Gold Price Forecast: XAU/USD retreats from $1,950 as USD Index rebounds firmly, US Employment in focus

- Gold price has extended its downside to near $1,940.00 amid a solid recovery in the USD Index.

- The overall market mood has turned cautious as investors are anticipating one more interest rate hike from the Fed.

- Gold price has delivered a breakdown of the volatility contraction pattern and is anticipated to deliver a vertical fall

Gold price (XAU/USD) witnessed extreme selling pressure after a short-lived pullback move to near $1,946.70 in the Asian session. The precious metal has extended its downside journey to near $1,940.00 as the US Dollar Index (DXY) has recovered its entire losses and is aiming to print afresh day high above 104.34.

S&P500 futures are continuously easing gains generated on Monday as investors are worried that Tuesday’s trading session could be extremely volatile after an extended weekend. The overall market mood has turned cautious as investors are anticipating one more interest rate elevation from the Federal Reserve (Fed).

Earlier, Fed chair Jerome Powell cited that tight credit conditions by US regional banks are doing the job for the central bank as liquidity disbursement in the economy has dropped. Firms are facing barriers in augmenting working capital requirements and are satisfied with operating at less capacity.

However, fresh incoming data showed that consumer spending is sky-rocketing in the US economy, and labor market conditions have not eased as expected, which is forcing the Fed to continue its policy-tightening spell.

This week, the release of the US Employment data will provide more clarity about interest rate guidance. As per the consensus, Thursday’s Automatic Data Processing (ADP) Employment Change is expected to land at 170K lower than the former release of 296K.

Gold technical analysis

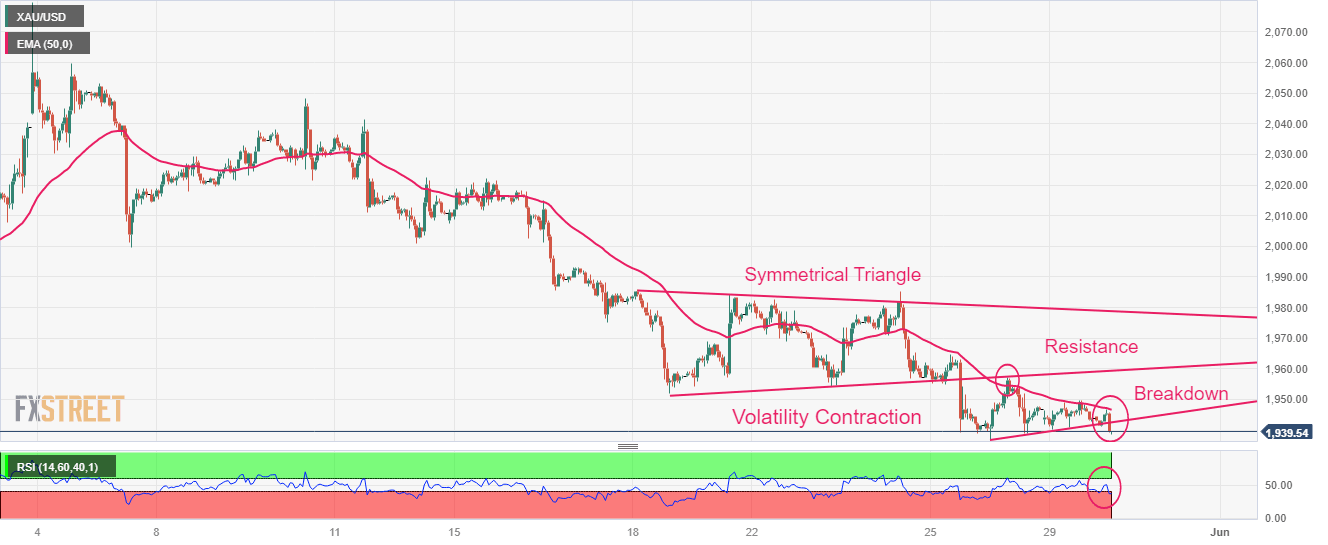

Gold price has delivered a breakdown of the volatility contraction and is anticipated to deliver a vertical fall. Earlier, the precious metal displayed a downside move after a breakdown of the Symmetrical Triangle chart pattern on an hourly scale.

The 50-period Exponential Moving Average (EMA) at $1,948.00 has acted as a barricade for the Gold price.

Meanwhile, the Relative Strength Index (RSI) (14) has slipped below 40.00, which indicates that the downside momentum has been triggered.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.