Gold Price News and Forecast: XAU/USD downside could be losing momentum

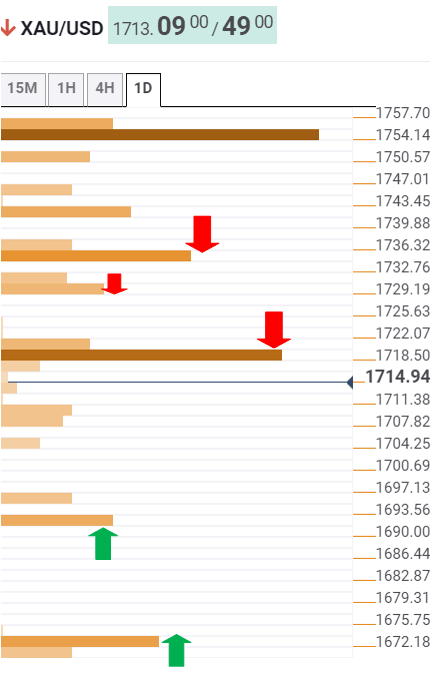

Gold Price Analysis: XAU/USD bulls face an uphill battle, a dead cat bounce? –" Confluence Detector

Gold (XAU/USD) is nursing losses after a sharp $16 drop witnessed in early Asia, as the prices hit the lowest levels since June 2020 at $1710.50. The yellow metal remains in the red for the fourth straight day on Tuesday, as the US dollar continues to draw bids amid strong US ISM Manufacturing PMI and broad risk aversion.

The corrective declines in the US Treasury yields and US stimulus optimism fail to rescue the XAU bulls. Although the bounce in gold could extend if the sell-off in the yields accelerate amid intensifying risk-off mood, which could drag the greenback lower. Read more...

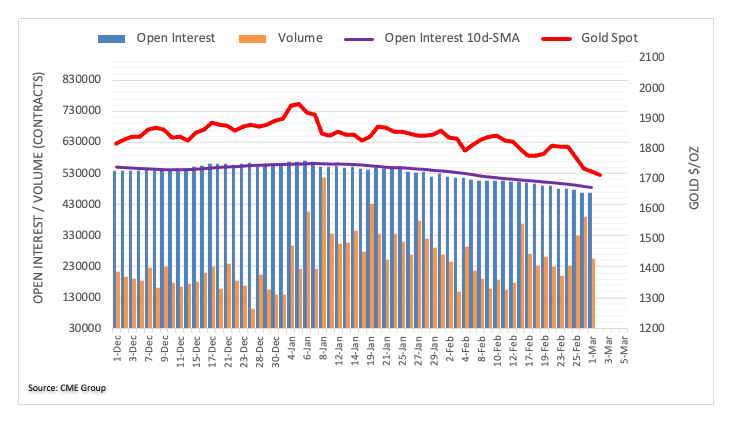

Gold Futures: Downside could be losing momentum

Open interest in gold futures markets shrunk for the third session in a row at the beginning of the week, this time by just 937 contracts according to preliminary figures from CME Group. In the same line, volume went down by around 133.5K contracts after three consecutive daily builds.

Gold prices extended the downtrend on Monday and already trades at shouting distance from the key support at the $1,700 mark per ounce troy. Shrinking open interest and volume play against a deeper pullback that could extend to the $1,670 level in the near-term. Read more...

Gold Price Analysis: XAU/USD bounces off multi-month lows, lacks follow-through

Gold reversed the Asian session dip to fresh multi-month lows and was last seen trading just above the $1720 level, nearly unchanged for the day.

Gold prolonged its recent bearish trajectory and continued losing ground through the early part of the trading action on Tuesday. Sustained US dollar buying was seen as one of the key factors that continued exerting pressure on the dollar-denominated commodity, though a combination of factors helped limit deeper losses. Read more...

Author

FXStreet Team

FXStreet