Gold Price Forecast: XAU/USD eyes a break above $1,800 ahead of US Inflation

- Gold price is aiming to recapture a five-month high at around $1,800.00 as the risk-on profile is regaining traction.

- S&P500 to display wild gyrations ahead of Fed’s monetary policy meeting.

- November’s CPI could display a surprise rise as payroll additions soared.

Gold price (XAU/USD) has picked recovery after dropping marginally below $1,796.00 in the early Tokyo session. The precious metal is aiming to extend its recovery above the round-level resistance of $1,800.00 as the risk-appetite theme has regained strength. On a broader note, the risk profile could display some volatile moves as investors have shifted their focus toward the release of the US Consumer Price Index (CPI), which is scheduled for Tuesday.

Meanwhile, the US Dollar Index (DXY) is struggling to conquer the immediate resistance of 105.00 as the broader theme doesn’t support a risk-aversion mood. S&P500 showed a precautionary mood on Friday ahead of the last Federal Reserve (Fed)’s monetary policy meeting of CY2022. The US Treasury yields displayed some choppy moved but settled near 3.60% on Friday, showing cautiousness in the global market.

As per the projections, the headline CPI is expected to remain stable at 7.7%. While the core inflation could display a slight improvement to 6.4% from the former release of 6.3%. The inflationary pressures could display a surprise jump as labor demand remained extremely tight in November and the service sector is booming led by solid demand.

Gold technical analysis

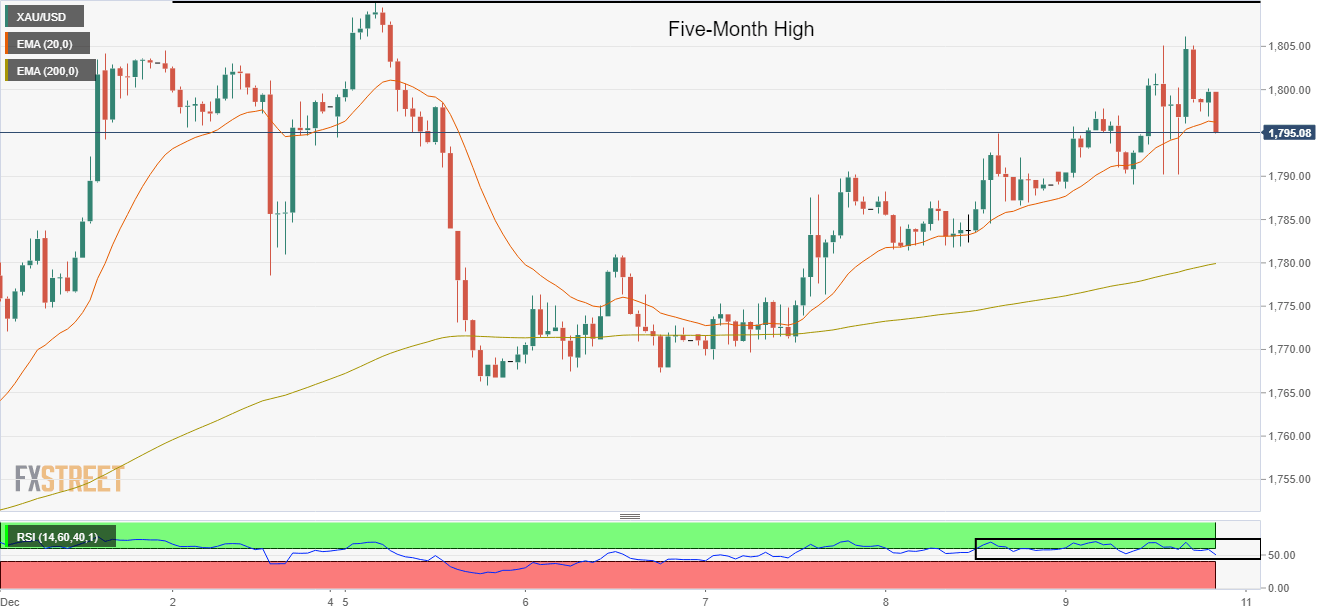

On an hourly scale, Gold price is aiming to test a fresh five-month high around $1,810.00 on an hourly scale. The 20-period Exponential Moving Average (EMA) at $1,796.24 is acting as a major support to the gold price. Also, advancing 200-EMA at $1,780.00 indicates that the long-term trend is intact toward the north.

Meanwhile, the Relative Strength Index (RSI) (14) is looking to shift into the bullish range of 60.00-80.00 for activating an upside momentum.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.