Gold price steadily climbs to three-day peak, above $2,630; lacks bullish conviction

- Gold price ticks higher for the third straight day, albeit it lacks strong follow-through.

- Geopolitical risks and trade war fears continue to support the safe-haven XAU/USD.

- The Fed’s hawkish tilt, elevated US bond yields and modest USD strength cap gains.

Gold price (XAU/USD) builds on its recovery from a one-month low touched last Thursday and gains positive traction for the third successive day at the start of a new week. The commodity sticks to its positive bias through the first half of the European session and is supported by some haven flows – bolstered by geopolitical risks and trade war fears. That said, a positive risk tone acts as a headwind for the precious metal.

Meanwhile, the Federal Reserve's (Fed) hawkish signal remains supportive of elevated US Treasury bond yields and assists the US Dollar (USD) in attracting some dip-buying on Monday. This further contributes to capping the non-yielding Gold price, making it prudent to wait for strong follow-through buying before positioning for additional gains. Traders now look to the Conference Board's Consumer Confidence Index for a fresh impetus.

Gold price continues to draw support from geopolitical tensions; modest USD strength caps gains

- The US Dollar pulled back from a two-year high on Friday following the release of the US Personal Consumption Expenditure (PCE) Price Index, which pointed to signs of inflation moderation.

- The US Bureau of Economic Analysis (BEA) reported that inflation in the US, as measured by the change in the PCE Price Index, edged higher to 2.4% on a yearly basis in November from 2.3% previous.

- Meanwhile, the core PCE Price Index, which excludes volatile food and energy prices, rose 2.8% during the reported period, matching October's reading but arriving below the expectation of 2.9%.

- Furthermore, Personal Income decelerated sharply from 0.7% in October and grew 0.3% last month, while Consumer Spending rose 0.4% after a downwardly revised reading of 0.3% in October.

- Russian President Vladimir Putin has pledged retaliation after Ukraine staged a major drone attack on the city of Kazan, which damaged residential buildings and shut down the airport.

- Israeli forces bombed the so-called “safe zone” in southern Gaza, causing tents to go up in flames and killing at least seven Palestinians, taking the death toll over the past day to at least 50.

- The Federal Reserve last week signaled that it would slow the pace of rate cuts in 2025, lifting the benchmark US Treasury bond yield to its highest level in more than six months last week.

- Monday's US economic docket features the release of the Conference Board's Consumer Confidence Index and might provide some impetus later during the early North American session.

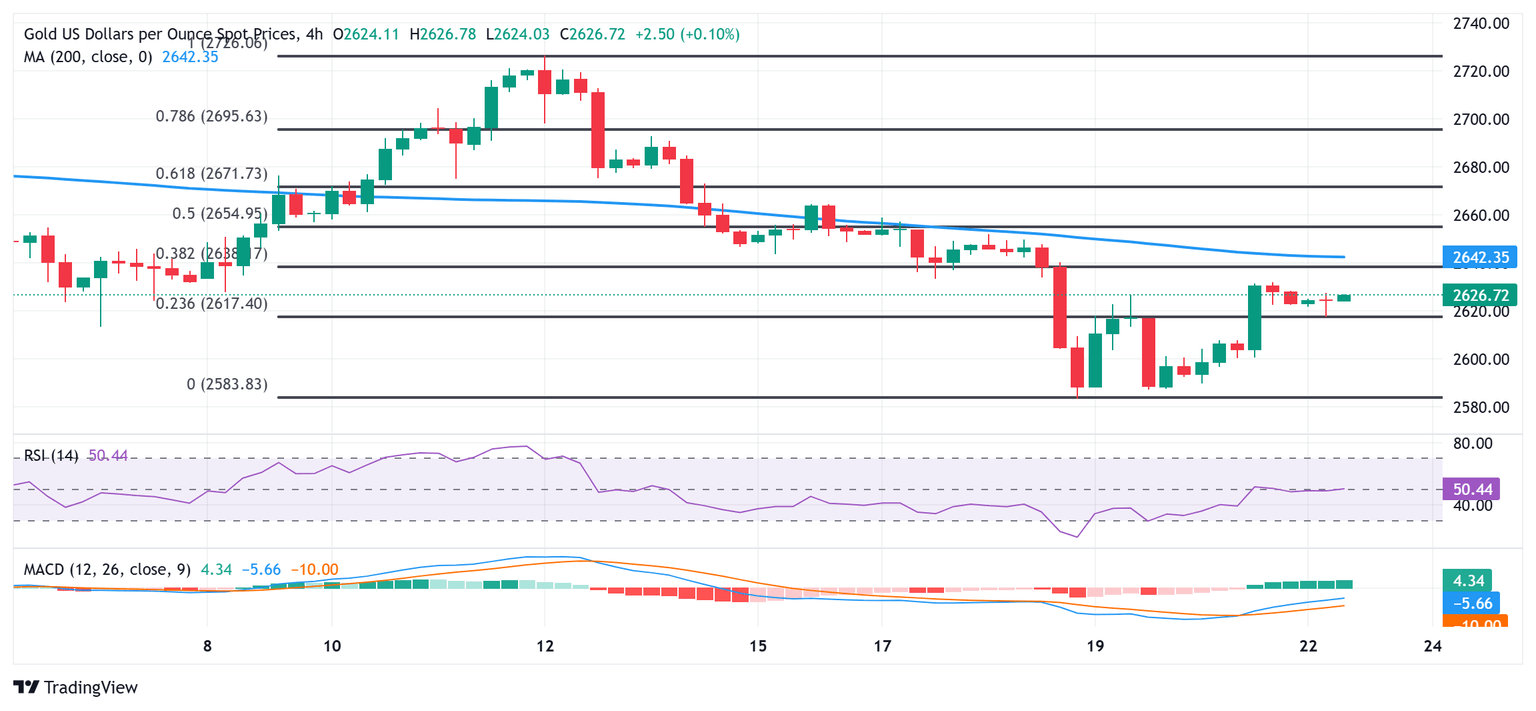

Gold price might struggle to break through the 38.2% Fibo. hurdle, around the $2,637 region

From a technical perspective, acceptance above the 23.6% Fibonacci retracement level of the recent pullback from a one-month peak favors bullish traders. That said, negative oscillators on daily/4-hour charts warrant some caution before positioning for any further appreciating move. Hence, any subsequent move up might still be seen as a selling opportunity and seems limited.

Meanwhile, the 38.2% Fibo. level, around the $2,637 area, now seems to act as an immediate hurdle ahead of the $2,643-$2,647 congestion zone, which coincides with the downward sloping 200-period Simple Moving Average (SMA) on the 4-hour chart. The latter should act as a key pivotal point, which if cleared decisively, should pave the way for a further appreciating move.

On the flip side, the $2,616-$2,615 region that is deemed as a pullback area, or the 23.6% Fibo. level could offer immediate support. This is followed by the $2,600 round-figure mark, below which the Gold price could retest the monthly swing low, around the $2,583 zone touched last week. Some follow-through selling will be seen as a fresh trigger for bears and set the stage for deeper losses in the near term.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.