Gold Price Forecast: XAUUSD bears are moving in at a key resistance

- Gold is hanging on a thread as the US Dollar catches a corrective bid.

- Gold is meeting resistance and the backside of a key trendline.

The Gold price has stalled on the bid in Tokyo, falling by 0.10% at the time of writing. XAUUSD has fallen from a high of $1,781.48 to a low of $1,775.97, capped within a potential ceiling of the recent bullish correction. The yellow metal did perk up on the back of rising geopolitical risks and a weaker USD from the start of the session.

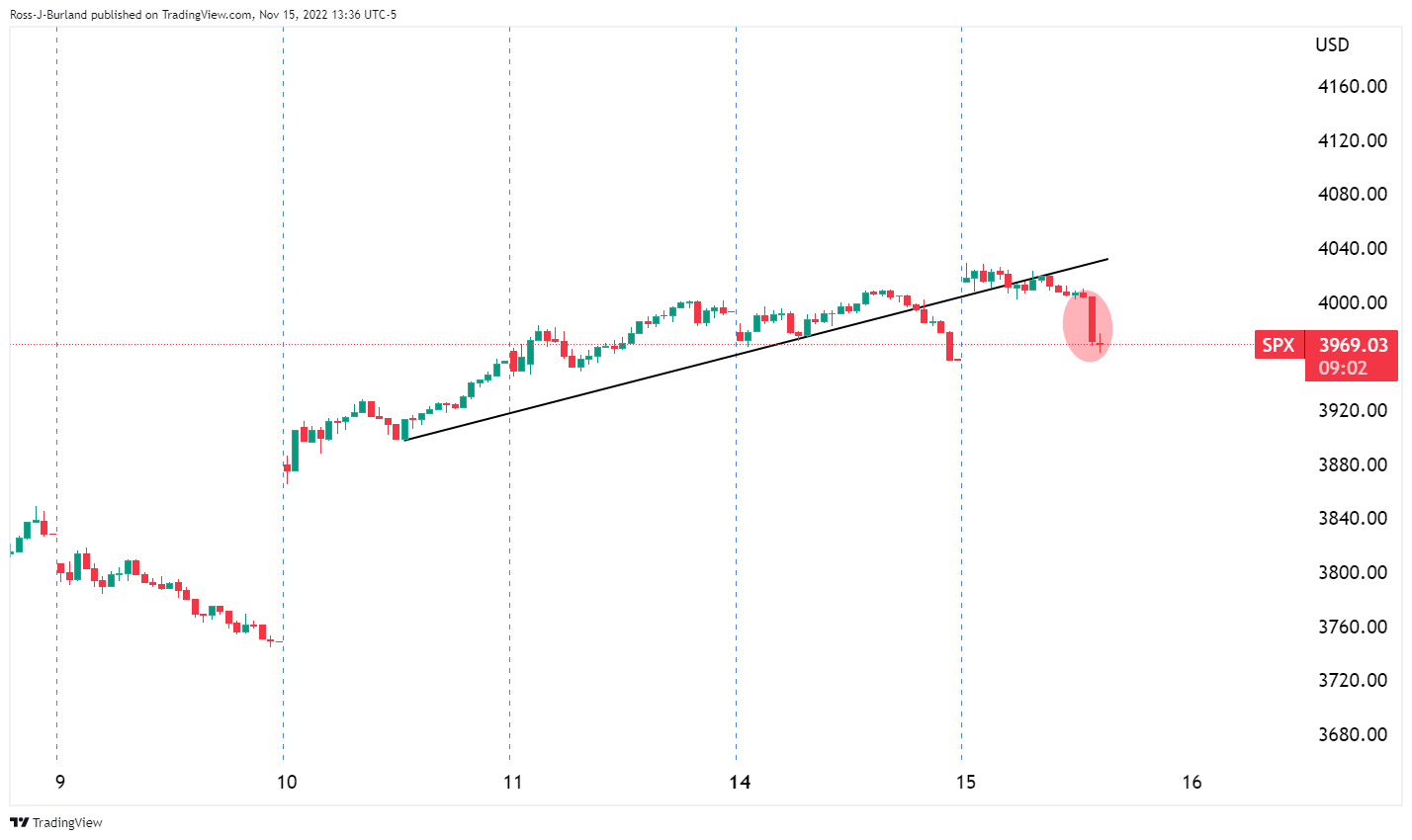

Reports of Russian missiles crossing into Poland weighed on risk sentiment during the New York mid-day session. US stocks were turning into a sea of red with the benchmarks heading south as per the SP 500 index:

Poland news creates volatility

However, the sentiment was mixed due to the possibility that this was not a direct attack by Russia and a false alarm.

A Polish reporter was quoted on the blasts:

''My sources in the services say that what hit Przewowo is most likely the remains of a [Russian] rocket shot down by the Armed Forces of Ukraine.'' The doubts over the intentions of Russia to bomb Poland put a bid back into markets:

Polish President Andrzej Duda said that what happened was a one-off incident, adding that there were no indications that there will be a repeat of today's incident.

Meanwhile, investor demand was also supported by a weaker USD which was sparked by the lower-than-expected producer price inflation. The DXY fell to its lowest since mid-August around 105.35 and was on track to test the August 10 low near 104.636.

US Dollar corrects PPI lead drop

US yields reacted accordingly to the PPI whereby the headline came in at 8.0% vs. 8.3% expected and a revised 8.4% (was 8.5%) in September. The core came in at 6.7% YoY vs. 7.2% expected and actual in September. The data has buffered the idea that the Fed is closer to a pivot than ever before. However, the bulls have moved in and are treading water again as the US Dollar catches a sage haven bid:

As for the yellow metal, ''isn't out of the woods just yet,'' according to analysts at TD Securities. ''We find a rally towards the $1850/oz mark would still be supported by CTA short covering, which points to continued squeeze risks in gold should the US dollar continue to weaken. In contrast, the bar for CTAs to add to their shorts once more is more elevated.''

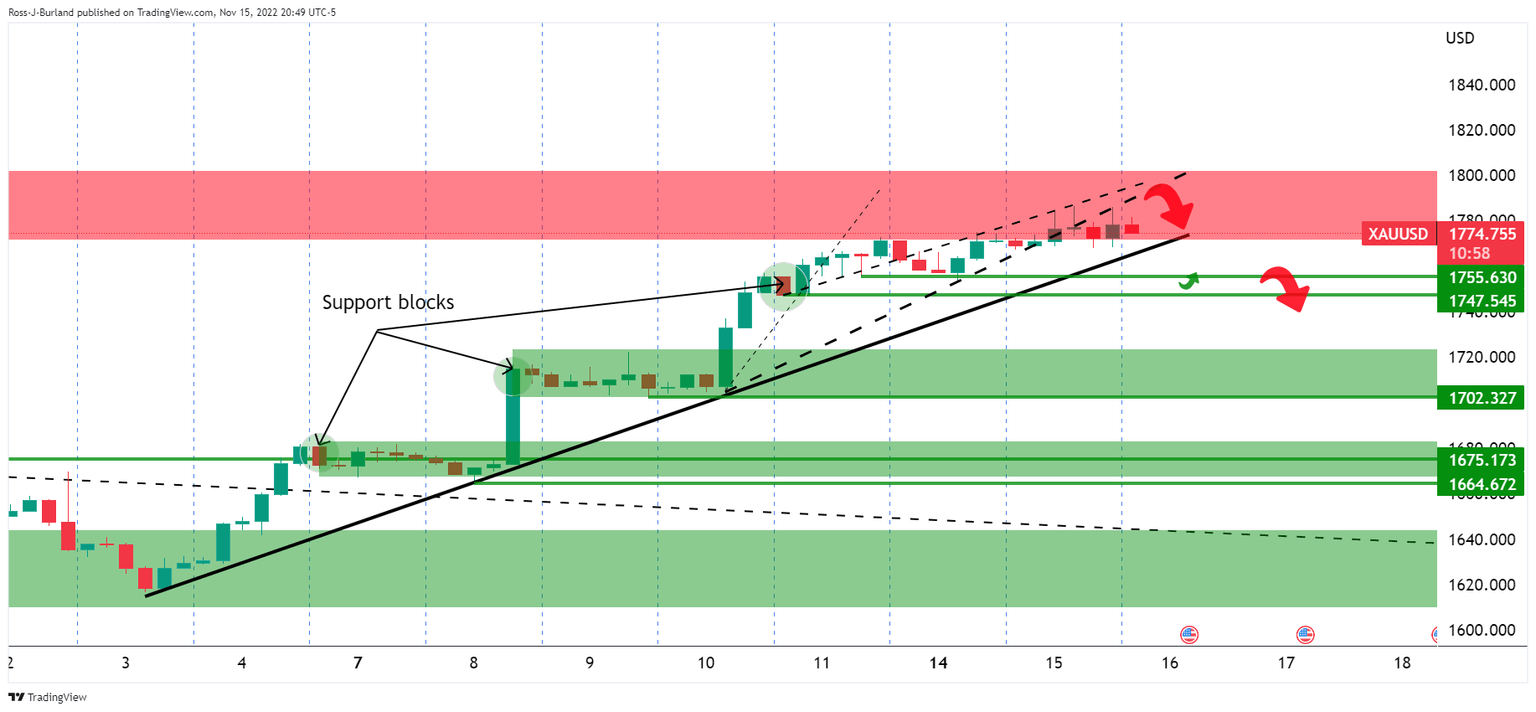

Gold technical analysis

The 4-hour chart shows the price dangling over the edge of the rally in resistance and on the back side of the prior micro trendline. This would be expected to lead to a phase of distribution on the lower time frames where bears can be looking for an optimal entry according to the mid-week set ups that may, or may not, present themselves.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.