Gold price struggles near weekly low amid fewer Fed rate cut bets, despite Middle East tensions

- Gold price comes under renewed selling pressure despite a combination of supporting factors.

- The Fed's hawkish stance acts as a tailwind for the USD and weighs on the XAU/USD pair.

- Trade uncertainties and rising geopolitical risks could support the safe-haven precious metal.

Gold price (XAU/USD) is seen consolidating its intraday losses to over a one-week low and trades just below the $3,350 level during the first half of the European session. The US Federal Reserve (Fed) earlier this week trimmed the outlook for rate cuts in 2026 and 2027, which, in turn, is seen acting as a tailwind for the US Dollar (USD) and undermining demand for the non-yielding yellow metal.

Apart from this, a generally positive tone around the European equity markets turns out to be another factor exerting pressure on the Gold price. However, rising geopolitical tensions in the Middle East might keep a lid on any optimism in the market against the backdrop of persistent trade-related uncertainties and limit losses for the safe-haven XAU/USD, which remains on track to register weekly losses.

Daily Digest Market Movers: Gold price bears retain intraday control on the back of Fed's hawkish stance

- The US Federal Reserve (Fed) held interest rates steady at the end of a two-day meeting on Wednesday amid concern that US President Donald Trump's tariffs could push up consumer prices. In the so-called dot plot, the committee projected two rate cuts by the end of 2025. However, Fed officials forecasted only one 25-basis points rate cut in each of 2026 and 2027 amid the risk that inflation could stay persistently higher.

- The global risk sentiment remains fragile on the back of persistent trade-related uncertainties and rising geopolitical tensions in the Middle East. In fact, Trump said earlier this week that tariffs on the pharma sector are coming soon. This adds a layer of uncertainty in the markets ahead of the July 9 deadline for sweeping “liberation day” tariffs and keeps investors on edge, which could benefit the safe-haven Gold price.

- On the geopolitical front, the aerial war between Iran and Israel continues for the eighth day amid speculations over a possible US involvement. According to the US Senate Intelligence Committee Chair, Trump said that he would give Iran the last chance to make a deal to end its nuclear program and delay his final decision on launching strikes for up to two weeks. This raises the risk of a broader regional war in the Middle East.

- The US Dollar is seen retreating further from over a one-week high touched on Thursday, in the aftermath of the Fed's hawkish pause, which, in turn, could support the commodity. Moreover, the supportive fundamental backdrop suggests that the path of least resistance for the XAU/USD pair is to the upside and backs the case for the emergence of some dip-buying at lower levels heading into the weekend.

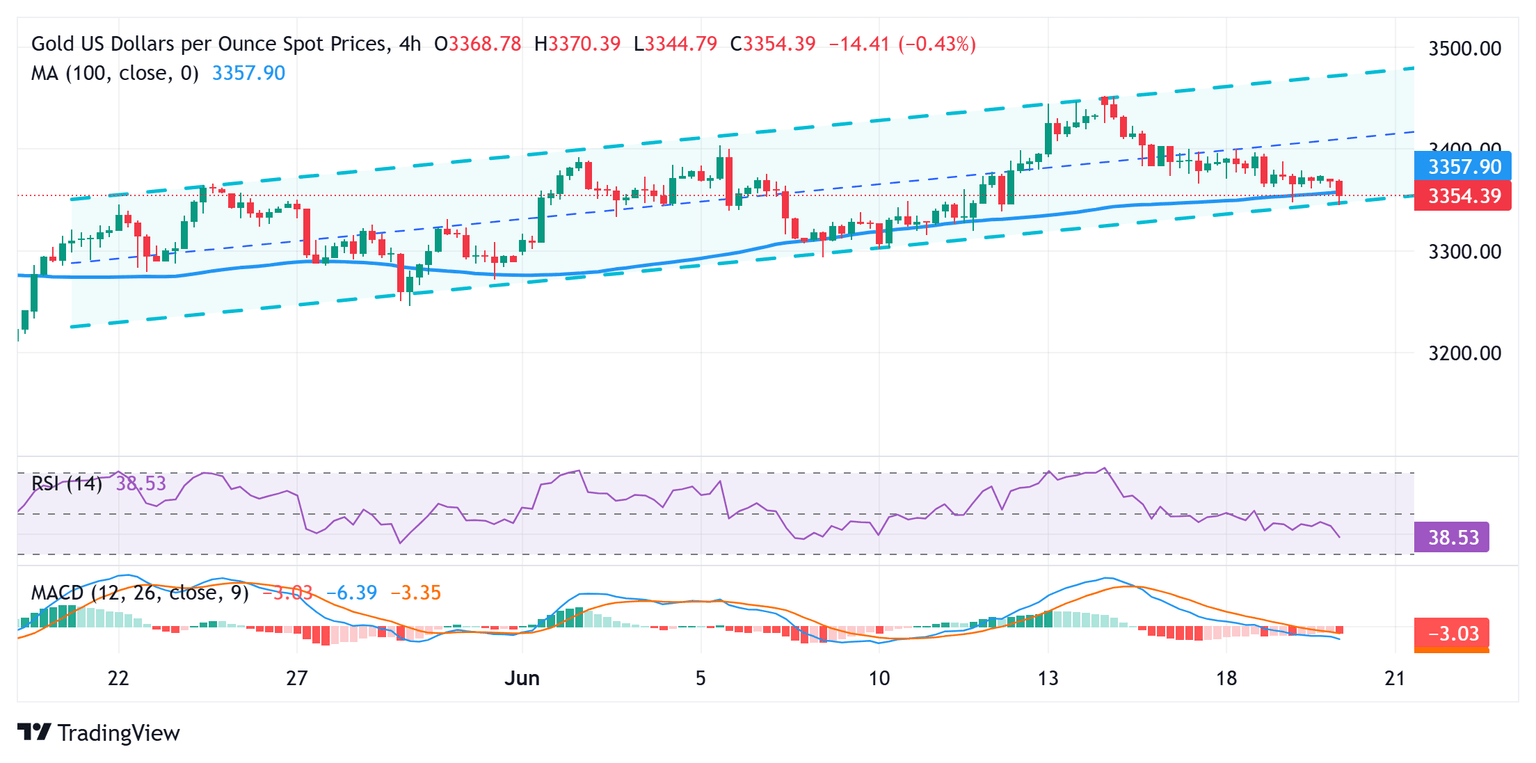

Gold price needs to find acceptance below ascending channel support to back the case for deeper losses

From a technical perspective, the intraday slide drags the Gold price below the 100-period Simple Moving Average (SMA), to a pivotal support marked by the lower boundary of a short-term ascending channel. Given that oscillators on the daily chart have been losing traction and gaining negative momentum on hourly charts, some follow-through selling should pave the way for an extension of this week's retracement slide from a nearly two-month high. The XAU/USD pair might then accelerate the fall towards the $3,323-3,322 intermediate support before eventually dropping to the $3,300 round figure.

On the flip side, the $3,374-3,375 horizontal zone might now act as an immediate hurdle ahead of the $3,400 mark. A sustained move beyond the latter could lift the Gold price to the $3,434-3,435 region en route to the $3,451-3,452 area, or a nearly two-month top touched on Monday. Some follow-through buying would then allow bulls to aim towards challenging the all-time peak, around the $3,500 psychological mark, which nears the ascending channel barrier.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.