Gold Price News and Forecast: XAU/USD tumbles near two-week’s lows, sub-$1600/oz [Video]

![Gold Price News and Forecast: XAU/USD tumbles near two-week’s lows, sub-$1600/oz [Video]](https://editorial.fxstreet.com/images/Markets/Commodities/Metals/Gold/gold-coins-on-a-weight-scale-gm173237086-20246712_XtraLarge.jpg)

Commodity Report: Gold Price Forecast [Video]

Gold slid more than 1% to its lowest in a week on Friday as the recent price rallies prompted investors to take profits, but the metal was still on track for a third consecutive monthly gain as the spread of coronavirus gathered pace. When sentiment is ruled by fear, investors always rush to cash and liquidity, and also sell profitable investments due to margin calls or to cover other investment losses. Prices hit a 7-year high of $1,689 earlier this week on coronavirus fears. Read more...

Gold Price Analysis: XAU/USD tumbles near two-week’s lows, sub-$1600/oz

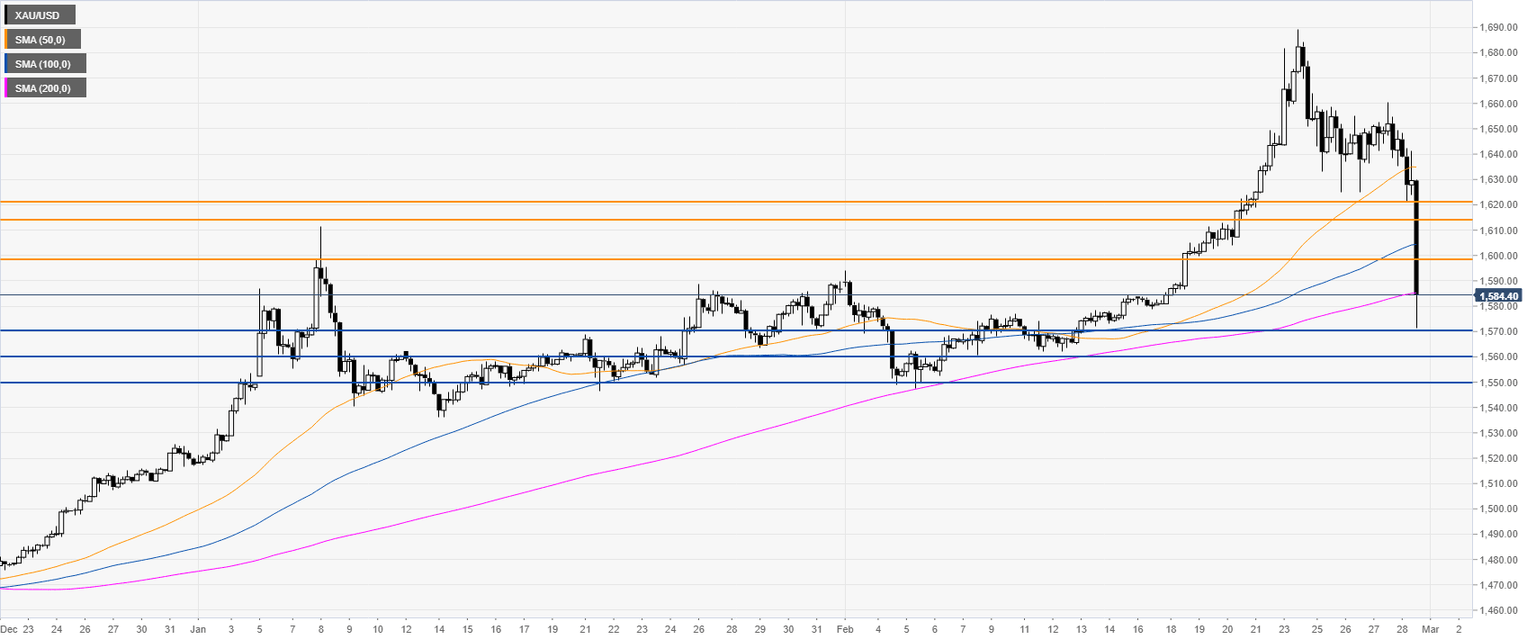

XAU/USD is trading in a bull trend above its main daily simple moving averages (SMAs). However, the market is pulling down sharply trading off seven-year’s highs.

Gold four-hour chart

Gold has been dropping sharply this Friday while reaching the 200 SMA on the four-hour chart. The bears seem to be in charge and more down could potentially be expected. Sellers can try to drive the market down towards the 1570.00, 1560.00 and 1550.00 support levels. Resistance can be expected near the 1599.00 and 1612.00 levels. Read more...

Will Gold Shine Due to Coronavirus Infecting the Global Economy?

With new cases of COVID-19 outside China rising, the chances of a pandemic and global recession have increased recently. What are the implications for the gold market?

Coronavirus Spreads Over the World

Unfortunately, the new coronavirus remains the hottest topic of the news. Although the COVID-19 epidemic has been slowing down in China since the beginning of February, it has quickly spread to several other countries. The WHO’s situation report from February 26 says that the infections of the new coronavirus has been reported in 37 countries. Actually, for the first time since the beginning of the epidemic on December 8, there have been more new cases reported from countries outside of China than from China. With so many countries, including the Western ones, struggling with the disease, the COVID-19 ceased to be Asian issue and has become a truly global issue. As world inches closer to the real pandemic, the financial markets could become even more nervous, so we could see more safe-haven flows into the gold market. Read more...

Author

FXStreet Team

FXStreet