Gold plummets on stronger Dollar, Trump effect

- Gold weakens as a result of a stronger US Dollar and the impact of Trump on Monday.

- President-elect Donald Trump’s Dollar positive policies and competition from Bitcoin are factors pressuring Gold.

- Rumors Trump has offered known protectionist Robert Lighthizer the job of chief of trade is also weighing.

Gold (XAU/USD) in fall continues to fall, trading in the $2,610s – over $60 down from last week’s close. A stronger US Dollar (USD) is mainly to blame, with the trade-weighted US Dollar Index (DXY) up almost half a percent so far on the day. Perceptions that President-elect Donald Trump’s economic policies will be positive for the Greenback are the main driver. Since Gold is mainly priced and traded in USD, a stronger Dollar causes its price to fall.

Trump’s love of what he described as “the most beautiful word in the dictionary” (tariff) is expected to increase the prices of goods and inflation. Whilst this alone is not US Dollar positive, it will make the US Federal Reserve (Fed) slow down the rate at which it cuts interest rates. Relatively elevated interest rates attract greater foreign capital inflows, which is, in turn, positive for USD. Trump’s penchant for lower taxes is also likely to stoke inflation further, compounding the effect.

Gold rattled by Lighthizer rumor

Gold may be further pressured by rumors that Trump has offered the job of US Trade Representative to Washington attorney Robert Lighthizer, a known protectionist hawk. Lighthizer held the same role during Trump’s 2016 - 2020 administration and is known for advocating a tough protectionist stance – especially regarding China. The story of his appointment first broke in the Financial Times (FT) on Friday, and although it was later contradicted by a Reuters’ article claiming one of their sources had said it was “untrue”, rumors persist.

With a Republican in the White House, a majority in the US Senate, and the Republicans edging closer to winning a majority in the US Congress, the ability of Trump to push through his radical economic agenda and tax cuts seems assured. The Republican party has so far won 214 seats in Congress to the Democratic party’s 203, with only 18 outstanding, according to the Associated Press. The threshold for a majority is 218.

Competition from alternative assets such as Bitcoin (BTC) is also likely bearish for Gold. BTC hit a new all-time high on Monday, above $82,000, due to expectations that Trump will relax crypto regulation. Stocks could also seem attractive initially if Trump brings down corporation tax and loosens regulation. Gold is likely to suffer as a consequence of portfolio managers pivoting into these riskier assets.

The perception that Trump will be able to bring an end to the Ukraine-Russia war, which he boasted he could settle “in one day – 24 hours,” may also be reducing safe-haven flows into Gold.

Technical Analysis: XAU/USD resumes short-term bear trend

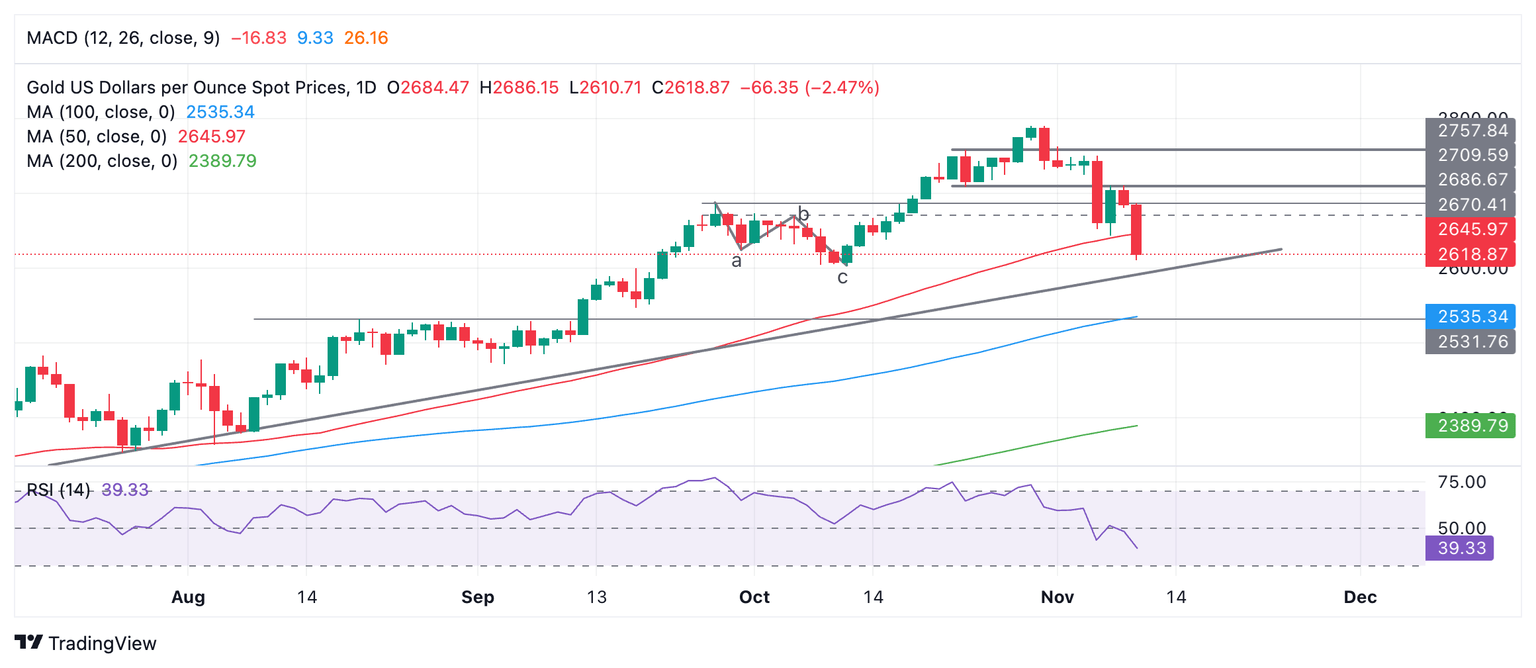

Gold starts falling again after temporarily recovering during its November sell-off. The precious metal is in a short-term downtrend, which, given it is a principle of technical analysis that “the trend is your friend,” is likely to extend.

XAU/USD Daily Chart

Gold has broken below the $2,643 November 7 low, confirming a bearish continuation, probably to the next target at the trendline for the long-term uptrend at $2,605.

Gold price is not oversold according to the Relative Strength Index (RSI), so more downside is possible.

The precious metal remains in an uptrend on a medium and long-term basis, with a material risk of a reversal higher in line with these broader up cycles at some point in time.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Joaquin Monfort

FXStreet

Joaquin Monfort is a financial writer and analyst with over 10 years experience writing about financial markets and alt data. He holds a degree in Anthropology from London University and a Diploma in Technical analysis.