Gold Price Forecast: XAU/USD sees downside below $1,730 on upbeat DXY, US NFP in focus

- Gold prices are likely to witness more downside on a firmer DXY.

- Hawkish FOMC minutes have brought an intense sell-off in gold prices.

- The US NFP is seen lower at 270k in relation to the prior release.

Gold price (XAU/USD) has turned into a consolidation phase after displaying a sheer downside move to near $1,732.00 in the New York session. On a broader note, the precious metal is in the grip of bears and possesses the downside potential if it violates the crucial support of $1,730.00.

The precious metal is attracting offers as the release of the Federal Open Market Committee (FOMC) minutes on Wednesday infused fresh blood into the US dollar index (DXY). The minutes were extremely hawkish as only one FOMC member was not in support of 75 basis points (bps) interest rate hike. Also, the Federal Reserve (Fed) is ‘unintentionally committed’ to bringing price stability and will elevate interest rates further to the same extent if high inflation persists further.

The DXY has refreshed its 19-year high at 107.26 and more gains are on the way ahead of the US Nonfarm Payrolls (NFP). A preliminary estimate for the economic data is 270k, lower than the prior print of 390k.

Gold technical analysis

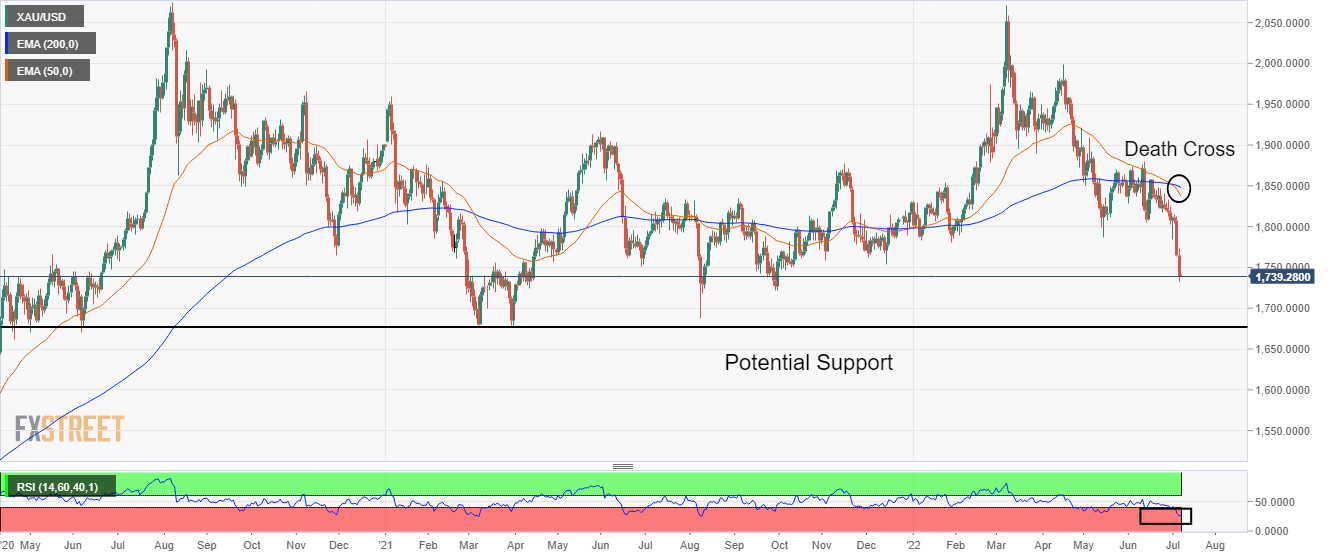

On the daily scale, the gold prices are declining towards the horizontal support placed on the 8 March 2021 low at $1,676.87. The 50- and 200-period Exponential Moving Averages (EMAs) have displayed a death cross at $1,850.00, which adds to the downside filters. Meanwhile, the Relative Strength Index (RSI) (14) has shifted into a bearish range of 20.00-40.00, which signals more downside ahead.

Gold daily chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.