Gold Price Forecast: XAU/USD bears in the market below trendline support

- Gold price is making the case for the downside.

- Banking sector jitters ease as authorities come to the rescue.

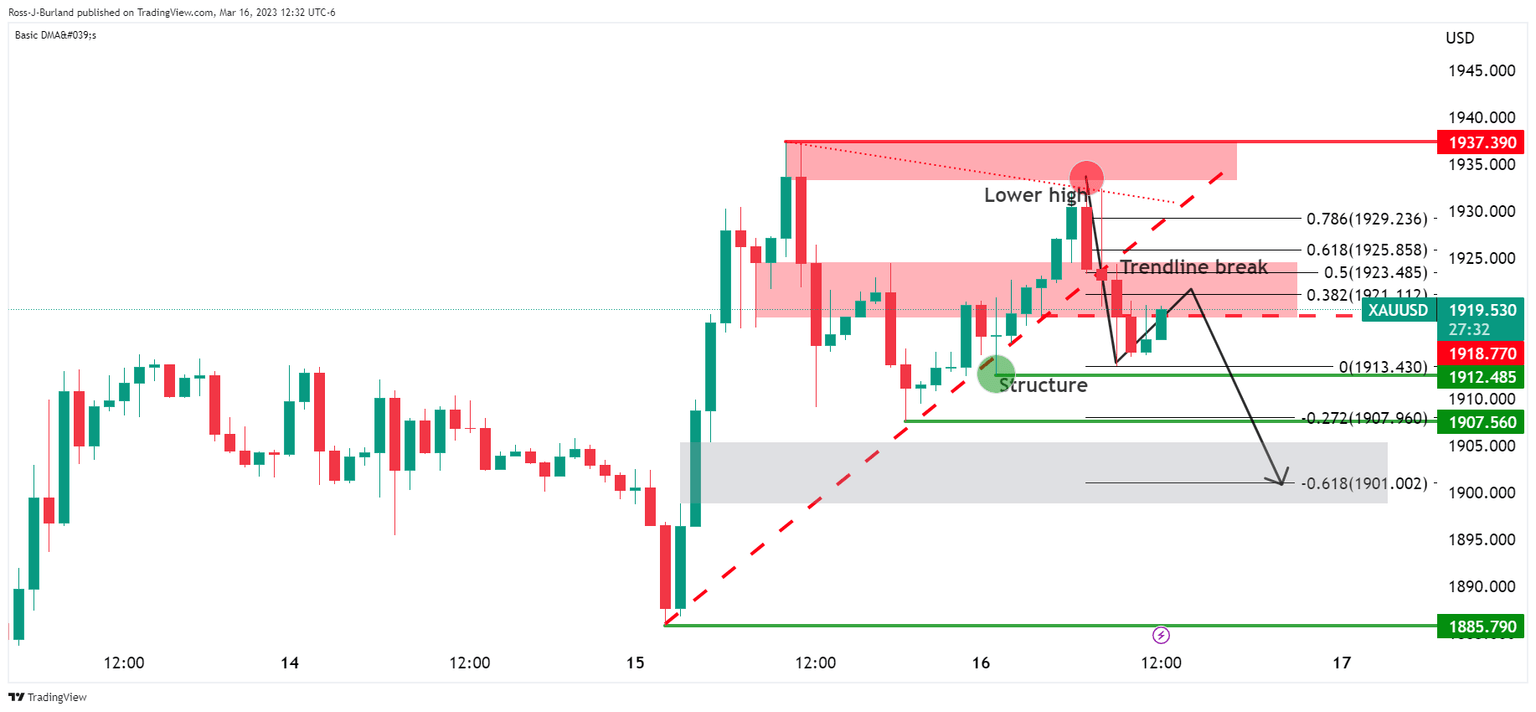

- The break of the Gold price trendline support is compelling and points to a downside continuation to test key structure of $1,912 to open risk to $1,900.

Gold Price was two-way over the European Central bank interest rate decision but then gave in to the bears that took control and moved towards a key structure area on the hourly chart, $1,912.49 where the lows reached $1,913. The initial reaction to the 50 basis point Refinancing Rate hike was a drop to test $1,926 before returning to $1,930 from where the bears piled in again to take out the bullish trendline support as illustrated below.

Meanwhile, the ECB hiked as follows:

ECB rate hike

- Main refi rate at 3.50% vs 3.00% prior.

- Raises interest rate on marginal lending facility to 3.75% vs 3.25% prior.

- Deposit facility to 3.00% vs 2.50% prior.

ECB statement key notes

- Refrains from signalling future rate moves in statement.

- Inflation projected to remain too high for too long.

- Headline inflation expected to average 5.3% in 2023, 2.9% in 2024 and 2.1% in 2025.

- Forecasts done before market turmoil.

- Elevated level of uncertainty reinforces importance of a data-dependent approach to ECB policy decision, which will be determined by its assessment of inflation outlook in light of incoming data and dynamics.

- Banking sector sector is resilient, with strong capital and liquidity positions

- Policy toolkit is fully equipped to provide liquidity support to eurozone financial system if needed.

As a result, markets have now priced the terminal rate at 3% and the Euro was put under pressure.

Banking crisis fears dwindle

Meanwhile, Gold price came under pressure in the main on the back of a pause in safe-haven buying as concerns over the health of Credit Suisse diminished after the institution secured funding from the Swiss National Bank to firm up its liquidity.

Analysts at ANZ Bank explained that ´´mainstream reports in the US that major US banks, working with the government, are in discussions to support California based First Republic Bank, also buoyed sentiment. US regional bank stocks climbed 5.0% and December 2023 fed funds futures sold off more than 40bp.¨´

´´The announcement of a bank funding plan sparked a sell-off in gold prices overnight, with CTA trend followers readjusting their length in response, but we continue to expect prices to remain resilient,´´ ´the analysts at TD Securities explained.

´´Meanwhile, risks that the tightening cycle is coming to an end should also realign discretionary flows with strong physical flows, which could translate into substantial upside,´´ the analysts argued.

Gold price technical analysis

The break of the trendline support is compelling and points to a downside continuation to test key structure of $1,912 to open risk to $1,900.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.