Gold Price Forecast: XAU/USD extends losses below $1,790.00, manifests pre-Fed policy anxiety

- Gold price has slipped sharply below $1,790.00 as anxiety soars ahead of Fed’s policy.

- The US Dollar Index struggles to surpass the immediate resistance of 105.20 despite the risk-off mood.

- Apart from the Fed’s policy, investors will also focus on the United States Inflation data.

Gold price (XAU/USD) has tumbled to near $1,787.00 in the Tokyo session after failing to sustain near the critical resistance of $1,805.00. The precious metal is shifted into a bearish trajectory as investors are getting anxious amid uncertainty over Federal Reserve (Fed) policy outlook.

New developments in United States' economic prospects after the release of the better-than-anticipated employment report and demand in the service sector for November month signaled that the Fed might continue the current interest rate hike pace to offset fresh evidence indicating a rebound in inflation or may provide higher interest rate guidance.

However, Fed policymakers warned that the continuation of a more significant rate hike regime could accelerate financial risks in the United States economy.

Meanwhile, the US Dollar Index (DXY) is struggling to surpass the immediate resistance of 105.20. S&P500 futures are displaying a subdued performance as investors have shifted to the sidelines ahead of Fed policy.

Going forward, investors will also focus on the US Consumer Price index (CPI) data, which will release on Tuesday. As per the consensus, the headline inflation is seen unchanged at 7.7%.

Gold technical analysis

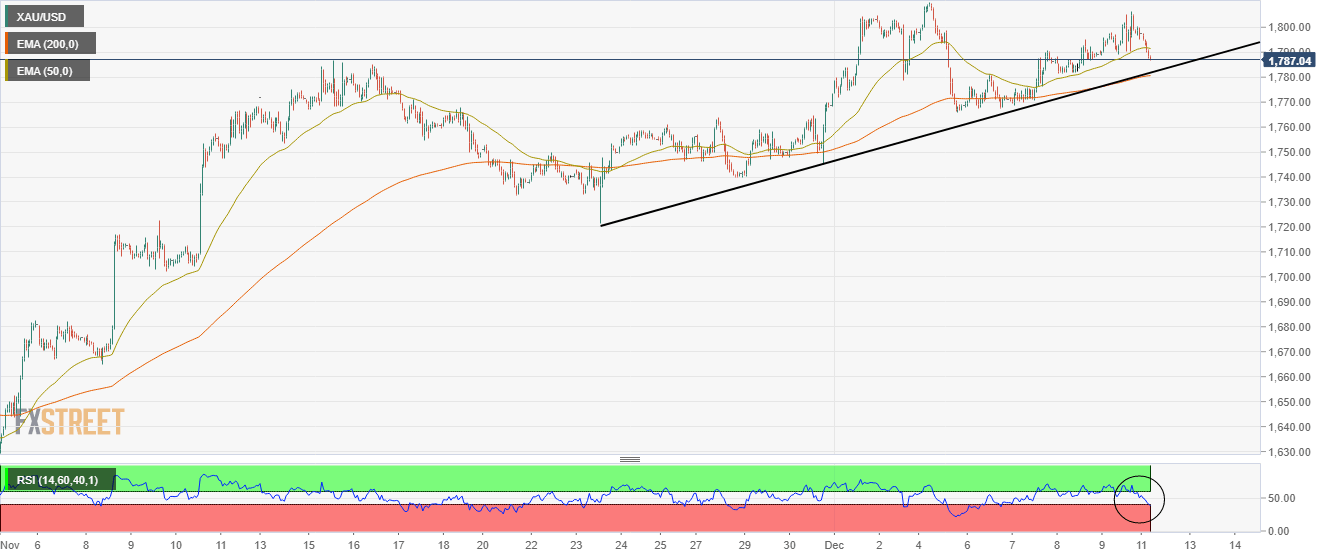

On an hourly scale, the Gold price is declining to near the upward-sloping trendline plotted from November 23 low at $1,721.23. The precious metal has surrendered the 50-period Exponential Moving Average (EMA) at $1,791.60. While the 200-EMA, around $1,780.00, is still advancing, which adds to the upside filters.

Meanwhile, the Relative Strength Index (RSI) (14) has dropped sharply to near 40.00 from the bullish range of 60.00-80.00. A slippage inside the 20.00-40.00 range will trigger a bearish momentum ahead.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.