Gold Price Forecast: XAU/USD bulls return as Federal Reserve drowns United States Treasury yields

- Gold price grinds higher after staging strong recovery from one-week low.

- Federal Reserve announcements, United States Treasury Secretary Janet Yellen’s comments weigh on yields and propel XAU/USD.

- Banking sector rout prods policy hawks despite meeting immediate rate hike needs, suggesting further upside for the Gold price.

Gold price (XAU/USD) bulls take a breather around $1,970 during Thursday’s sluggish Asian session, after posting the biggest daily gain in a week during the volatile Wednesday. That said, the Federal Reserve’s (Fed) dovish rate hike and US Treasury Secretary Janet Yellen’s comments suggesting no out-of-the-line support for the United States banks seem to weigh on the Treasury bond yields and propel the XAU/USD price. It’s worth noting that the cautious mood ahead of today’s monetary policy meeting by the Bank of England (BoE) and Swiss National Bank (SNB) allows space for metal buyers.

Gold price rally as United States Treasury bond yields slump

Gold price jumped over $30 as the United States Treasury bond yields marked the biggest daily slump in a week the previous day. The reason could be linked to the multiple announcements from the Federal Reserve (Fed) and the Treasury Department that bolstered fears of baking fallouts and drowned the US Dollar, due to the Fed’s dovish hike. That said, the US 10-year and two-year Treasury bond yields stay pressured around 3.45% and 3.96% at the latest, after falling 4.80% and 5.50% in that order the previous day.

US Federal Reserve failed to push back the banking sector fears despite announcing a 0.25% rate hike. The reason could be linked to the statements saying, “some additional policy firming may be appropriate,” instead of previous remarks like “ongoing increases in the target range will be appropriate”.

It should be noted that Fed Chair Jerome Powell and US Treasury Secretary Janet Yellen’s comments were more important as Fed’s Powell said that officials do not see rate cuts for this year, which in turn allowed breathing space to the greenback bears in the last. On the other hand, US Treasury Secretary Janet Yellen ruled out considering “blanket insurance” for bank deposits. Recently, Bloomberg also came out with the news suggesting that the Federal Deposit Insurance Corporation is said to delay the bid deadline for a Silicon Valley private bank.

Elsewhere, fears about the Russia-China ties and the cautious mood ahead of the key central bank announcements seem to also weigh on the market sentiment. However, chatters surrounding China’s ability to mark notable growth, despite the global banking rout, keep the Gold buyers hopeful.

Amid these plays, the S&P 500 Futures print mild gains even after Wall Street’s downbeat performance.

Central banks in focus

Having witnessed the initial reaction to the Federal Reserve (Fed) moves, Gold traders should keep their eyes on the monetary policy announcements from the Bank of England (BoE) and Swiss National Bank (SNB) for fresh impulse.

That said, strong inflation data from the UK may allow the BoE to keep its hawkish bias and announce a 0.25% rate hike while the SNB is up for 50 basis points (bps) of rate lift despite the banking turmoil.

Although the hawkish central bank actions may probe the XAU/USD bulls for a bit, any negative surprises, either in the form of dovish rate increases or no rate lifts at all, could bolster the Gold price towards crossing the key $2,015 hurdle.

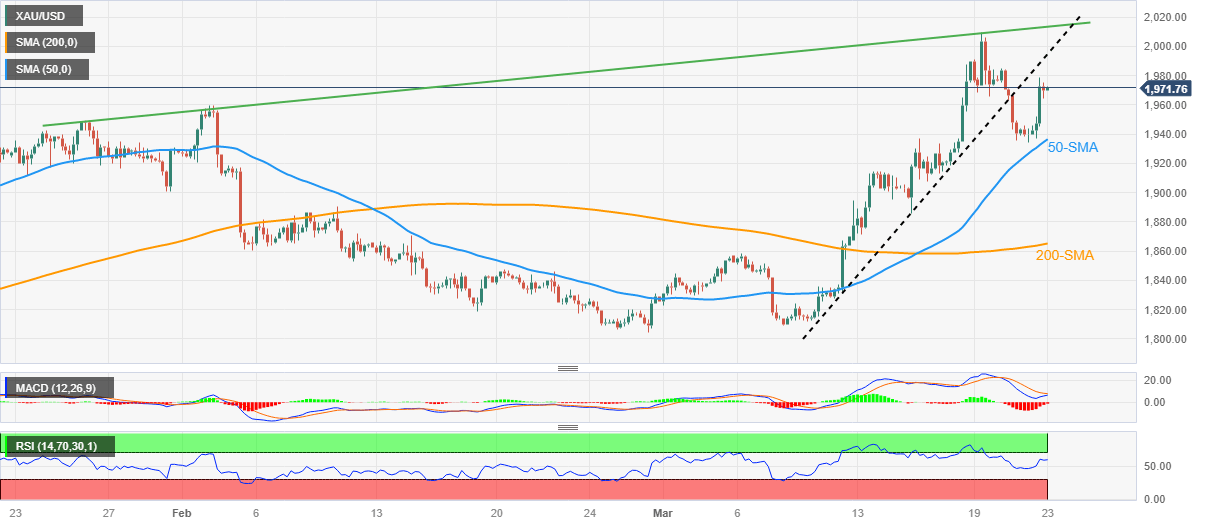

Gold price technical analysis

Gold price extends bounce off the 50-bar Simple Moving Average (SMA), backed by the looming bull cross on the Moving Average Convergence and Divergence (MACD) indicator and upbeat Relative Strength Index (RSI) line, not overbought.

In doing so, the XAU/USD approaches the previous support line from March 09, around $1,994 by the press time.

Following that, a two-month-old upward-sloping resistance line, near $2,015, acts as the last defense of the Gold bears.

On the contrary, a downside break of the 50-SMA support of $1,936 isn’t an open invitation to the XAU/USD bears as the $1,900 threshold and the 200-SMA level surrounding $1,865 could challenge the Gold sellers afterward.

Even if the metal drops below $1,865, multiple levels near $1,855 and $1,820 could prod the XAU/USD downside before highlighting the previous monthly low around $1,805 and the $1,800 threshold for the Gold sellers.

Overall, the Gold price regains upside momentum and appears well-set to challenge the $2,000 round figure.

Gold price: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.