Gold soars to record high as trade war erupts, USD crashes to 35-month low

- XAU/USD rallies over 2% as investors flee to safety amid US-China tariff battle and inflation uncertainty.

- China hits back with 125% tariff after US raises duties to 145%, triggering a global rush into safe-haven assets.

- US Dollar Index plunges to 99.01, its lowest since May 2022, amplifying bullion’s breakout to new all-time highs.

Gold's price rally extended for the third straight day on Friday with the yellow metal hitting a new all-time high of $3,245. Gains of over 2% were posted amid the escalation of the trade war between the US and China and its impact on the global economy. At the time of writing, XAU/USD trades at $3,233.

During the North American session, China applied 125% tariffs on the US as retaliation forUS President Donald Trump's decision to increase its duties to 145% on Chinese products. Therefore, investors seeking safety drove Bullion prices higher, boosted by a weaker Greenback, which plunged to a near three-year low, as depicted by the US Dollar Index (DXY) reaching 99.01.

The economic docket featured some Federal Reserve (Fed) officials crossing the wires. Inflation on the producer side edged lower for both headline and core readings, though the latter remains in the 3% threshold. After that, the University of Michigan Consumer Sentiment poll revealed that American households turned pessimistic about the economic situation and grew worried about inflation expectations.

Although the data was mixed, this could prevent the Fed from easing policy due to the trade tariffs, which are considered inflation-prone. Hence, as the Fed most likely remains in the wait-and-see mode, traders are now fully pricing in three interest rate cuts in 2025.

Daily digest market movers: Gold price rallies, unfazed by high US real yields

- The US 10-year Treasury yield rises seven basis points to 4.495%. US real yields surged seven and a half bps to 2.307%, as shown by the US 10-year Treasury Inflation-Protected Securities yields failing to cap Gold prices.

- The University of Michigan’s Consumer Sentiment Index showed a notable decline in April, dropping from 57.0 to 50.8, signaling rising pessimism among households. Inflation expectations surged, with the one-year outlook jumping from 5% to 6.7% and the five-year forecast rising from 4.1% to 4.4%.

- The US Producer Price Index (PPI) for March fell to 2.7% YoY, down from 3.2% and below the 3.3% forecast, suggesting easing input cost pressures. However, core PPI — which excludes food and energy — remained above the 3% threshold, coming in at 3.3% YoY, down from 3.5% in February and slightly under the 3.6% estimate.

- On Friday, some US banks expressed that the probability of a recession had increased. Among them are Wells Fargo and Morgan Stanley CEO Ted Pick.

- JPMorgan CEO Jamie Dimon said that US recession odds are at 50%.

- Recession fears had increased, according to Goldman Sachs, which said the chances of a recession rose from 35% to 45% in 12 months.

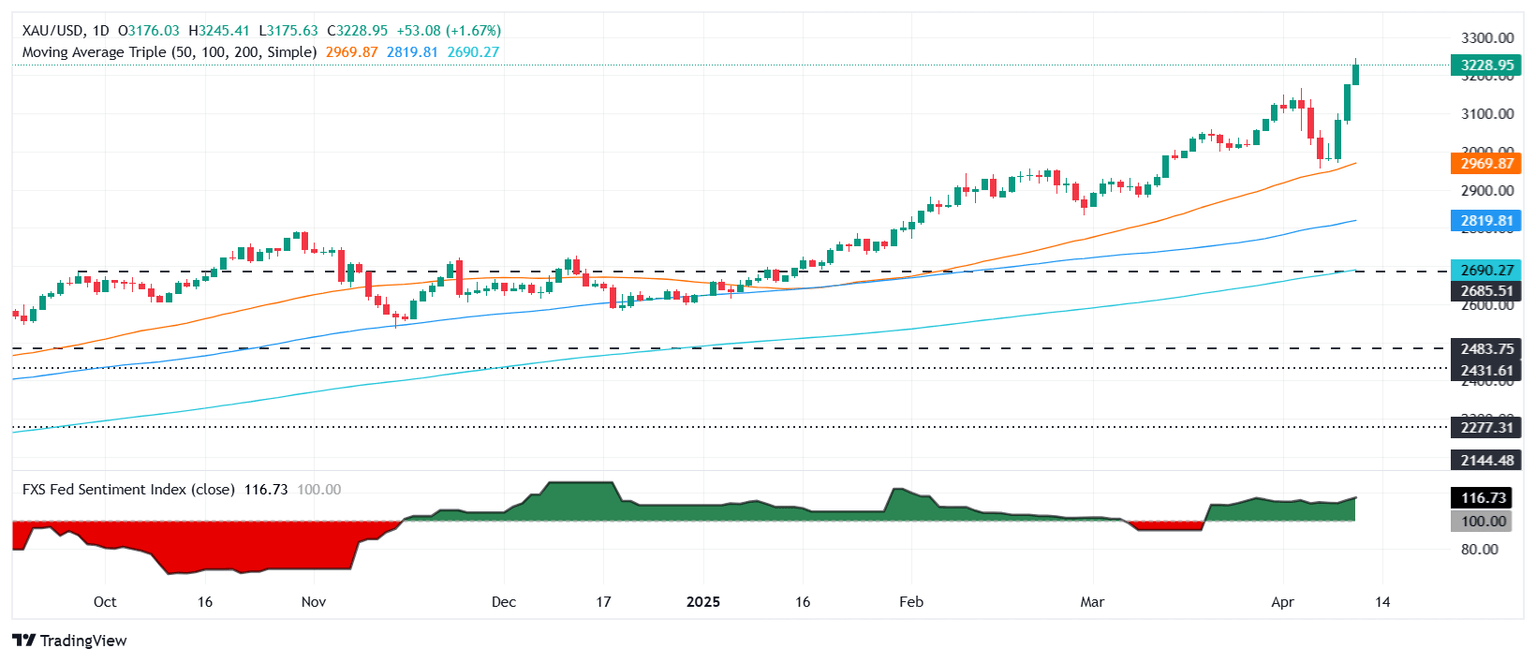

XAU/USD technical outlook: Gold price clears the $3,100 and $3,200 levels as it reaches record high

Gold price uptrend remains intact with buyers eyeing the $3,250 mark. A breach of the current all-time high (ATH) of $3,245 could pave the way toward the latter. If those two ceiling levels are cleared, the next stop would be $3,300.

Conversely, if XAU/USD drops below $3,200, the first support would be the April 10 high of $3,176. Once cleared, the next stop would be the $3,100 mark.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.