Gold Price News and Forecast: XAU/USD may move as high as $2,300 in the near-term

Gold Price Analysis: Down 0.40% in Asia, $1,980 is key support

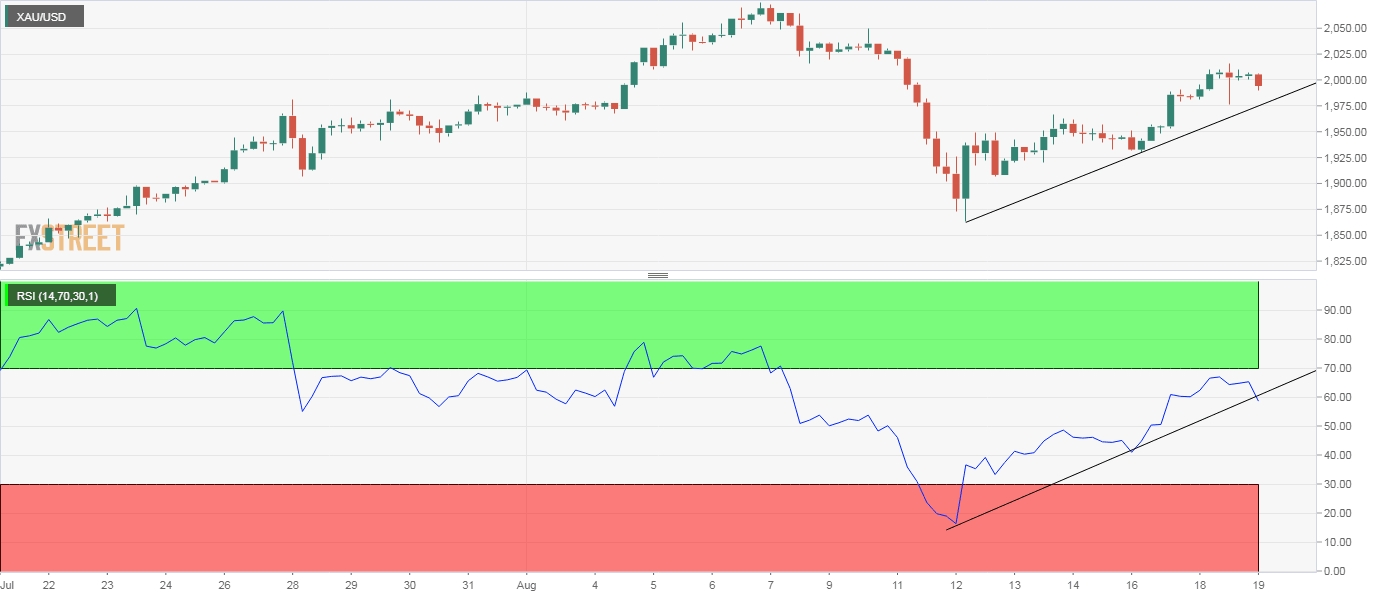

Gold is trading near $1,993 at press time, representing a 0.4% decline on the day. The yellow metal faced rejection at $2,015 on Tuesday. The 4-hour chart relative strength index has dived out of an ascending/bullish trendline. As such, the metal risks extending losses to $1,980. That level is currently housing the trendline rising from Aug. 12 and Aug. 16 lows.

A break below that trendline support would imply an end of the recovery from the Aug. 12 low of $1,863 and could cause some buyers to exit the market, leading to a deeper decline to $1,950. A move above $2,015 is needed to restore the immediate bullish view.

Gold may move as high as $2,300 in the near-term

UBS economist foresees gold’s price rising to $2,300 per ounce in the near-term in the event of an escalation of geopolitical tensions. The yellow metal is trading near $2,000 at press time. Prices fell from $2,075 to $1,863 in the four days to Aug. 12, as the US treasury yields recovered from record lows.

However, despite the recent pullback, UBS is retaining its year-end forecast of $2,000 per ounce. Indeed, with the Federal Reserve continuing to pump unprecedented amounts of liquidity alongside an uptick in inflation, a big pullback in gold looks unlikely.

Author

FXStreet Team

FXStreet