Gold Price Forecast: XAU/USD tests lower range limit around mid-1,900s on rising US debt uncertainties

- Gold Price holds lower ground as it prods bottom of short-term key trading range.

- Firmer US Treasury bond yields, US Dollar cap XAU/USD’s haven demand amid dicey markets.

- Mixed feelings about US debt ceiling deal, Federal Reserve restrict the Gold Price moves.

- US data, risk catalysts eyed for clear directions as US negotiators brace for long weekend.

Gold Price (XAU/USD) struggles for clear directions as bulls and bears jostle around a short-term key support line nearing $1,955 heading into Thursday’s European session. In doing so, the yellow metal portrays the market’s indecision amid mixed signals surrounding the US debt limit extension talks and the US Federal Reserve (Fed). Also likely to prod the XAU/USD traders is the cautious mood ahead of a slew of mid-tier data from the US.

The US policymakers’ inability to deliver a debt ceiling extension deal and the looming long weekend for the House Representatives amplifies the US default fears even if the negotiators see progress in the latest rounds of talks. With this, global rating agencies like Fitch and Moody’s turned cautious about the US credit rating status while the US Treasury Department accepted their fears.

Elsewhere, the Minutes of the latest Federal Open Market Committee (FOMC) Meeting suggested that the policymakers are divided about the latest 0.25% rate hike from the US central bank. The same doubts the market’s bets on another such move in June. Even so, Atlanta Fed President Raphael Bostic said, “‘We’re right at the beginning of the hard part’ of taming inflation.” On the same line, Federal Reserve Governor Christopher Waller mentioned that he doesn’t support stopping rate hikes unless getting clear evidence that inflation is moving down toward the 2% objective.

On the other hand, the market’s expectations of more easing from China, amid record-high interbank Repo turnover, contrasts with the geopolitical fears to challenge the Gold price moves.

While portraying the mood, the S&P500 Futures snap a two-day downtrend by bouncing off a two-week low to 4,138 by the press time, up 0.39% intraday at the latest. On the other hand, the US 10-year and two-year Treasury bond yields remain firmer at the highest levels since mid-March, close to 3.75% and 4.40% as we write.

Moving on, the US weekly Jobless Claims, the Chicago Fed National Activity Index and Pending Home Sales will decorate the calendar but the debt ceiling talks will be crucial to watch for clear directions.

Gold price technical analysis

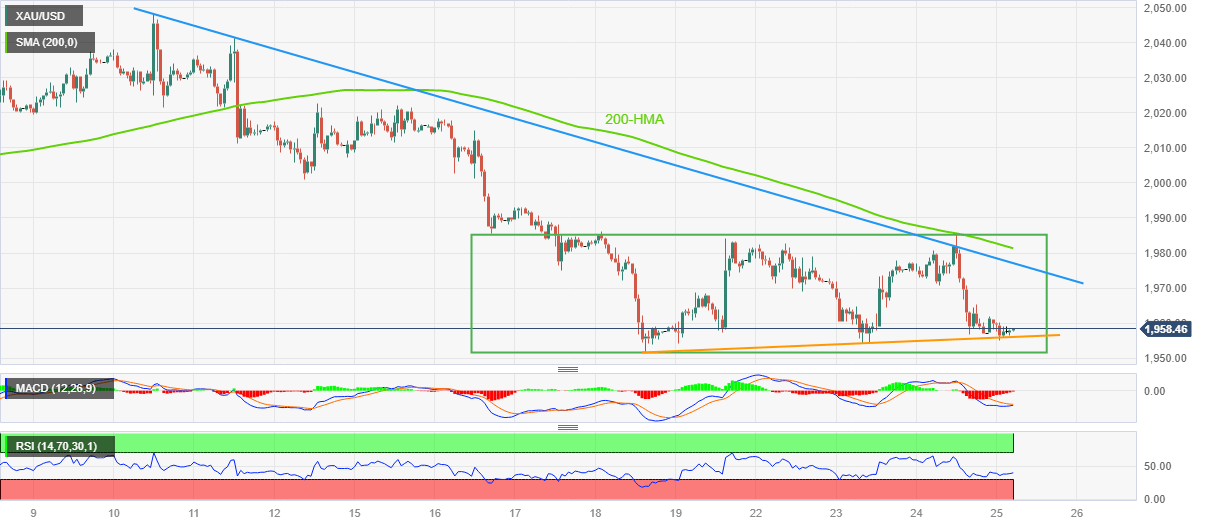

Gold price prods a one-week-old ascending support line surrounding $1,955 while staying within a short-term trading range established since May 16, currently between $1,985 and $1,951.

That said, the impending bull cross on the MACD and the below 50 conditions of the RSI (14) line defends the XAU/USD buyers.

However, a fortnight-long falling trend line and the 200-Hour Moving Average (HMA), respectively near $1,977 and $1,981, can restrict immediate upside moves of the Gold price.

It’s worth noting that the late March swing low of around $1,934 and the $2,000 psychological magnet are extra filters for the Gold price.

Overall, Gold prices consolidate recent gains amid sluggish markets but bears remain hopeful.

Gold price: Hourly chart

Trend: Further downside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.