Gold Price Forecast: XAU/USD, in range above $1,800 amid a moderate risk aversion

- Gold is moving directionless above $1,800 as risk appetite faded.

- Concerns about China and the escalating tensions in Ukraine have dampened investors' optimism.

- XAU/USD remains trapped within an ascending triangle pattern.

Gold futures are moving without a clear direction on Thursday trapped within a $10 range above $1,800 in a choppy market session amid growing concerns about the Chinese economy and the rising tensions in Ukraine.

China and Ukraine have dampened risk appetite

The moderate optimism observed in the first half of the week, triggered by the Chinese authorities’ decision to lift the restrictions for inbound travelers faffed on Thursday as the recent reports about the sharp increase of infections have cast doubts about a quick recovery of China’s economy.

These reports have raised suspicions about the transparency of the Chinese Government and have prompted some countries, namely the US, Italy, and India to impose mandatory tests for Chinese travelers, a move that might be followed by other countries over the coming days.

Furthermore, Ukraine is reporting the heaviest artillery shelling in some of its main cities since the war started, leaving big parts of the population between energy, which is curbing risk appetite further.

XAU/USD remains moving within an ascending triangle pattern

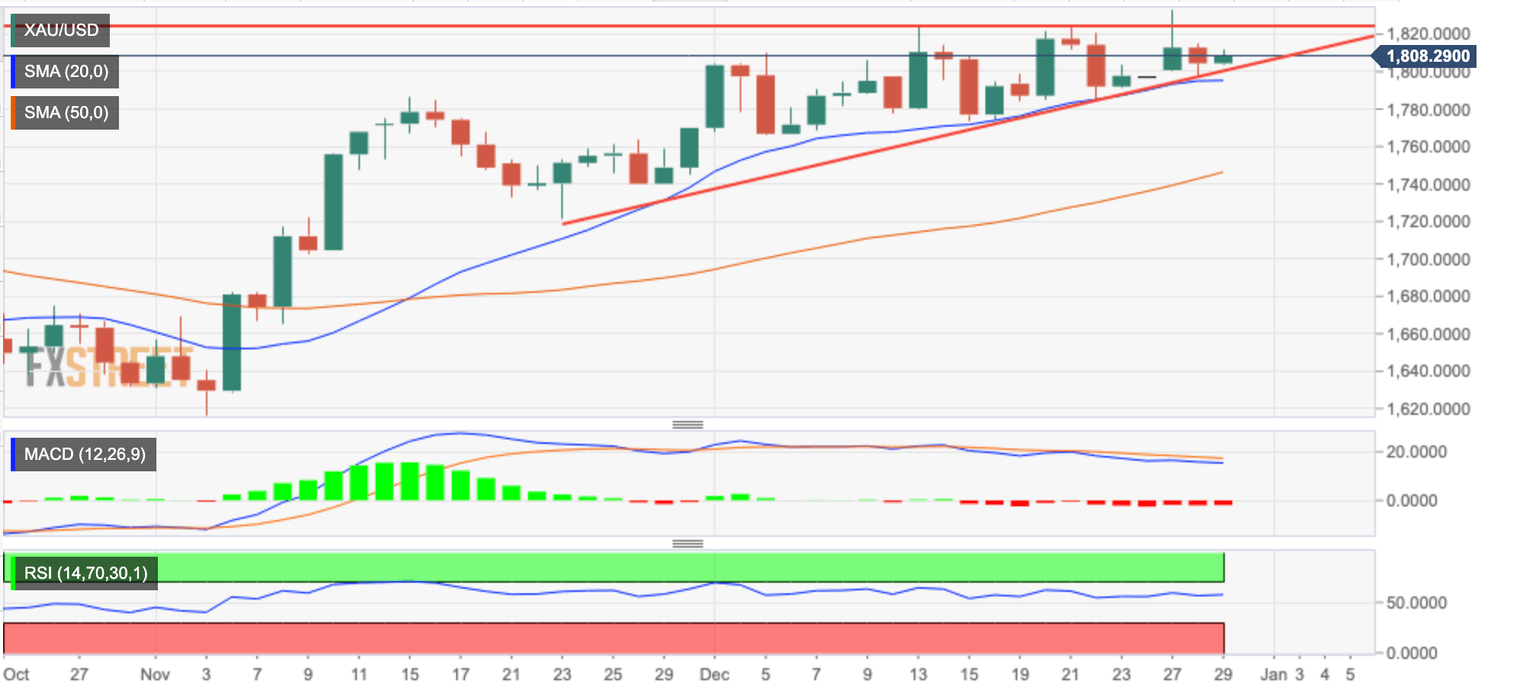

From a technical point of view, the daily chart shows the pair trapped within ascending triangle pattern, limited by resistance area at $1,825, and trendline support from late-November lows, now around $1,800.

With the MACD indicator in negative territory, a confirmation below the $1,800 trendline would cancel the uptrend and might trigger a deeper retreat to $1765/75 December 6 and 15 lows and November 23 low at $1720.

On the contrary, a run-up above the $1825/35 resistance area would confirm the bullish pattern and set the pair aiming to June high at $1,880 before the $1,900 psychological level.

XAU/USD daily chart

Technical levels to watch

Author

Guillermo Alcala

FXStreet

Graduated in Communication Sciences at the Universidad del Pais Vasco and Universiteit van Amsterdam, Guillermo has been working as financial news editor and copywriter in diverse Forex-related firms, like FXStreet and Kantox.