Gold turns flat with a little bit of help from a weaker Greenback

- Gold price able to limit Wednesday's losses due to outside tailwind from softer US Dollar.

- Traders assess the recent US inflation reading on the outlook for interest-rate cuts from the Fed.

- More downside for Gold could materialize if President Trump announces more trade deals.

Gold (XAU/USD) dips back to $3,235 on Wednesday while the worst of the selling pressure seems to be over due to a softer US Dollar (USD). The softer-than-expected inflation reading for April released on Tuesday, gave markets a push to head into Risk On assets, with the widely-feared inflation shock from tariffs not materializing yet. The softer-than-expected reading for both the monthly Headline and core components boosted a relief rally in equities and led investors to price in more Federal Reserve (Fed) rate cuts for this year.

Without any top-tier data releases for Wednesday in the Economic Calendar, markets will look for further clues after President Donald Trump visited Saudi Arabia and secured $600 billion in trade deals. On Thursday, Ukrainian President Volodymyr Zelenskyy is said to be ready to meet Russian President Vladimir Putin in Istanbul for peace talks, although Putin hasn’t confirmed his attendance. Both Europe and the US have urged Putin to come to Istanbul, while new sanctions are being weighed as countermeasures if peace talks do not take place.

Daily digest market movers: Gold impacting India's trade deficit

- Gold is facing more downside pressure, several analysts and Gold traders confirm to Bloomberg. “The US-China tariff rates surprised materially to the downside, which eases investor concerns around trade-driven growth risks,“ said Justin Lin, an analyst at Global X ETFs. “Capital is likely flowing out of defensive sectors and Gold," he added.

- Still, the Gold rally could possibly not yet be out of steam, according to Amy Lo, UBS head of wealth management in Asia. UBS Group AG’s rich clients are increasingly shifting away from US-dollar assets, turning instead to Gold, crypto and investments in China. “Gold is getting very popular,” Amy Lo said in an interview with Yvonne Man at Bloomberg’s New Voices event Tuesday in Hong Kong.

- India’s trade deficit likely narrowed to $18.9 billion in April from $21.5 billion in March. The contraction in the deficit was partly due to a drop in Gold imports – a surge in prices likely reduced demand for the metal. A sharp drop in crude Oil prices is also expected to lower Oil imports, countering a typical seasonal jump in volumes.

Gold Price Technical Analysis: Back to flat

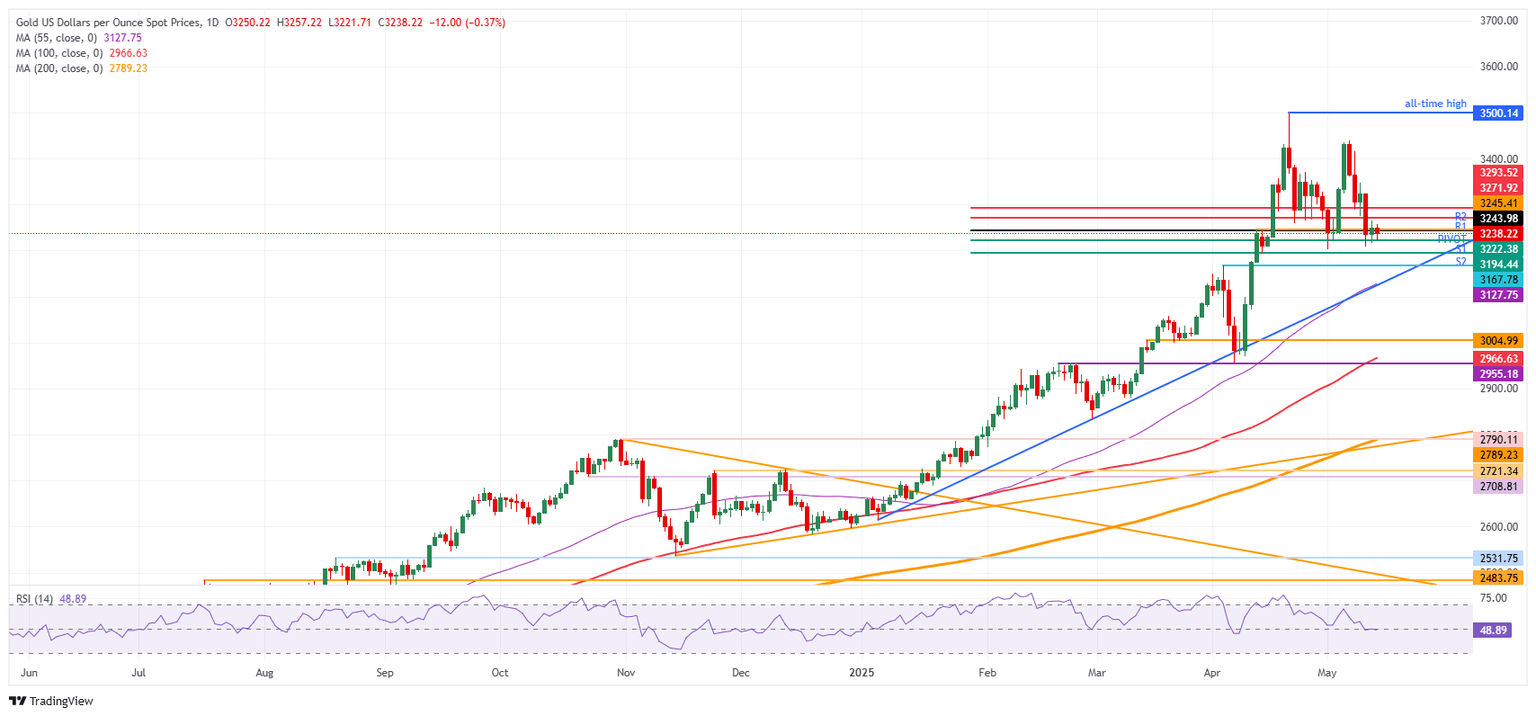

Despite the selling pressure on Wednesday, a fresh low for this week has not materialized as Monday’s low at $3,207 hasn’t been tested.. Gold appears to be in a consolidation stage, with lower highs and higher lows. Whichever gets broken first will see further follow-through towards either $3,300 or $3,200.

The daily Pivot Point at $3,243 needs to be reclaimed first in case of any recovery. In case of a breakout, out of the consolidation, the R1 at $3,271 will certainly be tested. Not for from there, the R2 at $3,293 is possibly the last level to offer firm resistance before entering the $3,300 area again.

On the downside, the daily S1 support at $3,222 already offered ample support in Asian trading. In case a breakout materializes, look for the S2 at $3,194 before the pivotal technical support at $3,167 will pop up.

XAU/USD: Daily Chart

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.