Gold roars above $3,300 as USD tumbles, Fed countdown begins

- Gold gains 2% as DXY drops, even as ISM Services PMI signals a resilient US economy.

- Trump announces 100% tariffs on foreign films, says Powell won’t be removed early but urges rate cuts.

- Markets fully price in Fed hold on Wednesday; Powell’s press conference in focus for policy signals.

Gold (XAU/USD) prices jumped over 2%, or more than $70, on Monday as the Greenback was battered, although positive economic data from the United States (US) suggests the economy remains solid. XAU/USD trades at $3,321 after bouncing off daily lows of $3,237.

Market mood improved following a report by the Institute for Supply Management (ISM) that service providers reassured the robustness of the US economy. The data hinted that prices are rising, ignited by US President Donald Trump’s tariffs

Over the weekend, Trump announced 100% duties on foreign-produced movies while saying that the Federal Reserve (Fed) should lower interest rates. He said he won’t remove Fed Chair Jerome Powell before his term ends in May 2026.

Trump added that the US is meeting with many countries, including China, and that his main priority is reaching a deal with Beijing.

Meanwhile, traders are bracing for the Federal Reserve monetary policy meeting on Wednesday. The markets have fully priced in that the US central bank will keep rates unchanged, though they will be looking at Fed Chair Jerome Powell's press conference. Policymakers will not update their forecasts until the June meeting, which could provide some hints regarding monetary policy.

Daily digest market movers: Gold price unfazed by higher US Treasury bond yields

- Bullion prices remain underpinned, although US Treasury bond yields rise. The US 10-year Treasury note yield climbs four and a half basis points to 4.35%. At the same time, US real yields rallied five bps to 2.087%, as shown by the US 10-year Treasury Inflation-Protected Securities yields.

- The ISM Services PMI rose to 51.6 in April, up from 50.8 and beating expectations of 50.6, signaling a modest improvement in service sector activity.

- Notably, the Prices Paid sub-index surged to 65.1—its highest since February 2023—up from 60.9, indicating a reacceleration in input inflation pressures.

- Last week’s US Nonfarm Payroll figures for April exceeded estimates despite trailing March’s numbers, suggesting that the labor market remains solid. Worth noting that the Unemployment Rate was unchanged at 4.2%, justifying the Fed’s stance of wait-and-see mode regarding monetary policy.

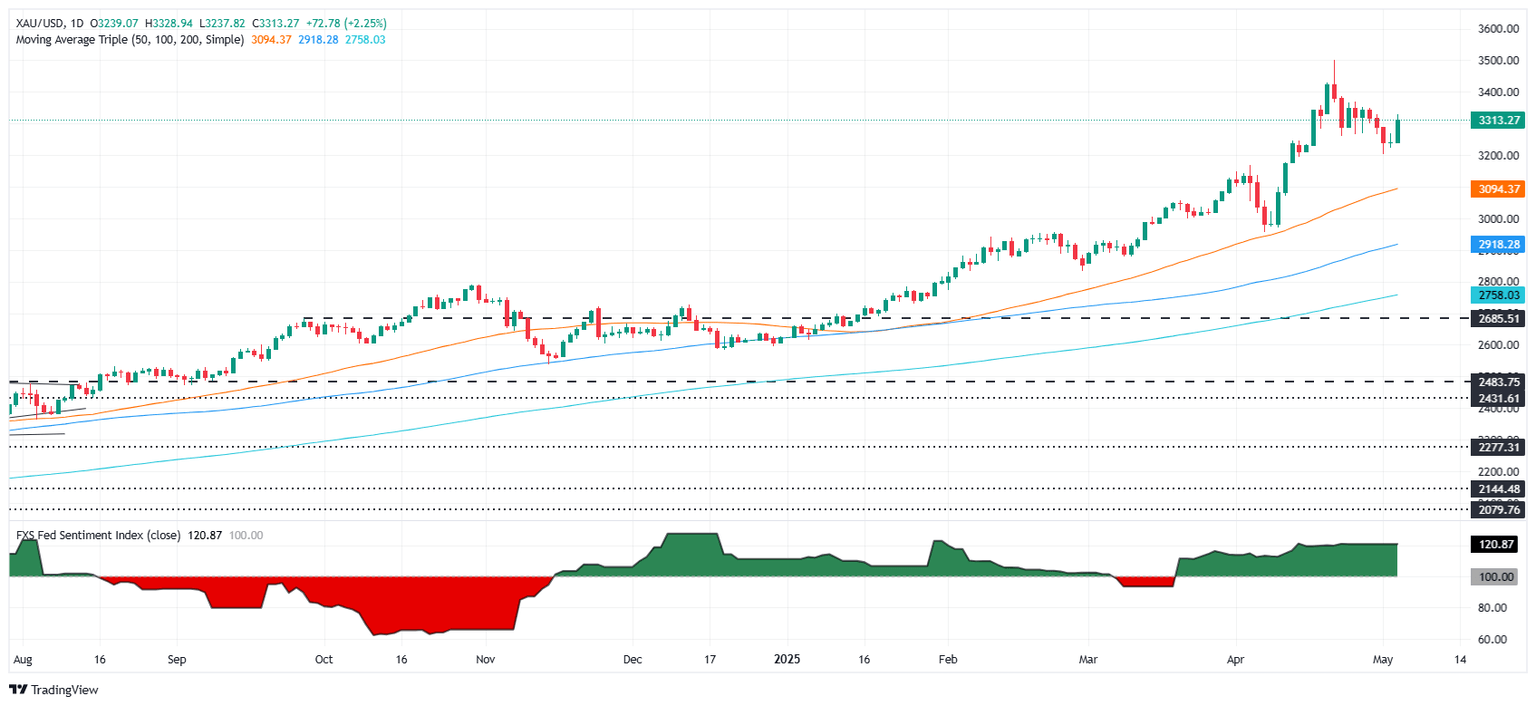

XAU/USD technical outlook: Gold price poised to challenge $3,350

Gold price uptrend resumed as today’s price action confirmed a ‘bullish harami’ two-candle chart pattern, indicating that bulls are gathering steam. The Relative Strength Index (RSI) further confirmed the latter, as the RSI’s line aims upwards.

Therefore, traders will face key resistance levels like $3,350, followed by the $3,400 figure. If surpassed, the next stop would be $3,450 and $3,500. Conversely, if sellers drag XAU/USD spot price below $3,300, look for a test of the May 1 low of $3,202, ahead of the April 3 high turned support at $3,167.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.