Gold Price Forecast: XAU/USD aims to recapture $1,700 as DXY turns subdued, Fed policy in focus

- Gold prices are advancing towards $1,700.00 amid a subdued DXY on the US warning to China.

- US President Joe Biden says the US military would defend Taiwan if China strikes the island.

- A third consecutive 75 bps rate hike is highly expected from the Fed.

Gold price (XAU/USD) has turned sideways around $1,680.00 after sensing a fragile hurdle in the Asian session. The precious metal has shifted into a mark-up phase after delivering an upside break of the consolidation formed in a range of $1,654.35-1,669.80. The yellow metal has rebounded firmly after refreshing a two-year low at $1,654.19 last week.

The gold prices are expected to remain volatile ahead of the interest rate decision by the Federal Reserve (Fed). Per the consensus, the Fed is expected to announce a third consecutive 75 basis points (bps) interest rate hike. However, doors are open for a higher rate as price pressures are needed to contain sooner.

Meanwhile, the US dollar index (DXY) oscillates around the critical support of 109.50 as market veterans have slashed the US growth rates. Economists at Goldman Sachs have trimmed the growth forecasts for 2023. The US Gross Domestic Product (GDP) is expected to increase by 1.1% as Fed’s tightening path along with the current restrictive policy will prove less room for growth in the scale of economic activities.

Also, the risk profile will be at play as US President Joe Biden says the US military would defend Taiwan in the event of an invasion by China.

Gold technical analysis

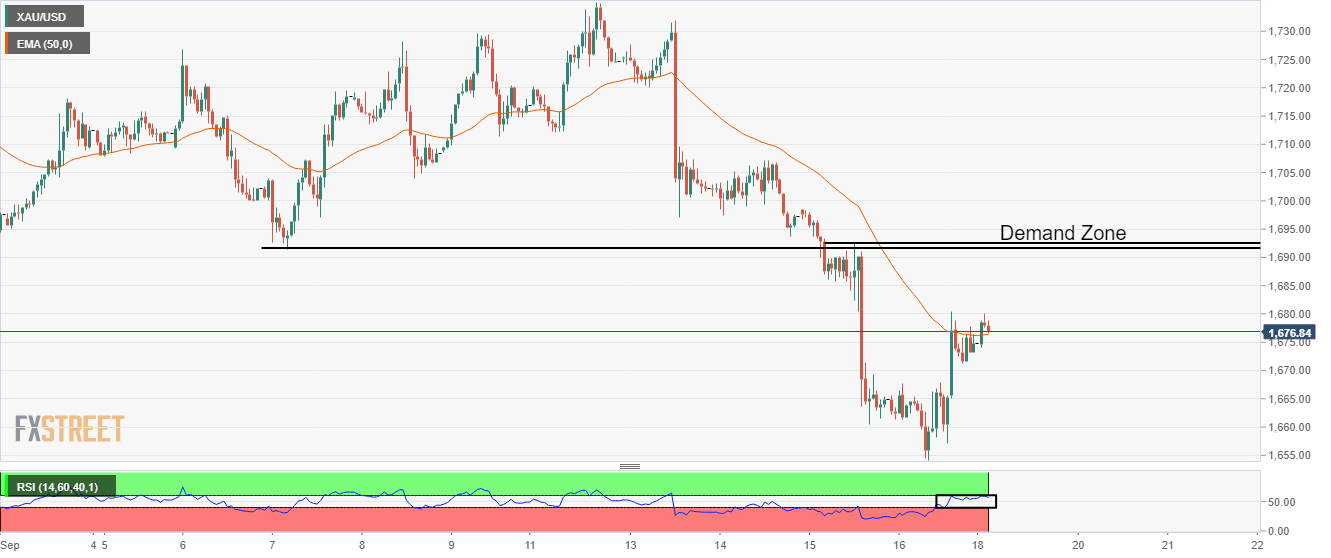

Gold prices are advancing towards the demand zone in a narrow range of $1,692.00-1,693.00 on an hourly scale. The precious metal has crossed the 50-period Exponential Moving Average (EMA) at $1,676.45, which adds to the upside filters. Also, the Relative Strength Index (RSI) (14) is on the verge of shifting into the bullish range of 60.00-80.00.

Gold hourly chart

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.