Gold Price Forecast: XAU/USD fades bounce off $1,640 support amid hawkish Fedspeak

- Gold price remains sidelined after rising for the last two consecutive days.

- US Treasury yields remain indecisive at multi-month high amid light calendar.

- Risk appetite remains firmer despite hawkish Fedspeak but XAU/USD buyers fear amid DXY’s hesitant fall.

Gold price (XAU/USD) treads water around the mid-$1,600s while struggling to extend the previous gains during Wednesday’s Asian session. In doing so, the bullion traces the market’s inaction amid a lack of major data/events. Even so, the risk-on mood keeps the buyers hopeful ahead of the inflation data from Eurozone, the UK and Canada.

That said, headlines suggesting the Russian military’s hardships in Ukraine and the UK Chancellor’s U-turn on previous fiscal plans join sluggish Treasury yields to keep the market sentiment positive. Alternatively, hawkish Fedspeak and upbeat US data challenge the risk profile and the XAU/USD buyers.

“Until I see some compelling evidence that core inflation has at least peaked, not ready to declare a pause in rate hikes,” said Minneapolis Federal Reserve Bank President Neel Kashkari on Tuesday per Reuters. Elsewhere, the US Industrial Production for September rose to 0.4% versus the 0.1% expected while the softer NAHB Housing Market Index for October eased to 38 from 43 market consensus.

While portraying the mood, S&P 500 Futures trace Wall Street’s gains whereas the US 10-year Treasury yields remain sidelined.

Looking forward, the XAU/USD buyers need to have softer prints of the upcoming inflation numbers and additional positives for Ukraine, as well as the UK, to keep the reins.

Technical analysis

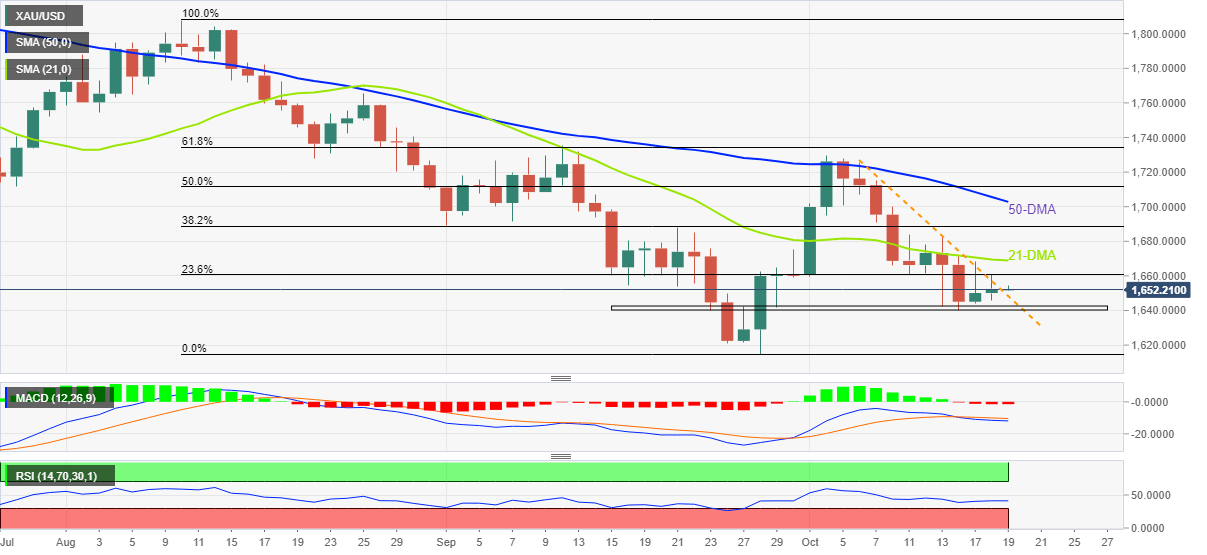

Although the gold price struggles to extend the recovery from a three-week-old horizontal support area near $1,640, the metal defends the previous day’s upside break of a fortnight-long descending resistance line, now support around $1,647.

That said, the bearish MACD signals and sluggish RSI, as well as the XAU/USD’s sustained trading below the 21 and 50-DMA, respectively around $1,669 and $1,703, keeps the sellers hopeful.

Hence, the bullion is on the bear’s radar but a clear downside break of $1,640 appears necessary to renew the fall toward the yearly low of $1,615.

It should be noted, however, that a clear upside break of the 50-DMA hurdle surrounding $1,703 will propel the quote toward the monthly high near $1,730.

Gold: Daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.