- Gold looks to retest Tuesday’s high at $1815 amid falling Treasury yields.

- June FOMC meeting’s minutes eyed for more clues on the policy outlook.

- Gold Weekly Forecast: XAU/USD fails to clear key resistance at $1,790

Update: Gold trimmed a part of its intraday gains, albeit has managed to hold its neck above the $1,800 mark heading into the North American session. The XAU/USD built on its recent bounce from the $1,750 area, or the lowest level since mid-April and edged higher for the sixth consecutive session on Wednesday. Concerns about the spread of the highly contagious Delta variant of the coronavirus continued weighing on investors' sentiment and extended some support to traditional safe-haven assets, including gold.

Apart from this, the ongoing sharp decline in the US Treasury bond yields was seen as another factor that drove some flows towards the non-yielding yellow metal. That said, a modest US dollar uptick acted as a headwind for the dollar-denominated commodities. Investors also seemed reluctant to place any aggressive bets ahead of Wednesday's release of the FOMC meeting minutes. This, in turn, capped the upside for gold. Hence, it will be prudent to wait for some follow-through buying beyond the overnight swing highs, around the $1,815 region, before positioning for any further appreciating move.

Given that the Fed brought forward its timetable for the first post-pandemic interest rate hike at the end of June policy meeting, investors will look for fresh clues about the central bank's policy outlook. This will play a key role in influencing the USD price dynamics in the near term and assist investors to determine the next leg of a directional move for gold.

Previous update: Gold price is riding higher on concerns over dwindling global economic recovery, fuelled by Delta covid strain flareups and weaker US ISM Services PMI and German ZEW survey. The re-emergence of global economic concerns led to an influx of risk-off flows into the safe-haven assets such as the US Treasury bonds, gold etc, weighing negatively on the returns on the markets. The recent sell-off in the Treasury yields across the curve has been the main driver behind gold’s move above the $1800 mark. The US dollar’s upside also remains capped by the weakness in the yields, with the benchmark 10-year rates down about 2.50%, as of writing. Meanwhile, the risk-on action in the European equities also exerts bearish pressure on the safe-haven dollar while underpinning gold price.

Next of relevance for gold traders remain the June Fed meeting’s minutes due for release at 1800 GMT on Wednesday. The minutes could shed more light on the interest rate trajectory after the Fed delivered a hawkish surprise last month.

Read: FOMC Minutes June Preview: A view of the Jackson Hole agenda

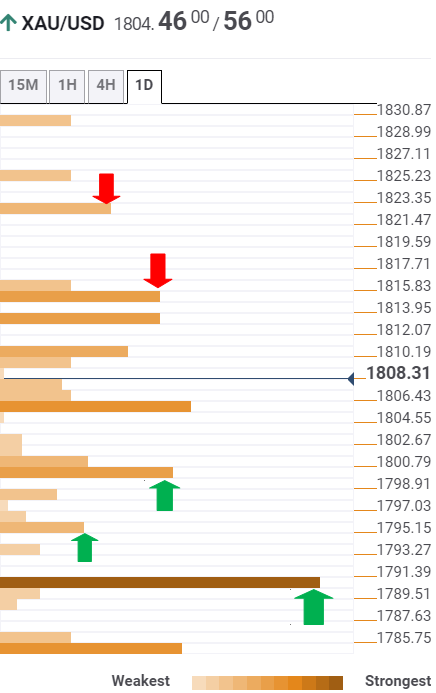

Gold Price: Key levels to watch

The Technical Confluences Detector shows that gold price is marching towards the previous day’s high at $11815, where the Fibonacci 38.2% one-month coincides.

Ahead of that level, the confluence of the Fibonacci 23.6% one-day and pivot point one-day R1 at $1810 could challenge the latest leg up.

If Tuesday’s high is taken out convincingly, a rally towards the pivot point one-week R2 at $1822 cannot be ruled out.

Alternatively, strong support awaits at $1800, which is the intersection of the Fibonacci 61.8% one-day, SMA10 four-hour and SMA10 one-hour.

The next relevant cushion is seen at the previous week’s high of $1795.

Powerful support at $1790 is the level to beat for gold bears. That level is the convergence of the SMA100 one-day, Fibonacci 23.6% one-month and the previous day’s low.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.