Gold price gains amid uncertainty on US trade policies

- Gold gains 0.56% despite thin liquidity on US Presidents’ Day.

- Geopolitical risks, US trade policies support bullion’s long-term outlook.

- Traders await FOMC Minutes, Fed speakers, and key US economic data.

Gold price climbed on Monday during the North American session, posting gains of 0.56% amid thin trading as markets in the United States (US) were closed in observance of Presidents’ Day. The XAU/USD traded at $2,898 after hitting a daily low of $2,878.

Last Friday, Gold registered its most significant loss since December 18, yet the outlook for the precious metal looks promising amid geopolitical uncertainties and US trade policies aimed at narrowing the deficit.

Data from the US was mixed last week with the Consumer Price Index (CPI) and the Producer Price Index (PPI) coming slightly hot. Retail Sales disappointed investors, who rushed to price in further easing by the Federal Reserve (Fed).

Fed officials have become cautious as inflation remains above the 2% goal. Philadelphia Fed President Patrick Harker said that policy needs to be “steady” for now and emphasized that monetary policy is in a good place. Harker added that the labor market is solid and that policy should be focused on lowering inflation.

Recently, Fed Governor Michelle Bowman said she expects inflation to decline, though she acknowledged that upside risks remain.

This week, the US economic docket will feature further Fed speakers, housing data, the latest Federal Open Market Committee (FOMC) Meeting Minutes, Initial Jobless Claims, and S&P Global Flash PMIs final reading for February.

Daily digest market movers: Gold price benefits from safe-haven demand

- The US 10-year Treasury bond yield tanked four basis points (bps) on Friday and sits at 4.478%.

- US real yields, which correlate inversely to Bullion prices, dropped four basis points to 2.039%, a tailwind for XAU/USD.

- The World Gold Council revealed that central banks purchased over 1,000 tonnes of Gold for the third consecutive year in 2024. Following Trump's electoral victory, purchases by central banks surged by more than 54% YoY to 333 tonnes, according to WGC data.

- Money market fed funds rate futures are pricing in 43 basis points of easing by the Fed in 2025.

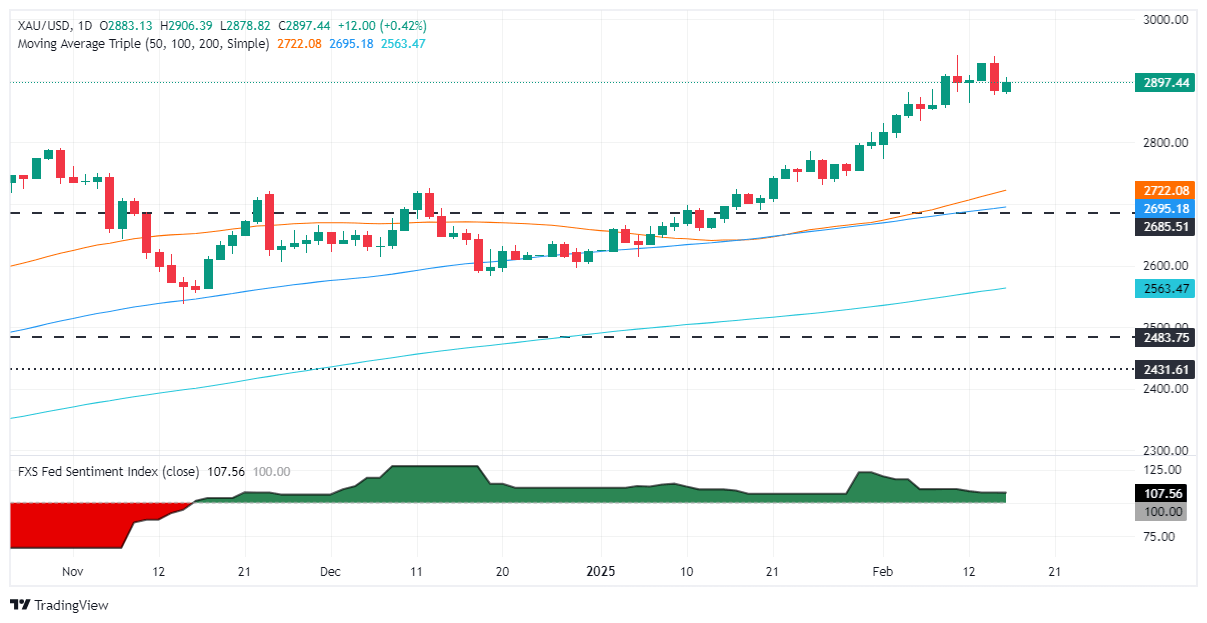

XAU/USD technical outlook: Gold price rises toward $2,900

The uptrend in Gold remains in play, though buyers must clear the $2,900 figure, to remain hopeful of testing the year-to-date (YTD) high of $2,942. If those two levels are cleared, the next ceiling level would be $2,950, followed by the $3,000 mark.

Conversely, XAU/USD daily close below $2,900 could pave the way for challenging the February 14 swing low of $2,877, followed by the February 12 low of $2,864. On further weakness, Gold could fall to test the October 31 swing high at $2,790.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.