Gold price recovers further from one-month low, retakes $3,300 ahead of US PCE Price Index

- Gold price attracts dip-buying as USD bulls pause after the overnight rally to a two-month high.

- The Fed’s hawkish tone tempers September rate cut bets and should limit any deeper USD losses.

- Traders now look forward to the release of the US PCE Price Index for some meaningful impetus.

Gold price (XAU/USD) builds on its steady intraday recovery through the first half of the European session on Thursday and has now reversed a major part of the previous day's slump to a one-month low. The US Dollar (USD) retreats slightly as bulls opt to take some profits off the table following the previous day's hawkish Federal Reserve (Fed)-inspired rally to a two-month peak. This, in turn, is seen as a key factor offering some support to the commodity.

The supporting factor, to a large extent, overshadows the upbeat market mood, which tends to undermine the safe-haven Gold price. However, reduced bets for a rate cut in September by the Fed could limit a deeper USD corrective fall and act as a headwind for the non-yielding yellow metal. Traders might also opt to wait for the release of the crucial US inflation data before positioning for the next leg of a directional move for the XAU/USD pair.

Daily Digest Market Movers: Gold price continues to be underpinned by retreating USD

- The US Federal Reserve kept its benchmark interest rate unchanged for the fifth consecutive meeting, in a range of 4.25% to 4.5%, despite intense pressure from US President Donald Trump and his allies to lower borrowing costs. The decision, however, met opposition from Fed Governors Michelle Bowman and Christopher Waller. This was the first time since 1993 that two governors had dissented on a rate decision.

- In the accompanying monetary policy statement, the committee had a more optimistic view and noted that the economy continued to expand at a solid pace. Adding to this, Fed Chair Jerome Powell said during the post-meeting press conference that the central bank had made no decisions about whether to cut rates in September. This comes on top of the upbeat US macro data, and lifted the US Dollar to a two-month high.

- Automatic Data Processing reported that private payrolls in the US rose by 104,000 jobs in July, following a revised 23,000 fall recorded in the previous month. Adding to this, the Advance US Gross Domestic Product (GDP) report published by the US Commerce Department showed that the economy expanded at a 3.0% annualized pace during the second quarter after contracting by 0.5% in the previous quarter.

- Traders now look to the Fed's preferred inflation gauge – the core PCE Price Index – for a fresh impetus. In the meantime, the USD bulls seem reluctant to place aggressive bets, assisting the Gold price to attract some buyers during the Asian session on Thursday. The fundamental backdrop, however, makes it prudent to wait for strong follow-through buying before confirming that the XAU/USD pair has bottomed out.

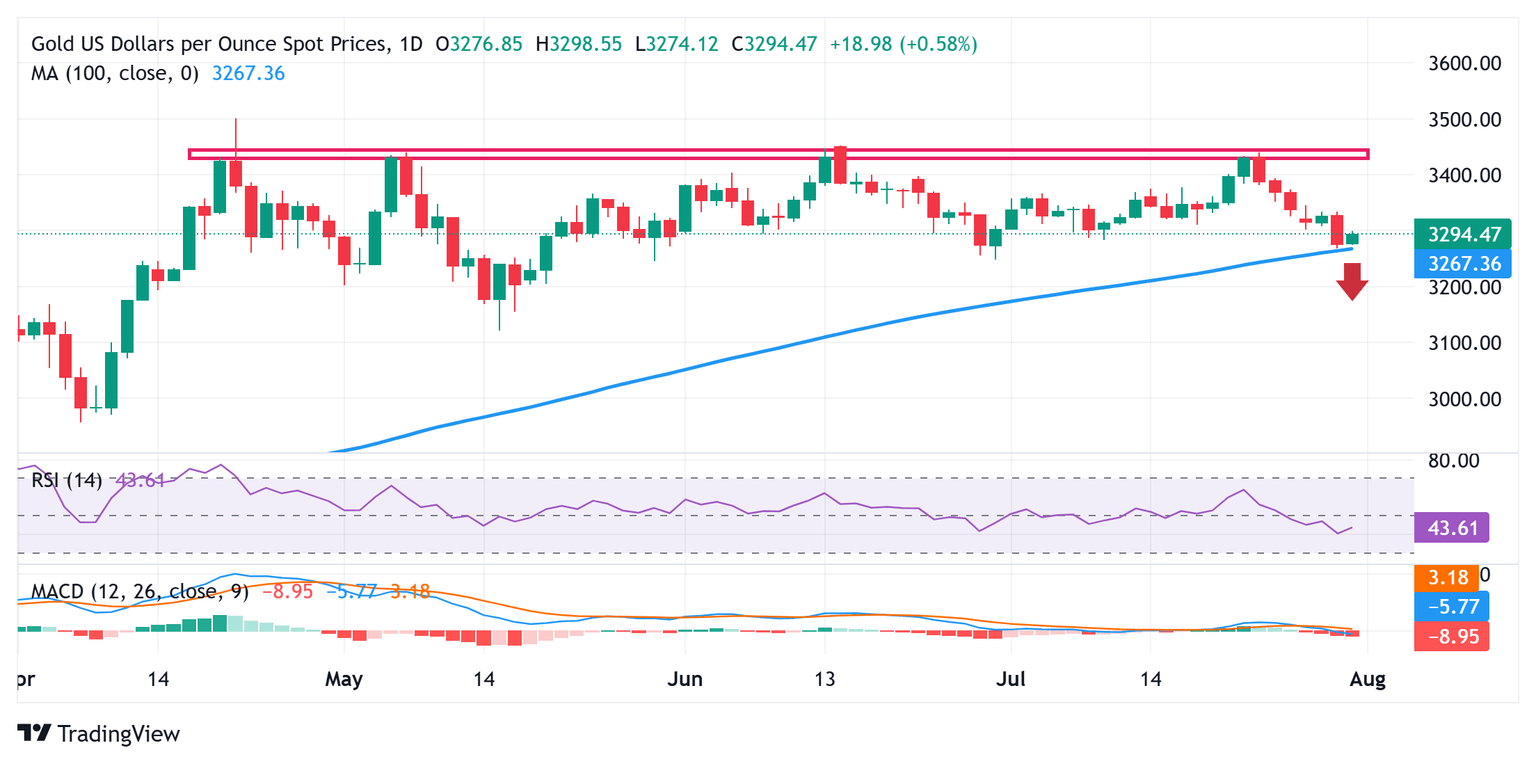

Gold price could accelerate the recovery move once the $3,309-3,310 hurdle is cleared

From a technical perspective, the commodity finds some support ahead of the 100-day Simple Moving Average (SMA) and, for now, seems to have stalled the post-FOMC downfall. However, oscillators on the daily chart have just started gaining negative traction, suggesting that any subsequent strength beyond the $3,300 mark is more likely to be sold into and remain capped near the $3,310 area. A sustained move above the latter, however, could trigger a short-covering rally and lift the Gold price to the next relevant hurdle near the $3,325-3,326 horizontal zone.

On the flip side, the $3,275-3,270 area (nearing the 100-day SMA) might continue to protect the immediate downside, below which the Gold price could retest the June monthly swing low, around the $3,248-3,247 region. The latter should act as a key pivotal point, which, if broken decisively, will be seen as a fresh trigger for the XAU/USD bears and pave the way for a fall towards the $3,200 round figure.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.