Gold price climbs past $3,300 on uncertainty about trade and weak USD

- Gold snaps two-day losing streak, gaining 1.5% on fresh trade war fears.

- Trump softens tariff talk, but China denies negotiations and demands full rollback.

- Fed rate cut bets rise as yields drop and economic uncertainty builds.

Gold price snapped two days of losses on Thursday and rose $50, or more than 1.50%, amid renewed concerns about the US-China trade war. Even though US President Donald Trump softened his stance on sticking to 145% tariffs on Beijing, the XAU/USD trades at $3,338 after jumping off daily lows of $3,287.

Market mood remains upbeat with Wall Street posting gains. Although traders seem relieved by Trump’s willingness to reach a deal with Beijing, China plays hardball and asks to cancel all “unilateral” US tariffs, clarifying that they have not held talks with the US government.

Bullion prices advance underpinned by the plunge in US Treasury bond yields. The US Dollar Index (DXY) is also feeling the pain after hitting four-day peaks against a basket of six currencies.

US economic data witnessed the release of Initial Jobless Claims for the last week, which was aligned with estimates. Durable Goods Orders jumped sharply in March, sponsored by airplane orders.

Meanwhile, a wave of Federal Reserve (Fed) officials grabbed the headlines. Cleveland Fed President Beth Hammack stated the Fed could act as soon as June if the data supports it but emphasized that uncertainty is weighing on business planning.

Fed Governor Christopher Waller echoed a similar tone, noting that while action in June remains on the table, rate cuts may be driven by a weakening labor market. Waller said, “rate cuts could come from rising unemployment.”

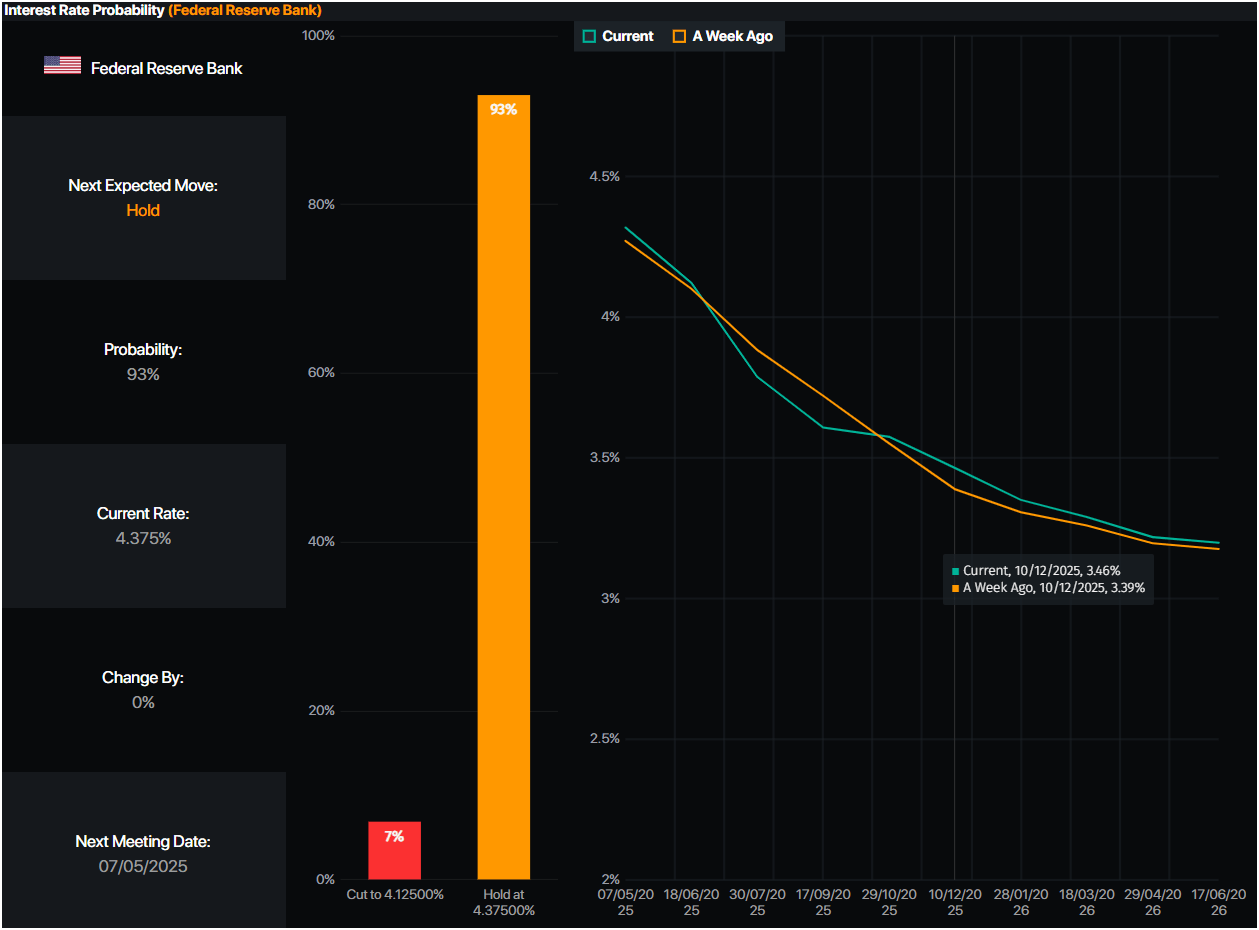

Regarding the chances of the Fed reducing interest rates at the upcoming meeting, traders see a 94% chance of keeping them unchanged, according to Prime Market Terminal. Nevertheless, traders expect the Fed funds rate to end at 3.45%, equal to 86 basis points of easing (bps).

Source: Prime Market Terminal

Daily digest market movers: Gold price climbs boosted by weak US Dollar

- The yield on the US 10-year Treasury note has decreased by seven-and-a-half basis points, reaching 4.31%.

- US real yields collapsed seven bps to 2.023%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- US Durable Goods Orders soared in March from 0.9% to 9.2%, sponsored by aircraft bookings. Initial Jobless Claims for the week ending April 19 rose by 222K as expected, up from 216K in the previous reading.

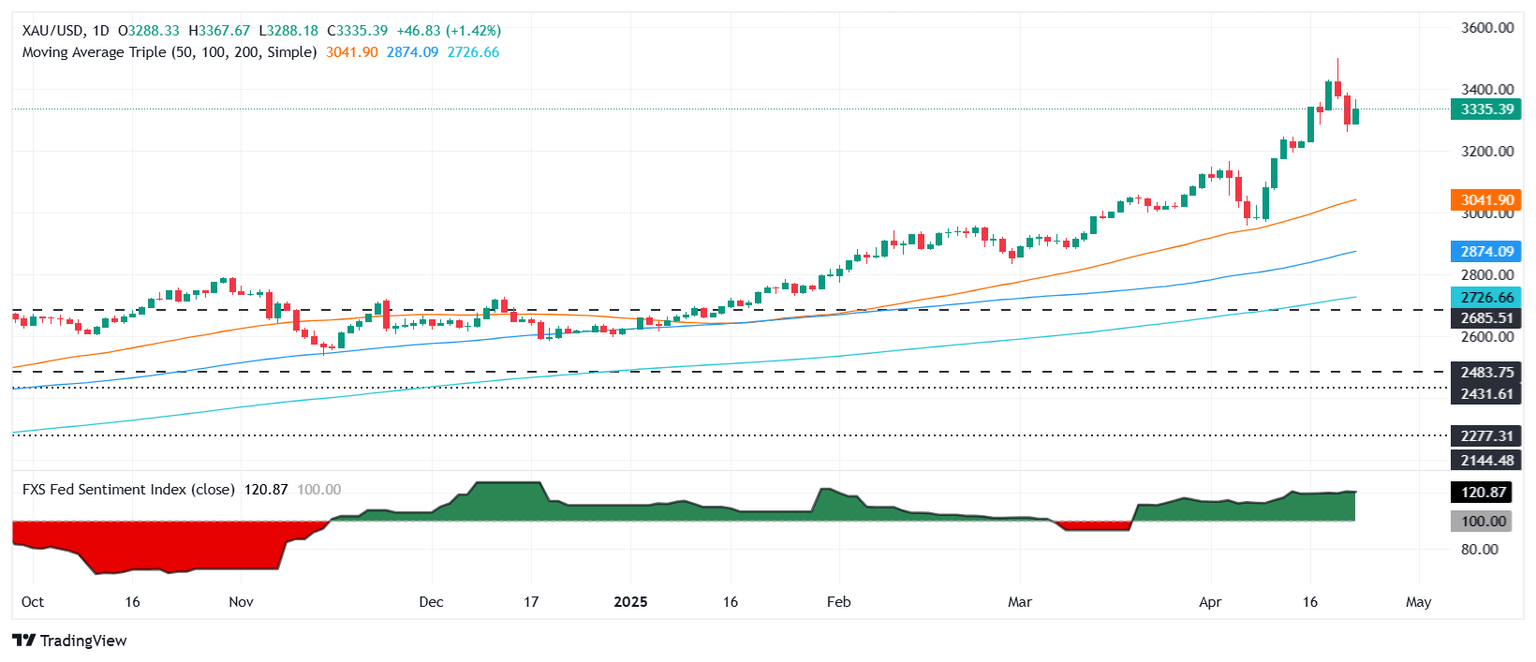

XAU/USD technical outlook: Gold price uptrend resumes as buyers reclaim $3,300

The Gold price uptrend resumed, yet buyers must clear the April 22 high of $3,386 to prevent sellers from dragging lower prices. The next key resistance level would be $3,400, followed by the $3,450 and the $3,500 figure.

On the other hand, if XAU/USD tumbles below $3,300, this could open the door to test $3,200 ahead of the April 3 peak of $3,167. A breach of the latter will expose the 50-day Simple Moving Average (SMA) at $3,041.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.