Gold Price News and Forecast: XAU/USD further upside appears contained

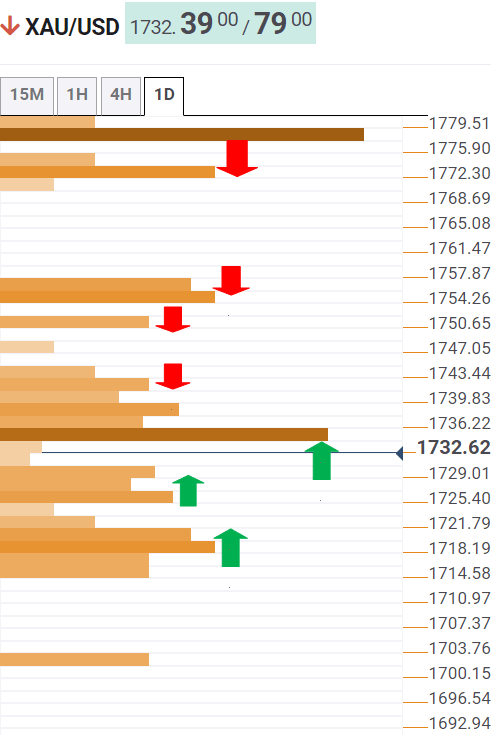

Gold Price Analysis: Range play likely for XAU/USD amid US-China talks, levels to watch –" Confluence Detector

Gold (XAU/USD) is on the defensive, treading water amid the recent surge in the US Treasury yields that lifted the dollar alongside. Thursday’s sudden rally in the rates countered the dovish Fed expectations, as investors bet on faster economic recovery and higher inflation. The BOE also echoed the Fed’s stance on monetary policy.

However, the downside in gold remains cushioned by the renewed jitters around the US-China talks and the slump in the global equities amid inflation fears. In the day ahead, the dynamics in the bond markets and US-China talks will continue to influence sentiment around the yellow metal, as the US docket remains data-dry. Read more...

Gold Futures: Further upside appears contained

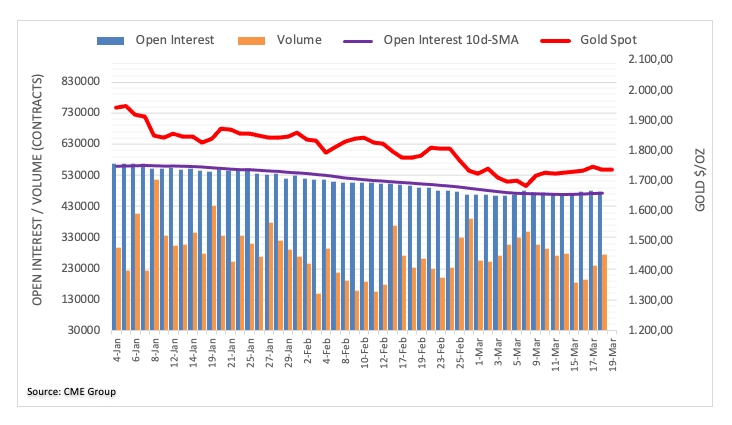

Open interest in Gold futures markets shrunk by around 3.1K contracts on Thursday, reversing three consecutive daily builds according to flash data from CME Group. Volume, instead, rose for the third session in a row, this time by around 34.3K contracts.

Gold prices charted an inconclusive day on Thursday after hitting weekly tops in the $1,760 area per ounce troy. The move was accompanied by shrinking open interest and rising volume, exposing further consolidation in the very near-term. Read more...

Gold Price Analysis: XAU/USD at risk as Fed announces no SLR exemption

Having struggled to hold above their 21-day moving average, which currently resides at $1741, spot gold prices (XAU/USD) have slipped back from European morning session highs and, as US trade gets underway, are trading flat on the session in the mid-$1730s, pretty much bang in the middle of this week’s $1720-$1755ish price range.

During Asia Pacific and early European session trading hours, precious metals markets had been deriving modest support from a gradual retracement lower in US government bond yields, which had (for example) seen the US 10-year drop back below the 1.70% level. at the end of the month. Read more...

Author

FXStreet Team

FXStreet