Gold daily chart

XAU/USD is trading in a bull trend above its main daily simple moving averages (SMAs). However, the market is pulling down sharply trading off seven-year’s highs.

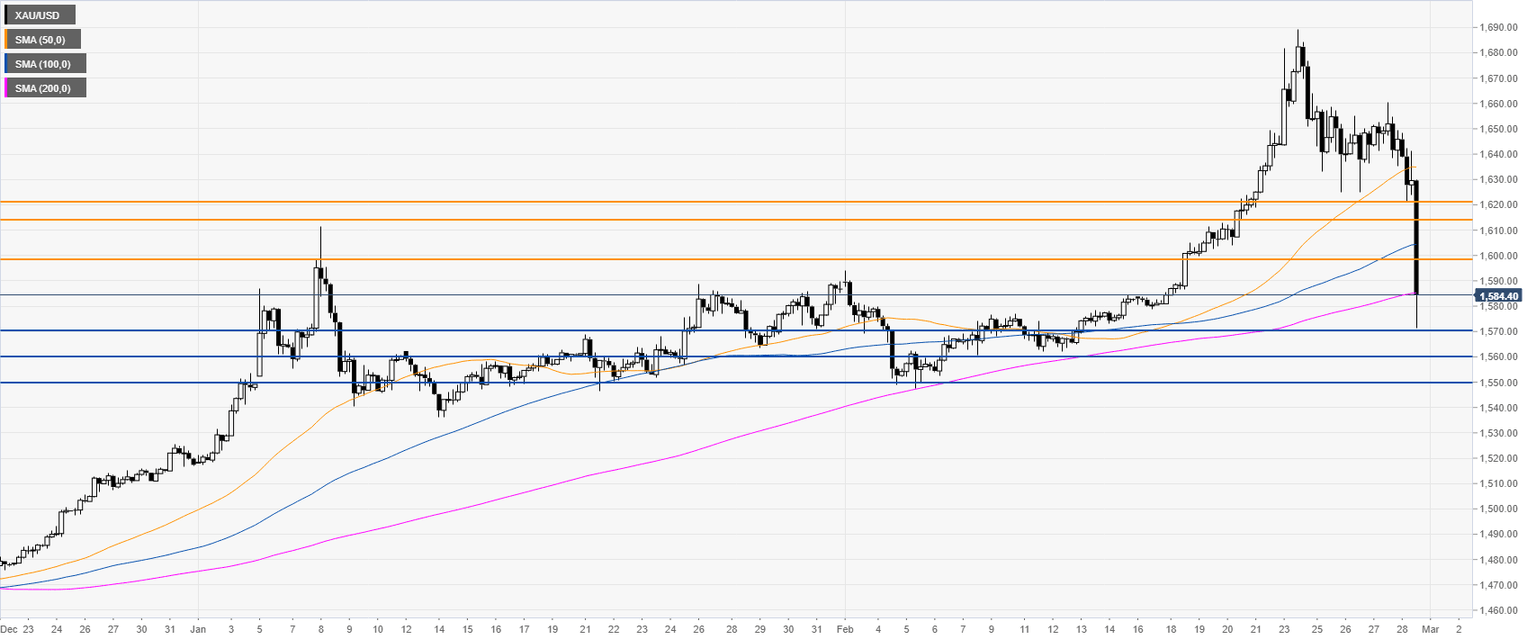

Gold four-hour chart

Gold has been dropping sharply this Friday while reaching the 200 SMA on the four-hour chart. The bears seem to be in charge and more down could potentially be expected. Sellers can try to drive the market down towards the 1570.00, 1560.00 and 1550.00 support levels. Resistance can be expected near the 1599.00 and 1612.00 levels.

Resistance: 1599.00, 1612.00, 1621.00

Support: 1570.00, 1560.00, 1550.00

Additional key levels