Gold price remains confined in a narrow band; looks to US data for some impetus

- Gold price struggles to preserve modest intraday gains, though the downside remains cushioned.

- Fed rate cut bets and US fiscal concerns should cap the USD recovery and support the commodity.

- Geopolitical risks and persistent trade-related uncertainties could further underpin the XAU/USD.

Gold price (XAU/USD) extends its consolidative price move around the $3,350 region through the first half of the European session on Wednesday and remains close to a nearly four-week high touched the previous day. Traders now seem reluctant and opt to wait for potential talks between US President Donald Trump and Chinese President Xi Jinping before placing fresh directional bets. In the meantime, persistent trade-related uncertainties and geopolitical risks might continue to act as a tailwind for the safe-haven precious metal.

Meanwhile, expectations that the Federal Reserve (Fed) will stick to its easing bias and lower borrowing costs further in 2025 and concerns about the worsening US fiscal condition keep the US Dollar (USD) bulls on the defensive. This turns out to be another factor lending some support to the non-yielding Gold price, though a generally positive risk tone could keep a lid on any meaningful upside for the bullion. Traders now look forward to the US ADP report on private-sector employment and the US ISM Services PMI for short-term impetuses.

Daily Digest Market Movers: Gold price struggles to attract buyers amid potential Trump-Xi call

- The Job Openings and Labor Turnover Survey (JOLTS) released on Tuesday showed that there were 7.39 million job openings on the last business day of April. The reading exceeded expectations of 7.1 million and also surpassed the 7.2 million openings recorded in March. The data pointed to the continued resilience of the US labor market and bolsters optimism regarding the health of the economy.

- Despite the upbeat data, the US Dollar faced some pressure from declining US Treasury bond yields and bets that the Federal Reserve (Fed) will deliver at least two 25 basis points rate cuts by the end of this year. Moreover, concerns that the US budget deficit could worsen at a faster pace than expected on the back of US President Donald Trump’s flagship tax and spending bill weigh on the Greenback.

- Atlanta Fed President Raphael Bostic said on Tuesday that he is 'very cautious' about jumping to cutting rates and that the best monetary policy approach now entails 'patience'. Bostic added that there is still a way to go on inflation as core prices are still an issue and that recession is not in his forecast right now, though he sees a possible path to one interest rate cut this year, depending on the economy.

- Meanwhile, Chicago Fed President Austan Goolsbee noted that a slowdown related to tariffs might not show up for a while in the data. All indicators point to stable and full employment and we have to wait and see if tariffs have a big or small inflation impact, Goolsbee added further.

- Separately, Fed Board of Governors member Lisa Cook said that the trade policy is now affecting the economy and may make it harder to get inflation lower. Cook expects increased inflation and reduced activity because of tariffs and warned that tariffs could lead to a stagflation environment. The Fed's monetary policy is well-positioned for a range of scenarios, Cook added further.

- Trump and Chinese President Xi Jinping are expected to hold a call this week, likely on Friday, amid renewed fears of a trade war between the world's two largest economies. Furthermore, the increase in steel and aluminum import tariffs from 25% to 50% come into effect on Wednesday. This keeps the trade-related risk premium in play and offers some support to the safe-haven Gold price.

- Traders now look forward to the release of the US ADP report on private-sector employment and the US ISM Services PMI. Apart from this, speeches from influential FOMC members will drive the USD demand and provide some meaningful impetus to the XAU/USD pair. The focus, however, remains glued to the official monthly jobs data, popularly known as the Nonfarm Payrolls (NFP) report.

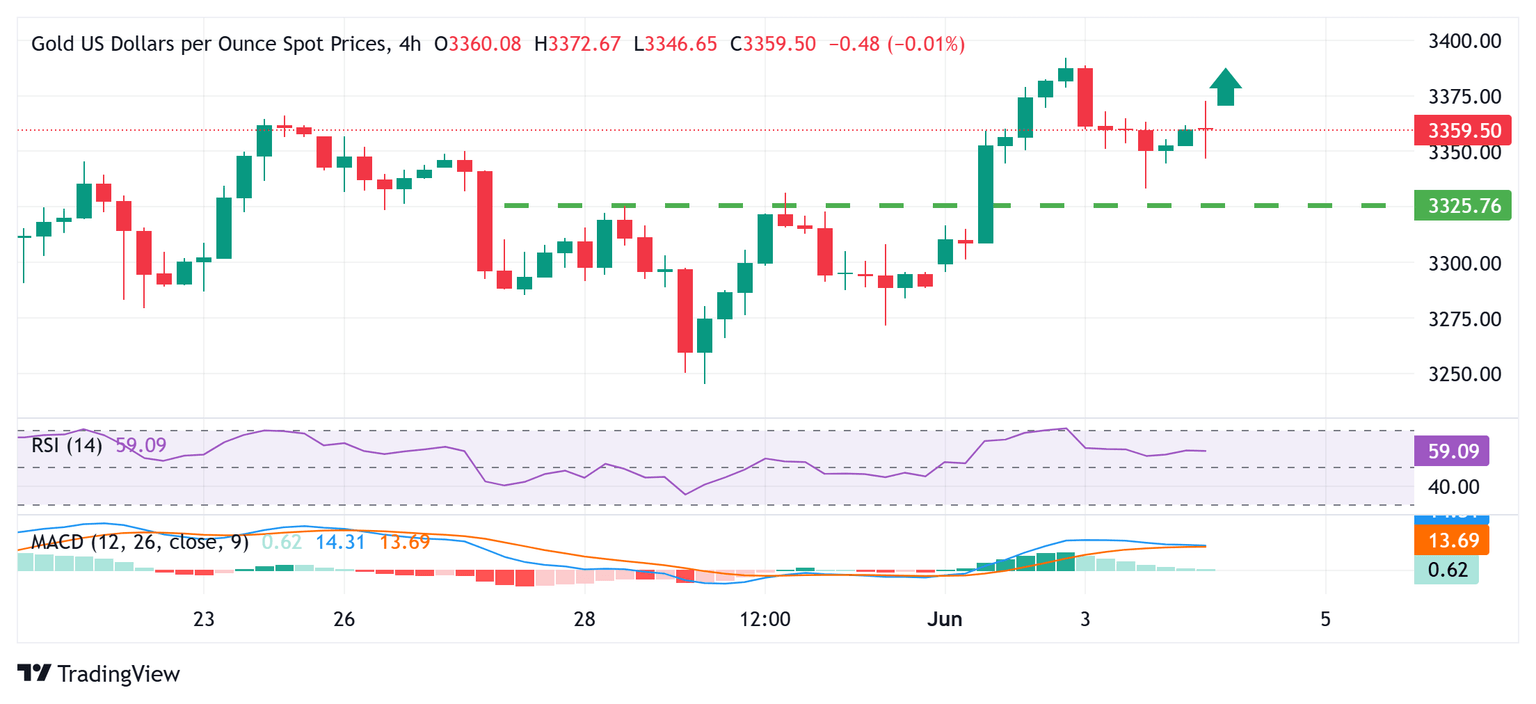

Gold price technical setup favors bulls; breakout above the $3,324-3,326 hurdle remains in play

From a technical perspective, the emergence of dip-buying on Wednesday comes on top of this week's breakout through the $3,324-3,326 barrier. Moreover, oscillators on daily/hourly charts are holding comfortably in positive territory and suggest that the path of least resistance for the Gold price is to the upside. However, any subsequent move up could face some resistance near the $3,380 region ahead of the $3,400 neighborhood or a multi-week high touched on Tuesday. A sustained strength beyond the latter should allow the XAU/USD pair to retest the all-time peak touched in April and make a fresh attempt to conquer the $3,500 psychological mark.

On the flip side, weakness below the $3,355 area might continue to attract some dip-buyers and is more likely to remain limited near the aforementioned resistance breakpoint, around the $3,326-3,324 area. Some follow-through selling, however, could make the commodity vulnerable to weakening further below the $3,300 mark and testing the $3,286-3,285 horizontal support.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Jun 04, 2025 12:15

Frequency: Monthly

Consensus: 115K

Previous: 62K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.