Gold falls as Trump calm Fed fears, China trade hopes boost US Dollar

- Trump confirms he won’t fire Fed Chair Powell, easing market fears over central bank independence.

- Gold slips $50 as risk sentiment improves on US-China trade optimism and calmer Fed rhetoric.

- World Gold Council reports $21B Q1 ETF inflows, the second-highest quarterly figure in history, signaling robust demand.

Gold prices drop as Wednesday’s Asian session begins, which is sponsored by Trump’s comments that he is not looking to fire Fed Chair Jerome Powell. At the time of writing, XAU/USD plunges over 1% and trades at $3,333.

Recently, US President Donald Trump said that he had no intention of firing Powell. He said, “The press runs away with things. No, I have no intention of firing him. I would like to see him be a little more active in terms of his idea to lower interest rates.”

Earlier news from the United States (US) Treasury Secretary Scott Bessent revealed that he saw a de-escalation with China, which improved the market mood, which is a headwind for Bullion prices. Since the headlines, the yellow metal drifted lower by $50 from around $3,420 to $3,370.

Despite this, uncertainty about US trade policies and President Donald Trump’s attacks on the Federal Reserve (Fed) can boost demand for Gold and push prices higher. So far in the year, Gold prices have remained up almost 29% due to geopolitics and Trump’s swinging mood.

Last week, Chair Jerome Powell said the Fed would remain data-dependent and even flagged the chance of a stagflationary scenario, acknowledging, “We may find ourselves in the challenging scenario in which our dual-mandate goals are in tension.”

Amid this backdrop and an uncertain economic outlook, investors flock to safety, as the flows of Gold ETFs are picking up, according to the World Gold Council (WGC).

“Global physically backed gold ETFs1 reported strong inflows in March totaling US$8.6bn. This helped drive total Q1 flows of US$21bn (226t) to the second highest quarterly level in dollar terms, only behind Q2 2020's US$24bn (433t),” revealed the WGC.

Daily digest market movers: Gold price retreats towards $3,400 on risk-on mood

- The US 10-year Treasury yield falls two basis points to 4.395%.

- US real yields followed suit, edges down two bps to 2.175%, as shown by the US 10-year Treasury Inflation-Protected Securities yields

- In rates markets, money market traders have priced in 91 basis points of Fed rate cuts by the end of 2025, with the first cut expected in July.

- Data-wise, this week's US economic docket will be packed with Fed speakers, S&P Global Flash PMIs, Durable Goods Orders, and the University of Michigan Consumer Sentiment final reading.

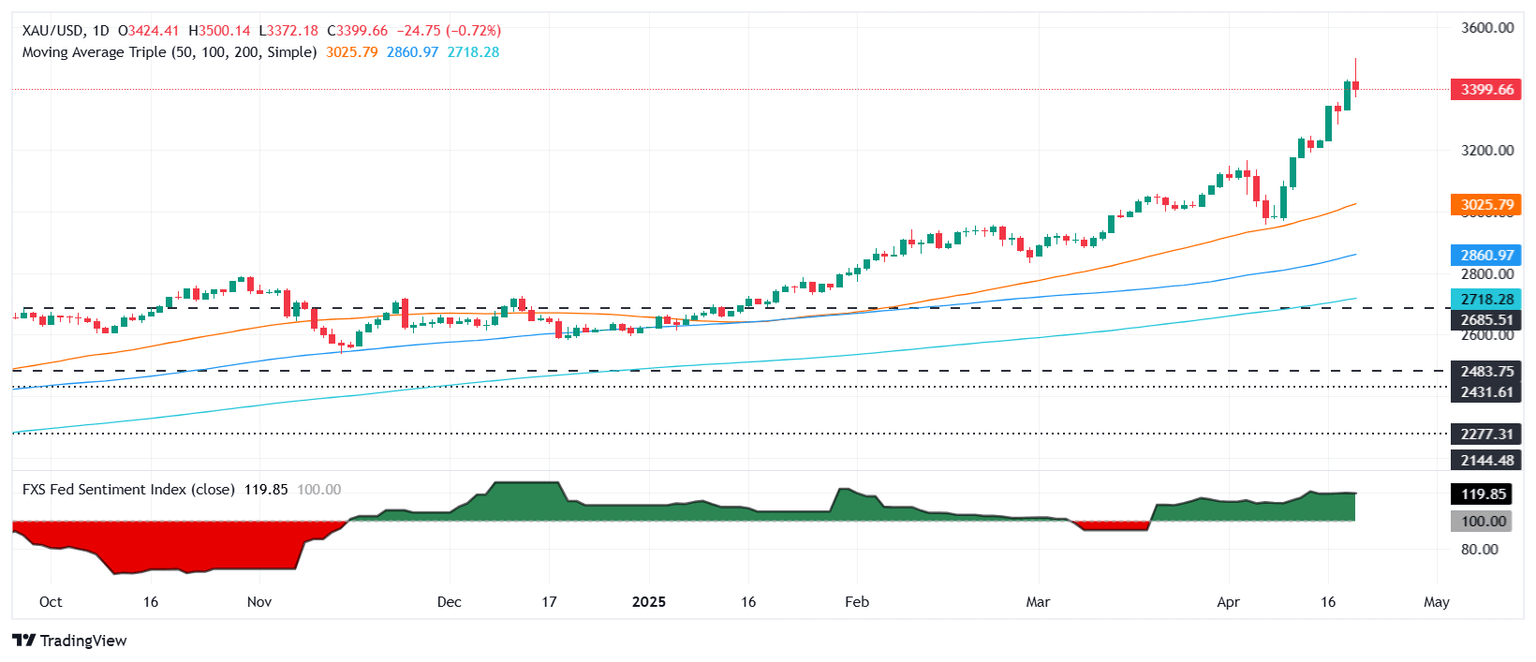

XAU/USD technical outlook: Gold price retraces after hitting $3,500

Gold’s uptrend remains intact, yet the fall below $3,400 was short-lived as the precious metal recovers some ground. If buyers want to re-test $3,500, they must surpass $3,450 once more before testing the all-time high. Nevertheless, the Relative Strength Index (RSI) has turned overbought, and failure to reach 80 could pave the way for Bullion’s pullback.

On the downside, XAU/USD’s daily close below $3,400 could push Gold’s price towards $3,350, followed by $3,300.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.