Gold declines on renewed US Dollar demand, Powell’s dovish signal might cap its downside

- Gold price edges lower in Monday’s early European session.

- Fed rate cut hopes and rising Russia-Ukraine tensions could lift the Gold price.

- Traders brace for the preliminary reading of the US Q2 GDP report later on Thursday.

The Gold price (XAU/USD) drifts lower to around $3,350 during the early European session on Monday, pressured by a stronger US Dollar (USD). Nonetheless, rising optimism of a September rate cut following comments by Federal Reserve (Fed) Chair Jerome Powell at the Jackson Hole symposium might cap the downside for the yellow metal.

The Fed’s Powell has opened the door to a rate reduction in the September meeting, but that position could become complicated if inflation pressures continue to rise. Powell added that the US economy is facing a “challenging situation,” with inflation risks now tilted to the upside and employment risks to the downside. Dovish remarks from Powell could provide some support to the precious metal, as lower interest rates could reduce the opportunity cost of holding Gold.

Additionally, the escalating tensions between Russia and Ukraine might contribute to gold’s upside. Ukrainian President Volodymyr Zelensky said that the country would continue to fight for its freedom "while its calls for peace are not heard," in a defiant address to the nation on its independence day, per BBC. His comments came after Moscow said Ukraine had attacked Russian power and energy facilities overnight, blaming drone attacks for a fire at a nuclear power plant in its western Kursk region.

Gold traders will keep an eye on the preliminary reading of the US Gross Domestic Product (GDP) for the second quarter (Q2), which will be released later on Thursday. The US economy is expected to grow at an annual rate of 3.0% in Q2. In case of a stronger-than-expected outcome, this could boost the Greenback and weigh on the USD-denominated commodity price.

Daily Digest Market Movers: Gold price loses momentum amid firmer US Dollar

- St. Louis Fed President Alberto Musalem said on Friday he will need more data before deciding to support a rate cut at the September meeting, warning inflation remains above the Fed's 2% target.

- Boston Fed President Susan Collins said that the overall economic fundamentals in the US are relatively solid. Nonetheless, she added that the central bank doesn't rule out a larger and more persistent impact of tariffs on inflation.

- Russian Foreign Minister Sergey Lavrov stated on Sunday that Russian President Vladimir Putin “is ready to meet” with Zelenskyy when the agenda is ready for a summit. But he said that no meeting is currently planned.

- Traders are now pricing in nearly an 85% possibility of a 25 basis points (bps) rate cut next month, up from 75% before the speech, according to the CME FedWatch tool.

- Physical gold demand in key Asian hubs remained subdued last week as price volatility kept buyers at bay, while jewelers in India resumed buying ahead of a key festival season.

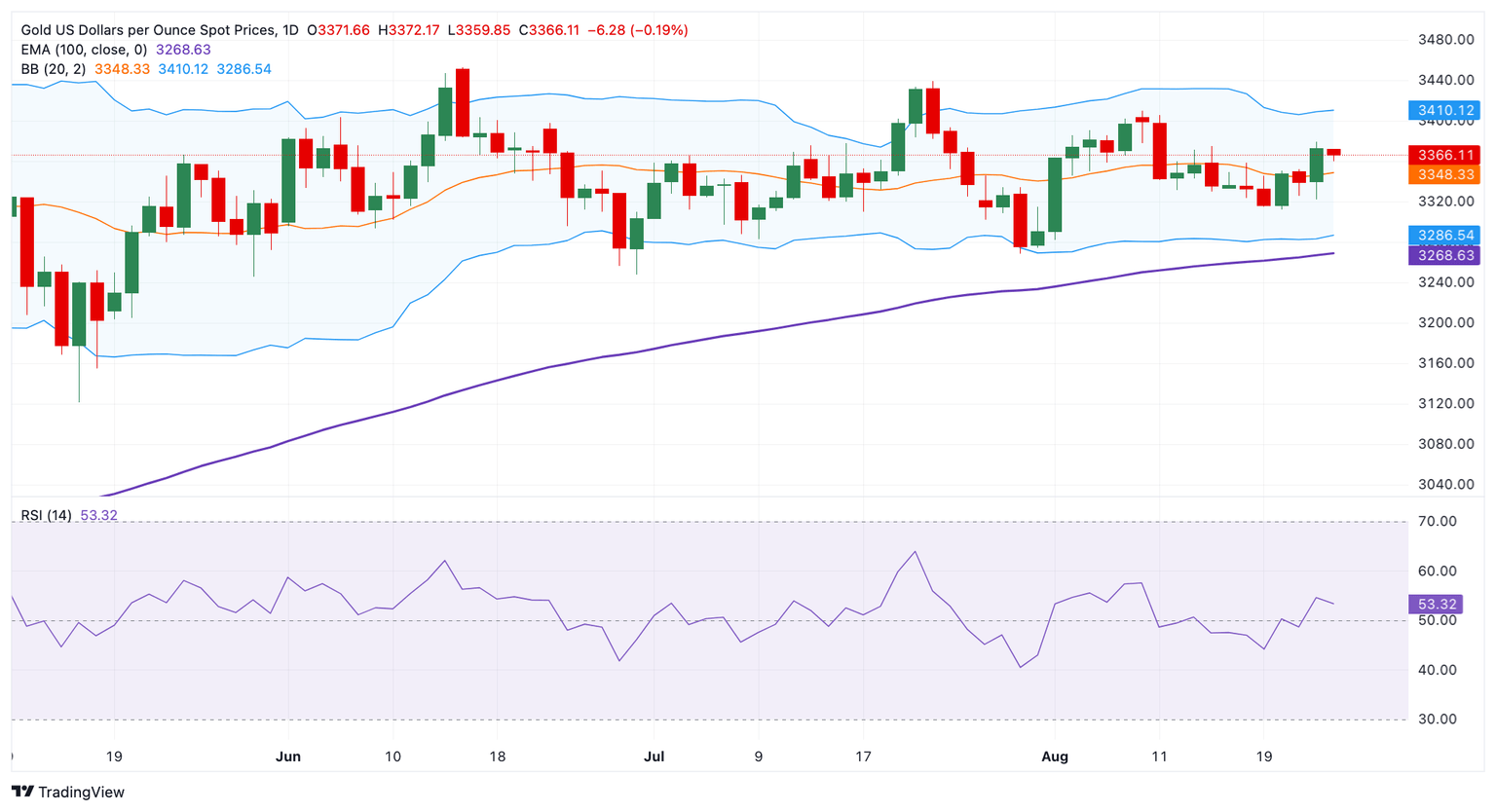

Gold retains a bullish tone in the longer term

The Gold price trades in negative territory on the day. Technically, the precious metal keeps the bullish vibe on the daily chart, with the price holding above the key 100-day Exponential Moving Average (EMA). However, in the near term, further consolidation cannot be ruled out as the 14-day Relative Strength Index (RSI) is hovering around the midline. This suggests the neutral momentum in the near term.

The key resistance level for yellow metal emerges in the $3,400-3,410 zone, representing the psychological level, the upper boundary of the Bollinger Band, and the high of August 8. Sustained trading above this level could take XAU/USD back toward $3,439, the high of July 23. The next hurdle is seen at $3,500, the round figure, and the high of April 22.

In the bearish event, the initial support level for the yellow metal is located at $3,315, the low of August 19. A break below the mentioned level might even drag the gold price lower to $3,285, the lower limit of the Bollinger Band. The next contention level to watch is $3,268, the 100-day EMA.

Interest rates FAQs

Interest rates are charged by financial institutions on loans to borrowers and are paid as interest to savers and depositors. They are influenced by base lending rates, which are set by central banks in response to changes in the economy. Central banks normally have a mandate to ensure price stability, which in most cases means targeting a core inflation rate of around 2%. If inflation falls below target the central bank may cut base lending rates, with a view to stimulating lending and boosting the economy. If inflation rises substantially above 2% it normally results in the central bank raising base lending rates in an attempt to lower inflation.

Higher interest rates generally help strengthen a country’s currency as they make it a more attractive place for global investors to park their money.

Higher interest rates overall weigh on the price of Gold because they increase the opportunity cost of holding Gold instead of investing in an interest-bearing asset or placing cash in the bank. If interest rates are high that usually pushes up the price of the US Dollar (USD), and since Gold is priced in Dollars, this has the effect of lowering the price of Gold.

The Fed funds rate is the overnight rate at which US banks lend to each other. It is the oft-quoted headline rate set by the Federal Reserve at its FOMC meetings. It is set as a range, for example 4.75%-5.00%, though the upper limit (in that case 5.00%) is the quoted figure. Market expectations for future Fed funds rate are tracked by the CME FedWatch tool, which shapes how many financial markets behave in anticipation of future Federal Reserve monetary policy decisions.

Author

Lallalit Srijandorn

FXStreet

Lallalit Srijandorn is a Parisian at heart. She has lived in France since 2019 and now becomes a digital entrepreneur based in Paris and Bangkok.