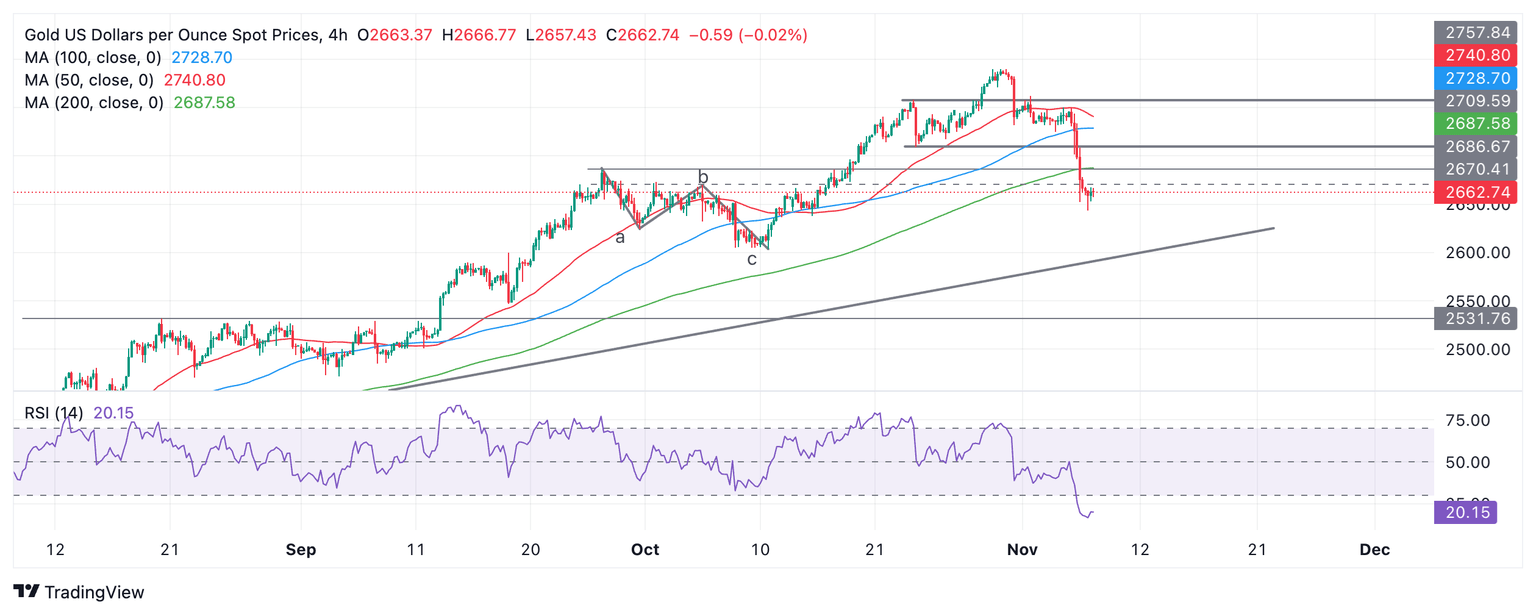

Technical Analysis: XAU/USD enters short-term downtrend

Gold shatters the glass of $2,700 and falls to the mid $2,650s on Thursday. The precious metal is now in a short-term downtrend and, given the principle that “the trend is your friend,” it is vulnerable to further weakness in the near term.

XAU/USD 4-hour Chart

That said, the Relative Strength Index (RSI) momentum indicator has entered deep into oversold territory, indicating short-holders should not add to their positions. If the RSI exits oversold, sellers are advised to close their trades and open tentative longs, as it will be a signal that the price will probably correct higher.

Due to the bearish short-term trend, a break below the $2,643 daily low would confirm a continuation, probably to the next downside target at $2,605, the trendline for the long-term trend.

The precious metal remains in an uptrend on a medium and long-term basis, with a material risk of a reversal higher in line with these broader up cycles. At the moment, however, there are no technical signs of this happening.

A break above the all-time high of $2,790 would re-confirm the medium-term uptrend and probably lead to a move up to resistance at $2,800 (whole number and psychological number), followed by $2,850.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.