Gold price retains positive bias and refreshes daily top; holds above $3,300 ahead of FOMC Minutes

- Gold price ticks higher as trade caution, US fiscal concerns, and geopolitical risks underpin safe-haven assets.

- Some follow-through USD buying and a positive risk tone keep a lid on further XAU/USD appreciation.

- Traders now look to FOMC Minutes for cues about the rate-cut path and before placing fresh directional bets.

Gold price (XAU/USD) looks to build on modest intraday gains and climbs to a fresh daily peak, around the $3,323-3,324 area during the first half of the European session. Despite the recent trade optimism, investors remain on edge amid the uncertainty surrounding US President Donald Trump's trade tariffs, US fiscal concerns, and geopolitical risks. This turns out to be a key factor that helps revive demand for the safe-haven precious metal.

Meanwhile, the US Dollar (USD) struggles to capitalize on its modest intraday gains amid worries about the worsening US fiscal condition. Adding to this, bets that the Federal Reserve (Fed) will cut interest rates again hold back the USD bulls from placing aggressive bets and support prospects for a further intraday appreciating move for the XAU/USD pair. Traders, however, seem reluctant and opt to wait for FOMC Minutes before placing fresh bets.

Daily Digest Market Movers: Gold price continues to attract intraday safe-haven flows

- The US Census Bureau reported on Tuesday that Durable Goods Orders declined by 6.3% in April, marking a significant decline and a stark turnaround from the 7.6% increase (revised from 9.2%) in the previous month. The reading, however, was better than the market expectation for a decrease of 7.9%. Adding to this, orders excluding transportation rose 0.2% during the reported month.

- Moreover, the Conference Board's US Consumer Confidence Index rebounded sharply after a prolonged decline since December 2024 and jumped to 98 in May. This represents a 12.3 points increase from 85.7 in April or the biggest monthly rise in four years amid an improving outlook for the economy and the labor market on the back of the US-China trade truce, which underpins the US Dollar.

- US President Donald Trump decided to postpone the proposed 50% tariffs on the European Union from June 1 until July 9, offering some relief to markets and weighing on the safe-haven Gold price. Investors, however, remain on edge amid the traded uncertainty, deep-rooted US-China trade tensions, concerns about the worsening US fiscal condition, and persistent geopolitical risks.

- Meanwhile, traders have been pricing in the possibility of at least two 25 basis points interest rate cuts by the Federal Reserve in 2025. The bets were reaffirmed by signs of easing inflationary pressures. Adding to this, expectations that Trump’s dubbed “Big, Beautiful Bill”, if passed in the Senate, would worsen the US budget deficit at a faster pace than expected should keep a lid on further USD gains.

- On the geopolitical front, Trump on Tuesday said that Russian President Vladimir Putin was playing with fire by refusing to engage in ceasefire talks with Ukraine. The remarks followed Russia's deadliest drone and missile attacks on Ukraine since the full-scale invasion in February 2022. Furthermore, an Israeli official rejected claims that Hamas agreed to a new Gaza ceasefire deal proposed by the US.

- Traders now look forward to the release of FOMC meeting minutes for cues about the future rate-cut path, which will play a key role in influencing the USD and providing some meaningful impetus to the non-yielding yellow metal. This week's US economic docket also features the Prelim Q1 GDP and the Personal Consumption Expenditure (PCE) Price Index on Thursday and Friday, respectively.

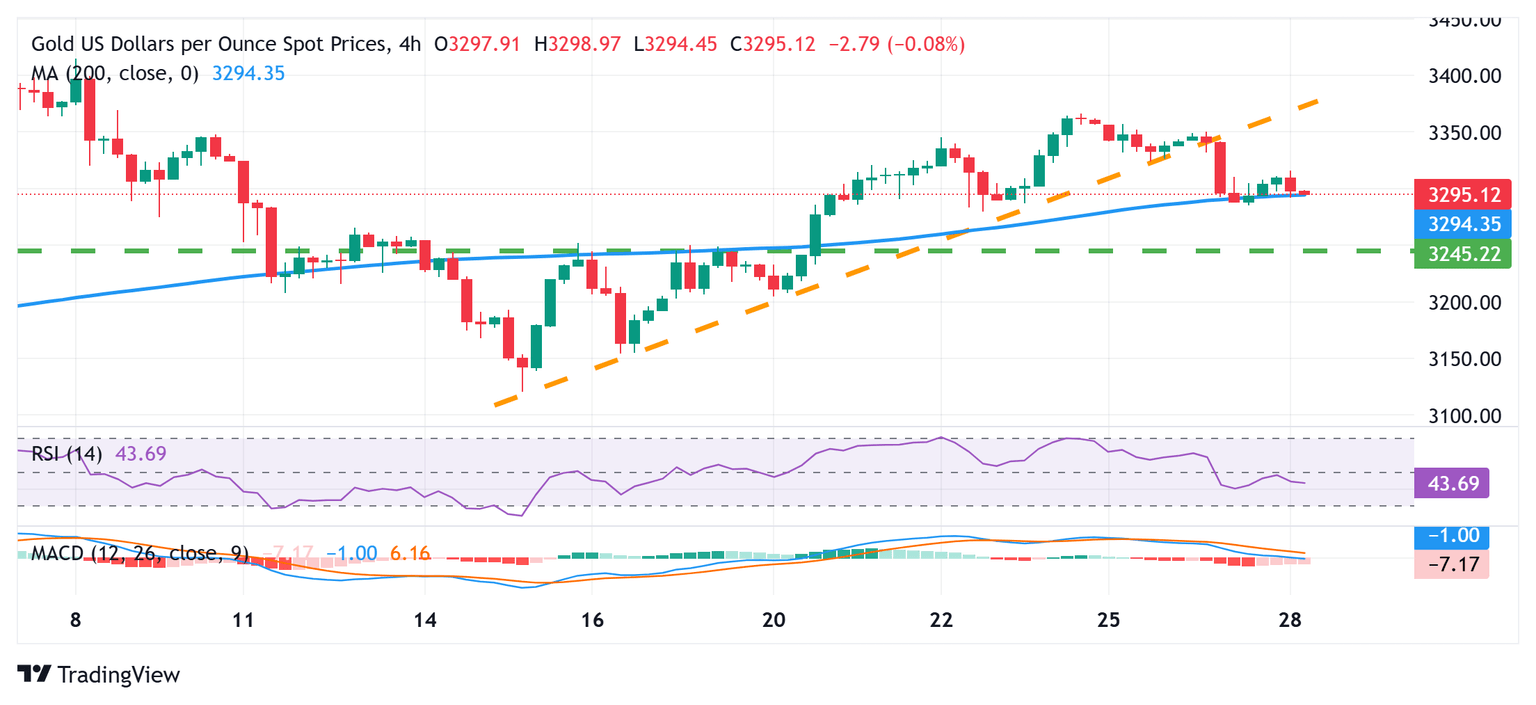

Gold price bounces off 200-SMA pivotal support on H4; not out of the woods yet

From a technical perspective, the overnight breakdown through a short-term ascending trend line was seen as a key trigger for bearish traders. Some follow-through selling below the 200-period Simple Moving Average (SMA) and acceptance below the $3,300 mark will reaffirm the negative bias. However, oscillators on the daily chart – though they have been losing traction – are yet to confirm the negative outlook. Hence, any subsequent fall could attract some buyers and find decent support near the $3,250-3,245 horizontal zone. The latter should act as a pivotal point, which if broken would set the stage for a further near-term depreciating move for the Gold price.

On the flip side, any subsequent move up might now confront some hurdle near the $3,340-3,345 region. The latter coincides with the ascending trend-line breakpoint, above which a fresh bout of a short-covering could lift the Gold price to over a two-week high, around the $3,365-3,366 zone touched last Friday. The subsequent move up should allow the XAU/USD pair to reclaim the A sustained strength beyond would be seen as a fresh trigger for bulls and should allow the Gold price to reclaim the $3,400 mark and climb further to the next relevant barrier near the $3,465-3,470 zone.

Economic Indicator

FOMC Minutes

FOMC stands for The Federal Open Market Committee that organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

Next release: Wed May 28, 2025 18:00

Frequency: Irregular

Consensus: -

Previous: -

Source: Federal Reserve

Minutes of the Federal Open Market Committee (FOMC) is usually published three weeks after the day of the policy decision. Investors look for clues regarding the policy outlook in this publication alongside the vote split. A bullish tone is likely to provide a boost to the greenback while a dovish stance is seen as USD-negative. It needs to be noted that the market reaction to FOMC Minutes could be delayed as news outlets don’t have access to the publication before the release, unlike the FOMC’s Policy Statement.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.