Gold sticks to positive bias; lacks bullish conviction amid a broadly firmer USD

- Gold attracts some buyers on Friday and stalls a two-day-old corrective slide from a record high.

- Geopolitical risks revive demand for the safe-haven XAU/USD, though the upside seems limited.

- Fed Chair Powell’s stance of rate cuts underpins the USD and caps the non-yielding commodity.

Gold (XAU/USD) sticks to modest intraday gains through the first half of the European session on Friday, though it lacks any follow-through buying amid mixed fundamental cues. Geopolitical tensions stemming from the intensifying Russia-Ukraine war and the ongoing conflicts in the Middle East continue to offer some support to the safe-haven precious metal. However, the post-FOMC US Dollar (USD) recovery keeps a lid on any meaningful appreciating move for the commodity.

A hawkish assessment of Federal Reserve (Fed) Chair Jerome Powell's remarks on Wednesday assists the USD to prolong this week's goodish rebound from the lowest level since February for the third straight day. This, in turn, holds back traders from placing aggressive bullish bets around the non-yielding Gold. Hence, strong follow-through buying is needed to confirm that this week's retracement slide from the all-time peak has run its course and positioning for any further appreciation.

Daily Digest Market Movers: Gold bulls seem non-committed as USD recovery remains uninterrupted

- US President Donald Trump said on Thursday that his Russian counterpart, Vladimir Putin, had let him down and insisted that US allies must stop purchasing oil from Russia so that the ongoing war with Ukraine could come to an end. Moreover, the President of the European Commission, Ursula von der Leyen, said that the EU will propose speeding up the phasing out of Russian fossil imports.

- The Israeli army carried out several strikes on the densely populated towns in southern Lebanon, targeting Hezbollah’s military infrastructure. An army spokesperson said that the operation was being carried out in response to Hezbollah’s attempts to rebuild its activities in the area. This keeps geopolitical risks in play and offers some support to the safe-haven Gold during the Asian session.

- The US Federal Reserve, as was expected, lowered borrowing costs for the first time since December 2024 on Wednesday and indicated that more rate cuts would follow through the end of this year amid the softening labor market. However, Fed Chair Jerome Powell said that risks to inflation are tilted to the upside and added that he doesn't feel the need to move quickly on interest rates.

- Adding to this, data released on Thursday showed the number of Americans filing new claims for unemployment benefits fell sharply from a near four-year high and came in at a seasonally adjusted 231,000 for the week ended September 13. Furthermore, the Philadelphia Fed Manufacturing Index rose more-than-expected from 1.7 to 23.2 for September, or the highest level since January.

- This assists the US Dollar in preserving its strong recovery gains from a three-and-a-half-year low and holds back the XAU/USD bulls from placing aggressive bets. Hence, it will be prudent to wait for strong follow-through buying before confirming that this week's corrective pullback from the all-time peak has run its course and positioning for the resumption of the well-established uptrend.

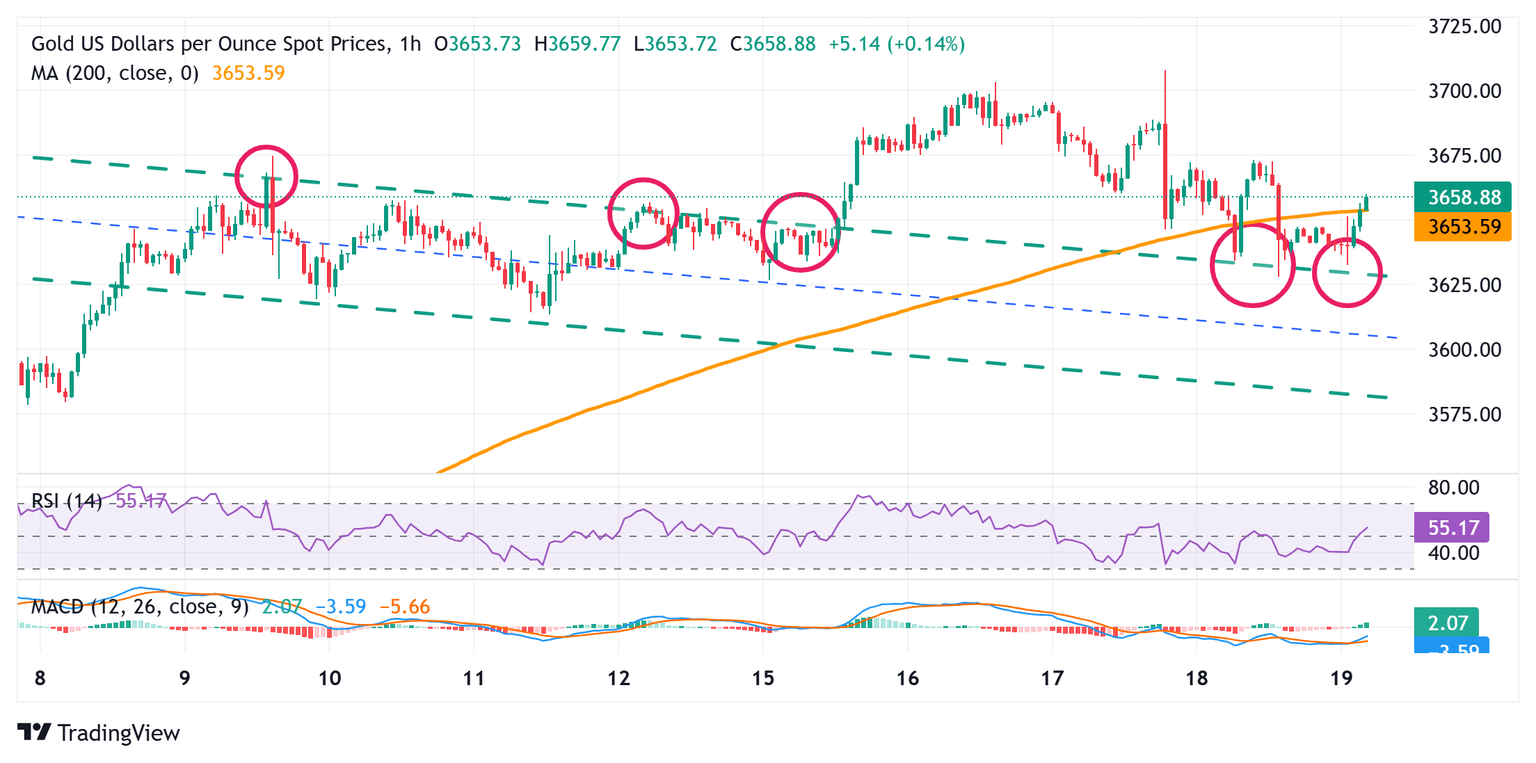

Gold needs to surpass the overnight swing high, around $3,673 to back the case for further gains

The overnight acceptance below the 200-hour Simple Moving Average (SMA) – for the first time since August 22 – favors the XAU/USD bears. The subsequent fall, however, stalls near a bullish flag pattern breakpoint, around the $3,628 region. This, in turn, warrants some caution before positioning for any meaningful decline.

In the meantime, a further move up beyond the $3,660 area might confront some resistance near the $3,673-3,675 zone, above which the Gold price could climb back to the $3,700 neighborhood. Some follow-through buying beyond the $3,707 region, or the all-time peak, will be seen as a fresh trigger for bullish traders.

On the flip side, the $3,628-3,626 resistance-turned-support, or the weekly trough, could act as an immediate support ahead of the $3,600 mark. A convincing break below the latter could drag the Gold price to the $3,563-3,562 support en route to the $3,511-3,510 region. The said area is likely to act as a strong base for the XAU/USD pair.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.