Gold Price Forecast: XAU/USD bears getting prepared to pounce, eye $1,747

- The gold price is under pressure as the US dollar perks up in the Tokyo open.

- Bears will be looking for a break of key hourly support following the test of the 50% mean reversion on the daily chart.

- The focus is on the Jackson Hole and the schedule for the day ahead.

The gold price is losing some shine in the Asian session, down some 0.2% at the time of writing. The yellow metal is trading at $1,755.08 and has been stuck in a tight range of between $1,754.94 and $1,758.80 on the day so far, leaving bearish technically. Hawkish comments from Fed officials ahead of Federal Reserve chairman Powell’s Jackson Hole speech also weighed on investor demand for the precious metal.

The US dollar has gained against a basket of currencies on Friday, albeit some way off the 20-year high, but is firming as investors waited for a speech by the Federal Reserve chairman at 10.00 ET for fresh clues on how aggressive the central bank will be in its battle against inflation. Following a slew of less inflationary data this week, traders had pared back the most hawkish of expectations, but still, the sentiment is that the Fed will stay firm on its intent to battle against inflation that remains at 8.5% on an annual basis, well above the Fed's 2% target. Jerome Powell's speech in Jackson Hole will therefore be scrutinized for any indication that an economic slowdown might alter the Fed’s strategy.

Fed funds futures traders are pricing in a 61% chance that the Fed will hike rates by another 75 basis points at its September meeting, and a 39% probability of a 50 basis points increase. The US dollar index DXY was last up 0.11% at 108.53, holding just below a 20-year high of 109.29 reached on July 14. The mighty buck could give back some gains on Friday if Powell expresses any concerns about the impact of the monetary tightening, thus supporting gold prices higher.

Looking forward, developments in the US dollar, US real yields and central bank policy will continue to dominate the direction of the price of the yellow metal for the remainder of this year and in 2023.

''We expect modestly lower gold prices for the remainder of this year,'' analysts at ABM Amro argued.

''We still expect the Fed to take the upper bound of the fed funds rate to 4% by early 2023, with the risk that some of that tightening will be frontloaded. This is slightly above market consensus. This should weigh on gold prices. We also expect the US dollar to remain relatively strong. However, we only expect a modest decline in gold prices from the current levels.''

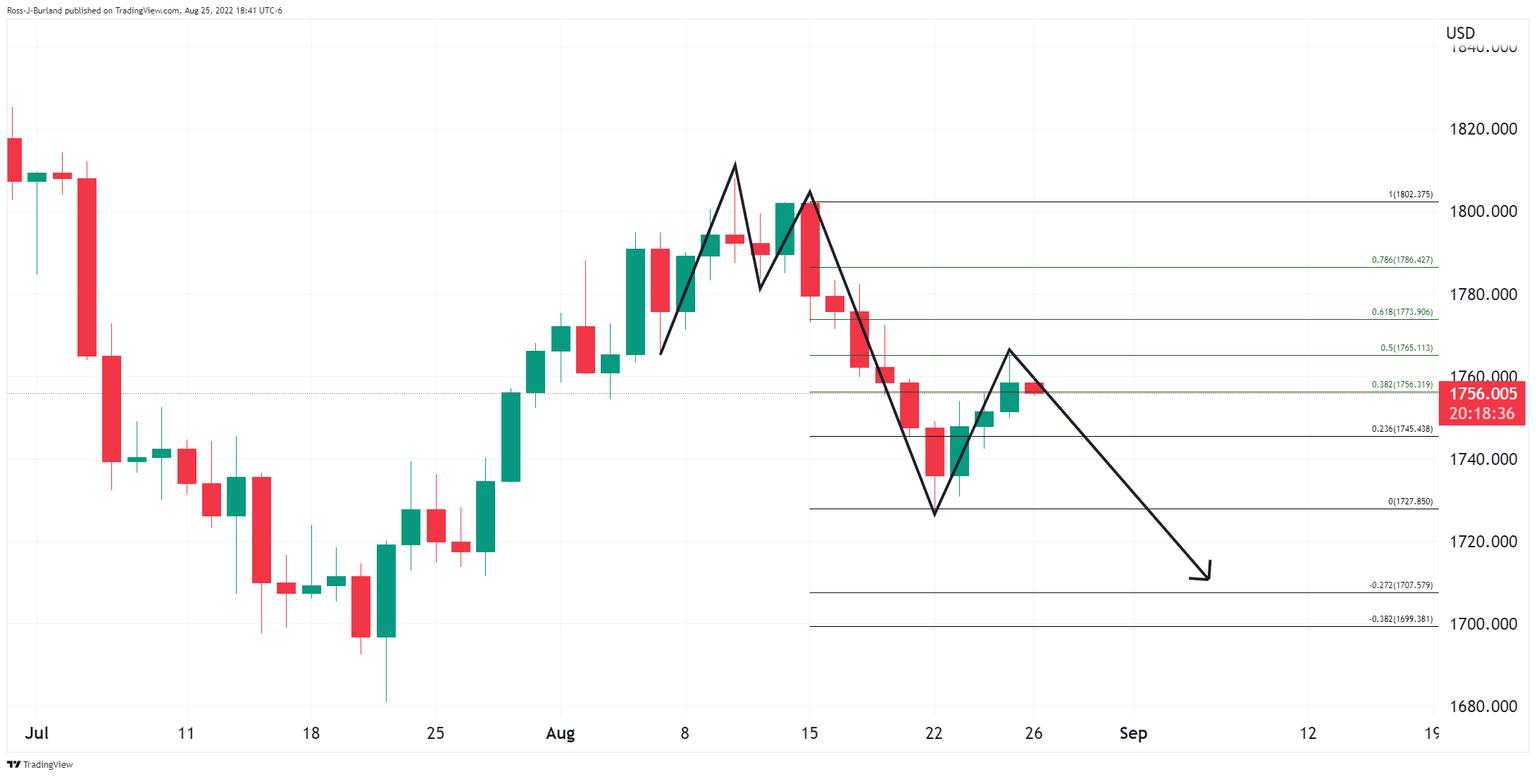

Gold technical analysis

The price has met a 50% mean reversion. Should this hold and bears commit, then downside opportunities will be up for grabs on the lower time frames.

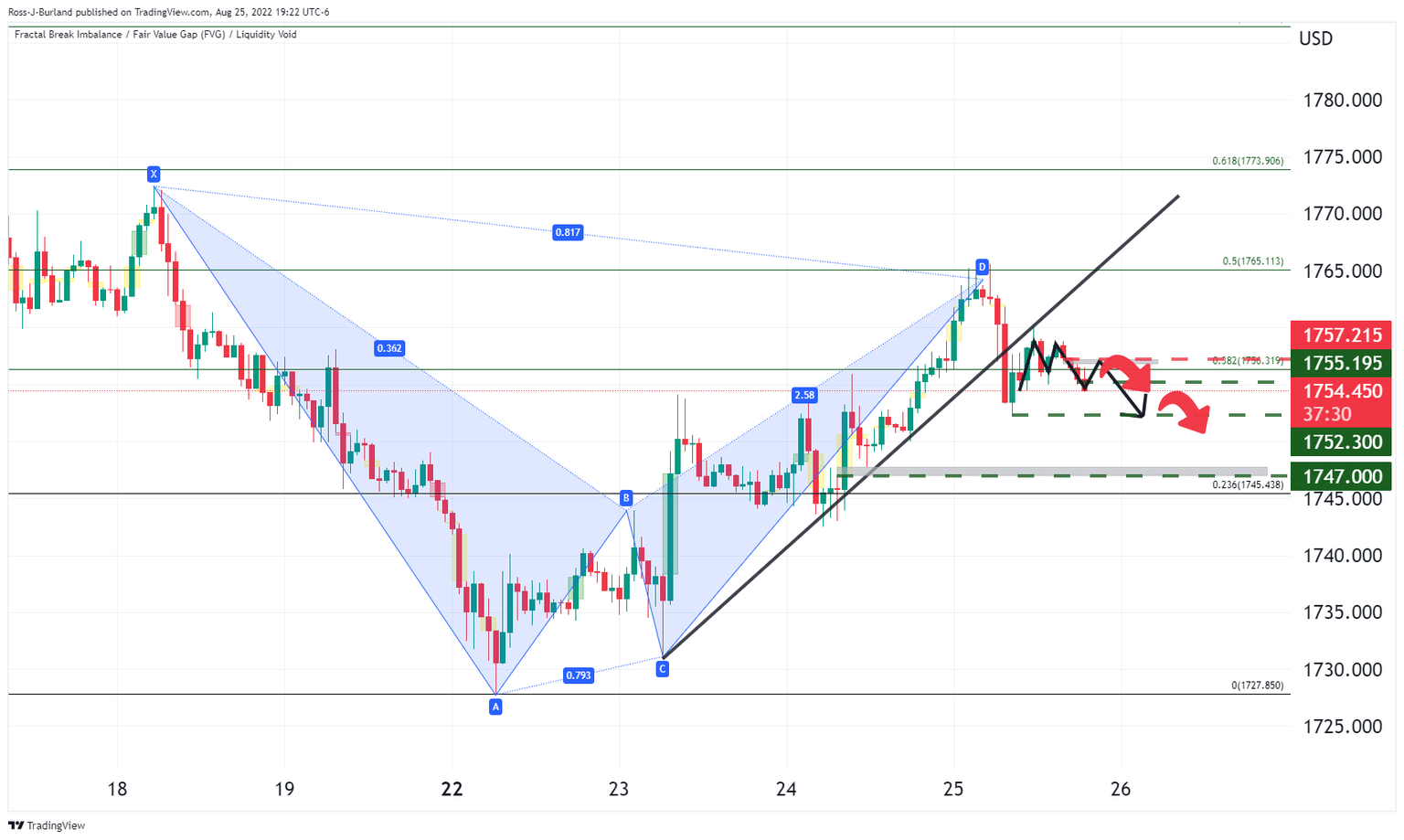

On an hourly basis, the price is in bearish territory and could be on the verge of a deeper move below the counter trendline towards $1,747.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.