Gold soars as investors flock to safety on trade and geopolitical uncertainty

- XAU/USD climbs to $2,888 as markets brace for tariffs, weaker US growth

- Gold snaps a two-day losing streak as risk-off sentiment drives safe-haven flows.

- Trump’s tariff threats, clash with Zelenskyy fuel market uncertainty.

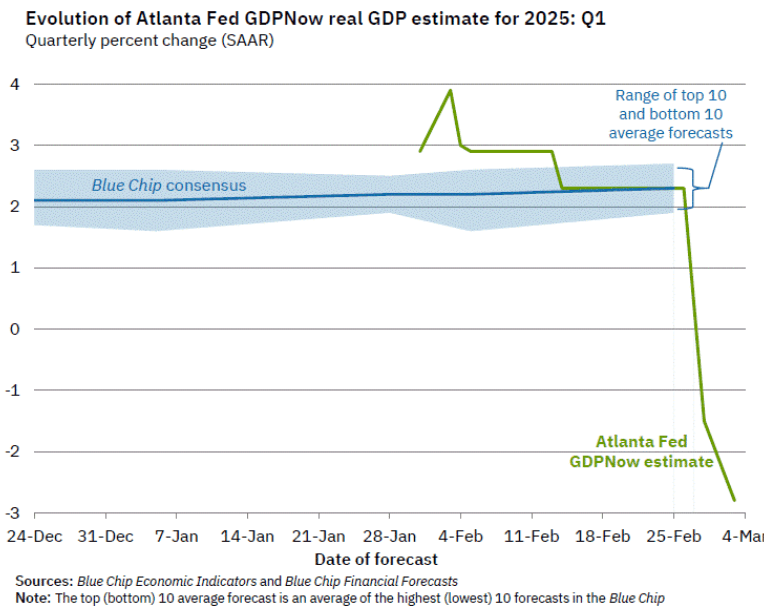

- Atlanta Fed GDP Now forecast plunges to -2.8%, boosts Gold’s appeal.

Gold price is rallying over 1% on Monday, snapping two days of losses as the Greenback gets battered due to safe-haven demand and falling United States (US) Treasury bond yields. Geopolitical tensions and tariff threats by US President Donald Trump increased demand for the safety appeal of Bullion. XAU/USD trades at $2,888 at the time of writing.

Risk appetite deteriorated following the clash between US President Donald Trump and Ukrainian President Volodymir Zelenskyy last Friday. In the meantime, tariffs imposed on Mexico, Canada and China are expected to kick in on Tuesday.

Data-wise, business activity in the manufacturing sector in February was mixed, with S&P Global improving, while the ISM dipped but continued to expand.

In the meantime, the last round of US economic data pushed the Atlanta GDP Now Q1 2025 forecast model further deep into negative territory from -1.6% on February 28 to -2.8% as of writing.

Source: GDPNow

Therefore, traders seeking safety bought Bullion pushing prices on the way towards $2,900. The US 10-year Treasury note falls two basis points (bps) down to 4.176% levels last seen in December 2024.

Alongside the data, St. Louis Fed President Alberto Musalem said the economic outlook is for continued solid economic growth, but recent data pose some downside risks.

Daily digest market movers: Gold price surges amid pessimistic US economic outlook

- US real yields, as measured by the yield in the US 10-year Treasury Inflation-Protected Securities (TIPS), tumble almost three bps to 1.808%.

- The US ISM Manufacturing PMI for February held steady at 50.3, slightly down from 50.9 and below the 50.5 forecast, indicating a mild slowdown in business activity.

- S&P Global Manufacturing PMI showed improvement, rising to 52.7 from 51.2, surpassing expectations of 51.6, signaling continued expansion in the sector.

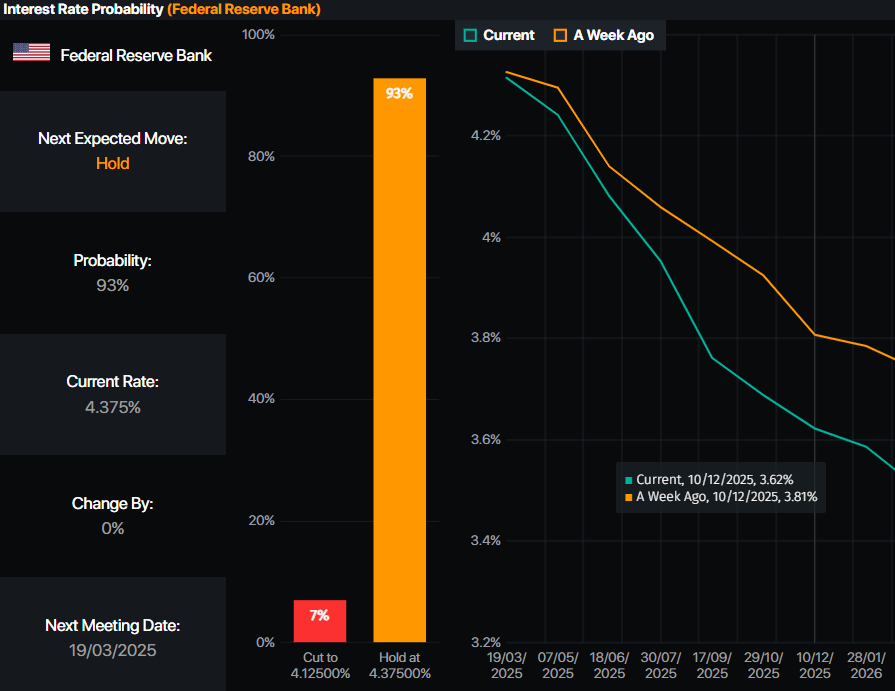

- Money markets had priced in that the Federal Reserve (Fed) would ease policy by 71 basis points (bps), up from 58 bps last week, revealed data from Prime Market Terminal.

Source: Prime Market Terminal

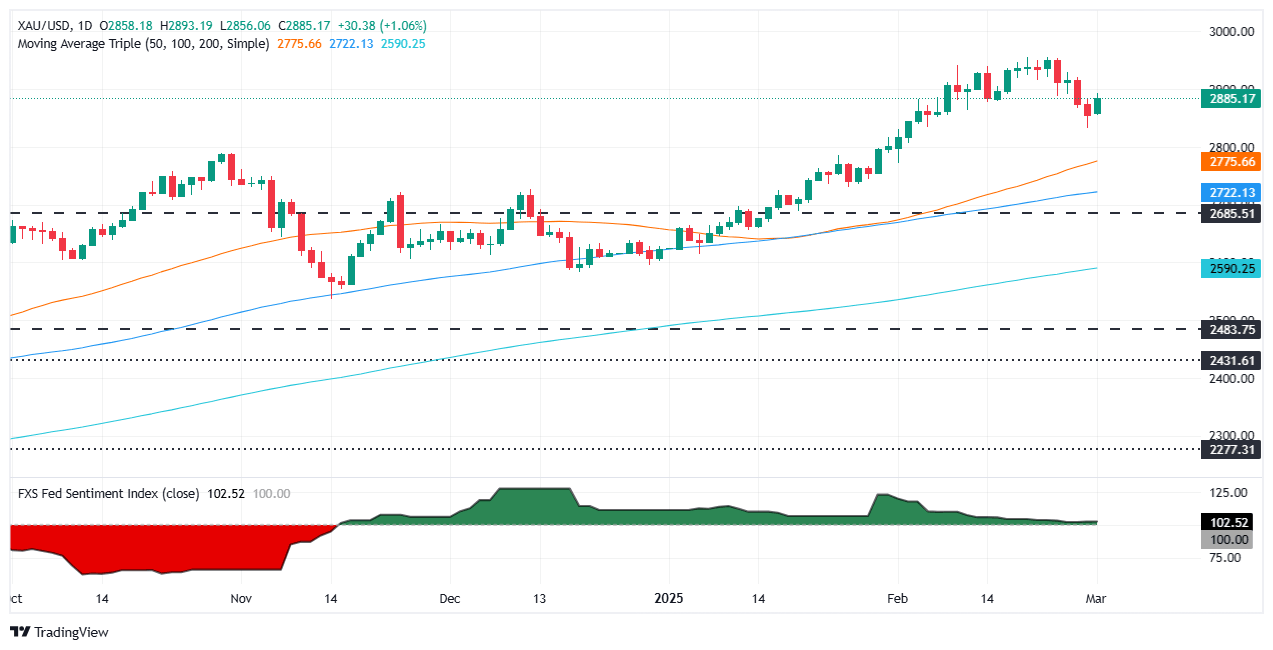

XAU/USD technical outlook: Gold price advances towards $2,900

Gold price uptrend resumed after two days of losses that drove XAU/USD below the $2,900 figure. Nevertheless, buyers stepped in near the $2,830 mark, lifting spot prices above $2,850, which exacerbated the rally toward $2,893. If buyers achieve a daily close above $2,900, bullion could be poised to challenge the year-to-date (YTD) peak at $2,954.

Otherwise, on further weakness, XAU/USD could aim toward the February 14 low of $2,877, followed by the February 12 swing low of $2,864. However, the broader uptrend remains intact unless XAU/USD drops below $2,800.

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.