Gold Price Forecast: XAU/USD juggles above $2,000, US Dollar softens despite hawkish Fed bets

- Gold price is oscillating in a tight range above $2,000.00 amid a quiet market mood.

- Fed policymakers are advocating for more interest rate hikes to curb stubborn inflation.

- Gold price has defended a breakdown of the Rising Channel pattern.

Gold price (XAU/USD) is displaying a back-and-forth action around $2,005.00 in the early Asian session. The precious metal has turned sideways after a gradual correction from $2,011.90. The US Dollar Index (DXY) is oscillating below 101.80 despite rising hopes of one more rate hike from the Federal Reserve (Fed).

S&P500 futures settled Tuesday’s trading session on a flat-to-positive note after some volatile moves. Below-forecast corporate results from Goldman Sachs and Johnson and Johnson dragged United States equities, portraying a stock-specific market mood. A correction in the USD Index also weighed on US Treasury yields. The alpha generated on 10-year US Treasury bonds dropped below 3.58%.

Meanwhile, hawkish commentaries from Fed policymakers convey that upside bias for the USD Index is still solid. St. Louis Fed President James Bullard advocated for the continuation of a policy-tightening spell by the central bank considering the fact that labor market data is still solid, as reported by Reuters.

Fed policymaker further added that demand for labor has not softened yet and a strong labor market leads to strong consumption, which fades the context of having a recession in the second half of 2023.

Also, Atlanta Fed Bank President Raphael Bostic said he favors raising interest rates one more time and then holding them above 5% for some time to curb inflation that remains too high, as reported by Bloomberg.

Gold technical analysis

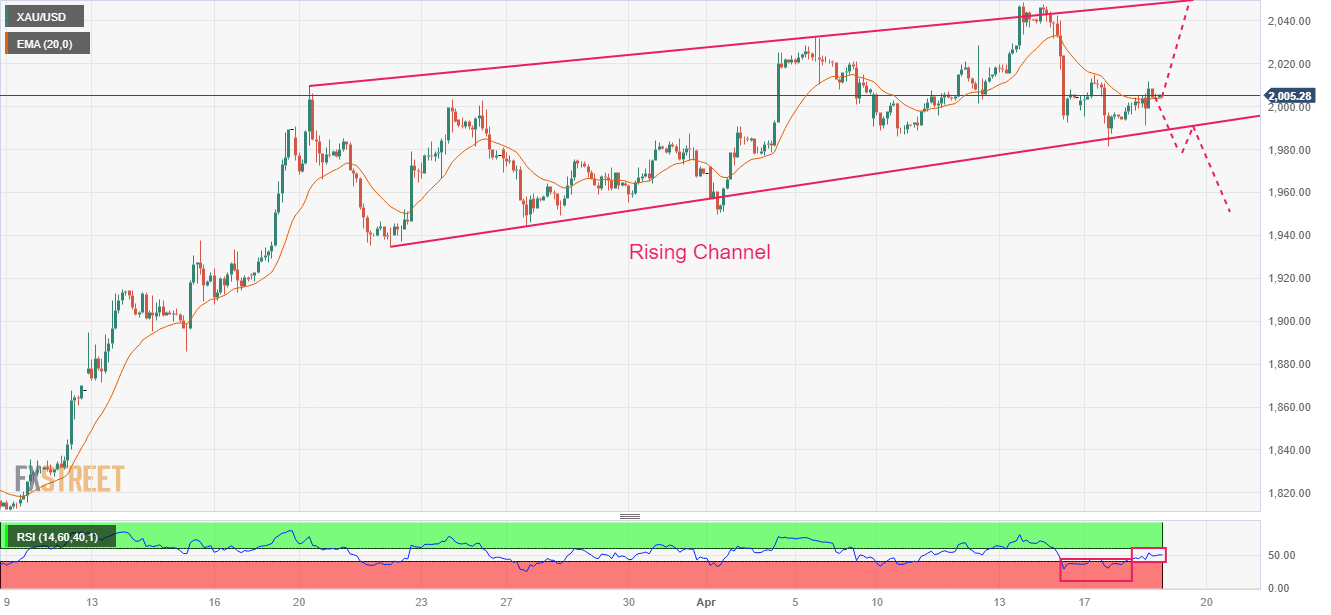

Gold price has defended a breakdown of the Rising Channel chart pattern for now formed on a two-hour scale. The precious metal is making efforts for shifting comfortably above the 20-period Exponential Moving Average (EMA), which is hovering at $2,004.30.

The Relative Strength Index (RSI) (14) has shifted into the 40.00-60.00 range from the bearish range of 20.00-40.00, which indicates that the momentum is not bearish anymore.

Gold two-hour chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.