Gold price eases from record high amid positive risk tone; bullish bias remains

- Gold price refreshes record high as US-China trade war underpins safe-haven demand.

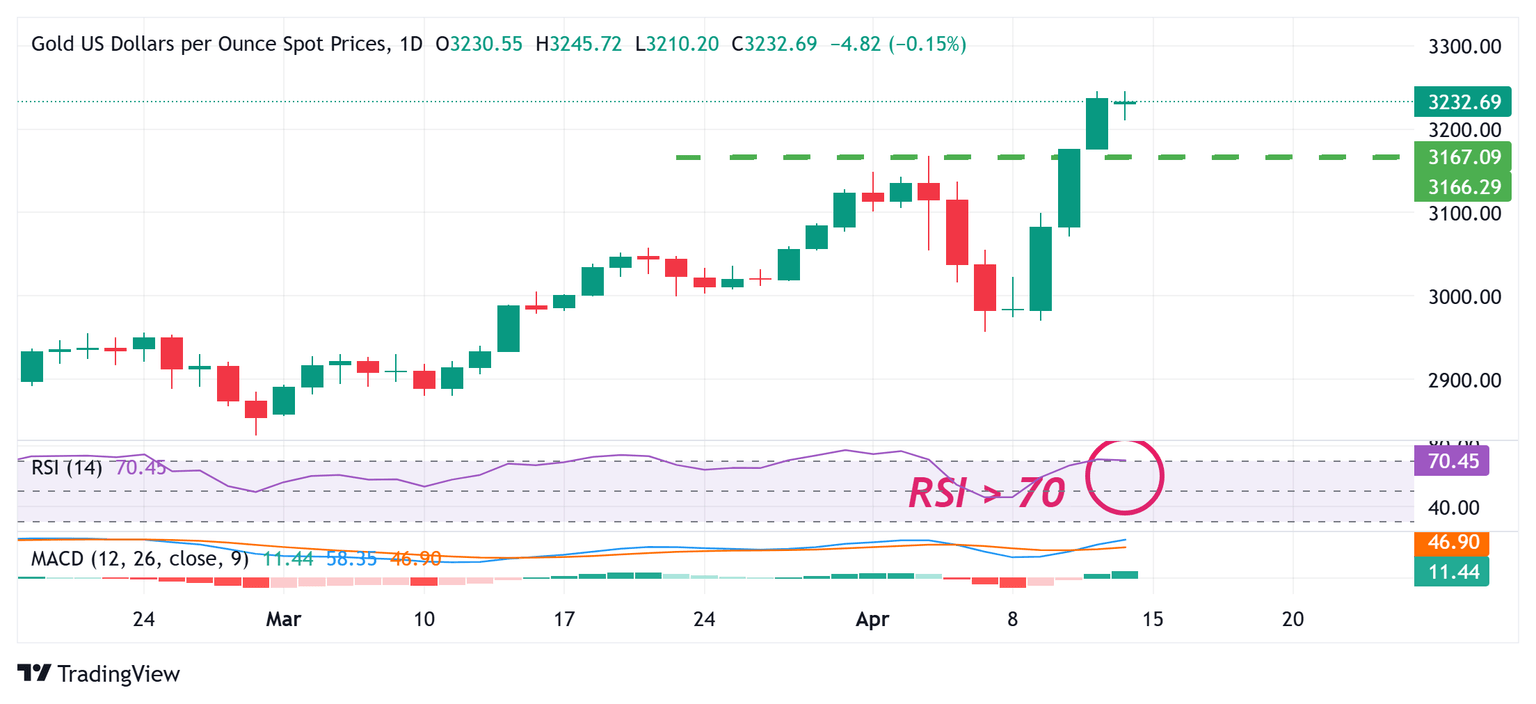

- A positive risk tone caps gains for the precious metal amid a slightly overbought daily RSI.

- US recession fears, Fed rate cut bets, and a bearish USD should support the XAU/USD pair.

Gold price (XAU/USD) retreats after touching a fresh record high earlier this Monday and trades with a mild negative bias around the $3,220 area during the first half of the European session. A positive tone around the equity markets prompts some profit-taking around the precious metal amid slightly overbought conditions on the daily chart. Any meaningful corrective decline, however, still seems elusive in the wake of a sharp escalation in US-China trade tensions, which might continue to act as a tailwind for the safe-haven bullion.

Meanwhile, investors now seem convinced that the Federal Reserve (Fed) will resume its rate-cutting cycle soon and lower borrowing costs at least three times this year amid worries about a tariffs-driven US economic slowdown. This keeps the US Dollar (USD) depressed near its lowest level since April 2022 and should contribute to limiting the downside for the non-yielding Gold price. Hence, any subsequent slide might still be seen as a buying opportunity and is more likely to remain limited, warranting caution for bearish traders.

Daily Digest Market Movers: Gold price bulls turn cautious as improving risk sentiment undermines safe-haven demand

- China increased its tariffs on US imports to 125% on Friday in retaliation for US President Donald Trump's decision to raise duties on Chinese goods to a combined 145%. This, in turn, adds to market concerns that the escalating trade war between the world's two largest economies would weaken global economic growth and lift the safe-haven Gold price to a fresh all-time peak.

- Meanwhile, the recent unusual spike in US Treasury yields suggests that investors are dumping US government bonds amid the weakening confidence in the US economy. Adding to this, the prospects for more aggressive policy easing by the Federal Reserve (Fed), bolstered by the US consumer inflation data released last week, keep the US Dollar depressed and further benefit the commodity.

- The US Bureau of Labor Statistics reported last Thursday that the headline Consumer Price Index (CPI) fell 0.1% in March and the yearly rate decelerated sharply to 2.4% from 2.8% in February. Moreover, the core CPI, which strips out food and energy, rose just 0.1% from the month before and came in at 2.8% for the 12 months ended in March, marking its lowest rate in nearly four years.

- Traders are now pricing in 90 basis points of Fed rate cuts by year-end 2025, which might further contribute to driving flows towards the non-yielding yellow metal. Moreover, investors expect tariffs to push inflation higher in the coming months. This could further underpin the XAU/USD's status as a hedge against rising prices and support prospects for a further near-term appreciation.

- Market participants this week will closely scrutinize comments from influential FOMC members, including Fed Chair Jerome Powell on Wednesday, for cues about the future rate-cut path. Apart from this, the US monthly Retail Sales figures, also due on Wednesday, will drive the USD demand and provide some meaningful impetus to the precious metal during the latter half of the week.

Gold price near-term bias seems tilted firmly in favor of bulls; the $3,168-3,167 support holds the key

From a technical perspective, the daily Relative Strength Index (RSI) is holding just above the 70 mark and points to slightly overstretched conditions. Hence, it will be prudent to wait for some near-term consolidation or a modest pullback before traders start positioning for a fresh leg up. Meanwhile, any corrective slide could be seen as a buying opportunity near the $3,200 round figure, which, in turn, should help limit the downside for the Gold price near the $3,168-3,167 region. The latter should act as a strong base and a key pivotal point for short-term traders.

Risk sentiment FAQs

In the world of financial jargon the two widely used terms “risk-on” and “risk off'' refer to the level of risk that investors are willing to stomach during the period referenced. In a “risk-on” market, investors are optimistic about the future and more willing to buy risky assets. In a “risk-off” market investors start to ‘play it safe’ because they are worried about the future, and therefore buy less risky assets that are more certain of bringing a return, even if it is relatively modest.

Typically, during periods of “risk-on”, stock markets will rise, most commodities – except Gold – will also gain in value, since they benefit from a positive growth outlook. The currencies of nations that are heavy commodity exporters strengthen because of increased demand, and Cryptocurrencies rise. In a “risk-off” market, Bonds go up – especially major government Bonds – Gold shines, and safe-haven currencies such as the Japanese Yen, Swiss Franc and US Dollar all benefit.

The Australian Dollar (AUD), the Canadian Dollar (CAD), the New Zealand Dollar (NZD) and minor FX like the Ruble (RUB) and the South African Rand (ZAR), all tend to rise in markets that are “risk-on”. This is because the economies of these currencies are heavily reliant on commodity exports for growth, and commodities tend to rise in price during risk-on periods. This is because investors foresee greater demand for raw materials in the future due to heightened economic activity.

The major currencies that tend to rise during periods of “risk-off” are the US Dollar (USD), the Japanese Yen (JPY) and the Swiss Franc (CHF). The US Dollar, because it is the world’s reserve currency, and because in times of crisis investors buy US government debt, which is seen as safe because the largest economy in the world is unlikely to default. The Yen, from increased demand for Japanese government bonds, because a high proportion are held by domestic investors who are unlikely to dump them – even in a crisis. The Swiss Franc, because strict Swiss banking laws offer investors enhanced capital protection.

BRANDED CONTENT

Finding the right broker for trading Gold is crucial, as not all brokers offer the same advantages. Explore our list of top-performing brokers to discover the best options for seamless and cost-effective Gold trading.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.