Gold price moves back closer to weekly top; looks to US NFP for fresh impetus

- Gold price remains confined in a range on Friday as traders keenly await the US NFP release.

- Rising trade tensions, the risk-off mood, and a weaker USD lend support to the precious metal.

- Bets for more interest rate cuts by the Fed contribute to limiting the downside for the XAU/USD.

Gold price (XAU/USD) builds on the steady intraday ascent through the first half of the European session and climbs back closer to the top end of its weekly range. The US Dollar (USD) selling bias remains unabated in the wake of rising bets that the Federal Reserve (Fed) will cut interest rates several times in 2025 amid worries about slowing US economic growth. This keeps the USD depressed near a multi-month low and turns out to be a key factor acting as a tailwind for the non-yielding yellow metal.

Moreover, the uncertainty surrounding US President Donald Trump's trade policies and their impact on the global economy turns out to be another factor underpinning the safe-haven Gold price. The XAU/USD pair, however, remains confined in a multi-day-old range as traders now seem reluctant and opt to wait for the release of the crucial US Nonfarm Payrolls (NFP) report – before placing directional bets. Nevertheless, the bullion remains on track to register strong weekly gains amid a bearish USD.

Daily Digest Market Movers: Gold price attract dip-buyers amid trade war fears, economic uncertainty and weaker USD

- Mounting worries over the potential impact of US President Donald Trump's trade tariffs on the US economy keep the US Dollar depressed near its lowest level since November 11 and should act as a tailwind for the Gold price.

- The uncertainty surrounding Trump's trade policies, especially after another U-turn on the recently imposed tariffs on Mexico and Canada, continues to weigh on investor sentiment and could support the safe-haven precious metal.

- Trump on Thursday exempted goods from both Canada and Mexico that comply with the US–Mexico–Canada Agreement for a month from the steep 25% tariffs, which went into effect earlier this week on Tuesday.

- Traders have been pricing in the possibility of further policy easing by the Federal Reserve amid concerns about an economic slowdown in the US, which further undermines the USD and benefits the non-yielding yellow metal.

- Philadelphia Fed President Patrick Harker on Thursday flagged growing threats to economic growth and risks to the inflation outlook, though acknowledged that the economy appears to be growing, with still low unemployment.

- Separately, Atlanta Fed President Raphael Bostic noted that the US economy is in incredible flux and it’s hard to know where things will land. The central bank needs to be mindful of any changes that impact prices and employment.

- Meanwhile, Fed Governing Board Member Christopher Waller said he leans strongly against a rate cut at the March meeting, although he reckons cuts later in the year remain on track if inflationary pressures continue to abate.

- On the economic data front, the US Initial Jobless Claims fell more than expected, to 221K during the week ended March 1, though it failed to provide any respite to the USD bulls or influence the XAU/USD pair.

- Traders keenly await the release of the crucial US Nonfarm Payrolls (NFP) report, which is expected to show that the economy added 160K new jobs in February and the Unemployment Rate held steady at 4%.

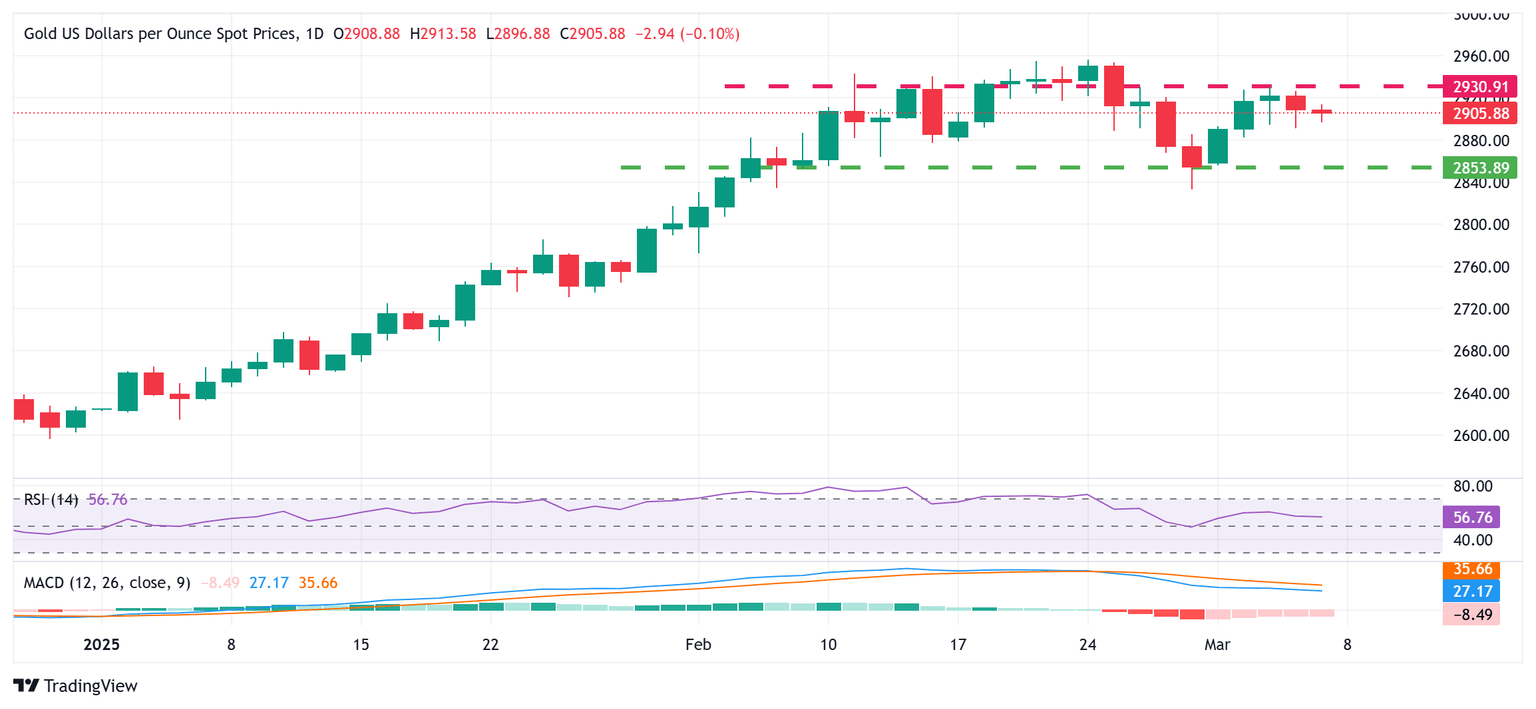

Gold price needs to clear the $2,934 hurdle before aiming to challenge the all-time peak

From a technical perspective, the Gold price has been showing resilience below the $2,900 round figure, warranting caution for bearish traders amid still positive oscillators on the daily chart. Acceptance below the said handle, however, could drag the XAU/USD to the $2,860-2,858 horizontal zone with some intermediate support near the $2,884-2,883 region. The downward trajectory could extend further towards last week's swing low, around the $2,833-2,832 area before the commodity eventually drops to the $2,800 mark.

On the flip side, the $2,926-2,930 zone now seems to have emerged as an immediate hurdle, above which the Gold price could aim to retest the all-time peak, around the $2,956 region touched in February. Some follow-through buying would be seen as a fresh trigger for bullish traders and pave the way for the resumption of the recent well-established uptrend witnessed over the past three months or so.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.