Gold price edges higher amid retreating USD and safe-haven buying ahead of Fed decision

- Gold price gains some positive traction amid the cautious market mood and a softer USD.

- The US-China trade uncertainty lends additional support to the safe-haven precious metal.

- Hawkish Fed expectations could cap gains for the XAU/USD ahead of the FOMC decision.

Gold price (XAU/USD) trades with a positive bias for the second straight day on Wednesday, though it lacks follow-through as traders remain on the sidelines ahead of the highly anticipated FOMC policy update. The Federal Reserve (Fed) will announce its policy decision at the end of a two-day policy meeting later today. Investors will look for cues about the future rate-cut path, which will play a key role in influencing the near-term US Dollar (USD) price dynamics and provide some meaningful impetus to the non-yielding yellow metal.

Meanwhile, the market nervousness heading into the key central bank event and the uncertainty over an extension of the US-China trade truce act as a tailwind for the safe-haven Gold price. Furthermore, some repositioning trade drags the USD away from its highest level since June 23, set on Tuesday, which, in turn, is seen as another factor underpinning the commodity. That said, reduced bets for an immediate interest rate cut by the Fed could limit a deeper USD corrective decline and keep a lid on any further appreciating move for the XAU/USD pair.

Daily Digest Market Movers: Gold price draws support from reviving safe-haven demand and a softer USD

- The US Dollar bulls take a brief pause following the recent sharp rally to over a one-month peak touched on Tuesday and ahead of the crucial FOMC monetary policy decision later this Wednesday. According to the CME Group's FedWatch Tool, traders are currently pricing in a 97% chance that the Federal Reserve will leave interest rates unchanged in the 4.25-4.50% range despite relentless pressure from US President Donald Trump.

- Hence, the focus will remain glued to the accompanying monetary policy statement and Fed Chair Jerome Powell's comments during the post-meeting press conference. There is still a possibility of a more hawkish tone amid the upside risks to inflation from higher US tariffs. Investors, however, still expect the Fed to signal a rate cut in September. Nevertheless, the outlook will drive the USD and influence the non-yielding Gold price.

- Heading into the key central bank event, traders will take cues from the US ADP report on private-sector employment amid signs of a slowdown in the labor market. In fact, the Job Openings and Labor Turnover Survey (JOLTS) published by the US Bureau of Labor Statistics on Tuesday showed that the number of job openings stood at 7.43 million in June, compared to May's downwardly revised print of 7.71 million and 7.55 million expected.

- Separately, the Conference Board's Consumer Confidence Index rose to 97.2 in July from 95.2 the previous month, suggesting that consumers are feeling optimistic. This could translate into increased consumer spending and play a significant role in stimulating economic activity. Hence, investors on Tuesday will also keep a close eye on the Advanced Q2 GDP print, which could provide some impetus to the buck and the XAU/USD pair.

- Market players this week will also confront the release of the US Personal Consumption Expenditure (PCE) Price Index and the Nonfarm Payrolls (NFP) report on Thursday and Friday, respectively. This should continue to infuse some volatility through the second half of the week and produce some meaningful trading opportunities around the commodity.

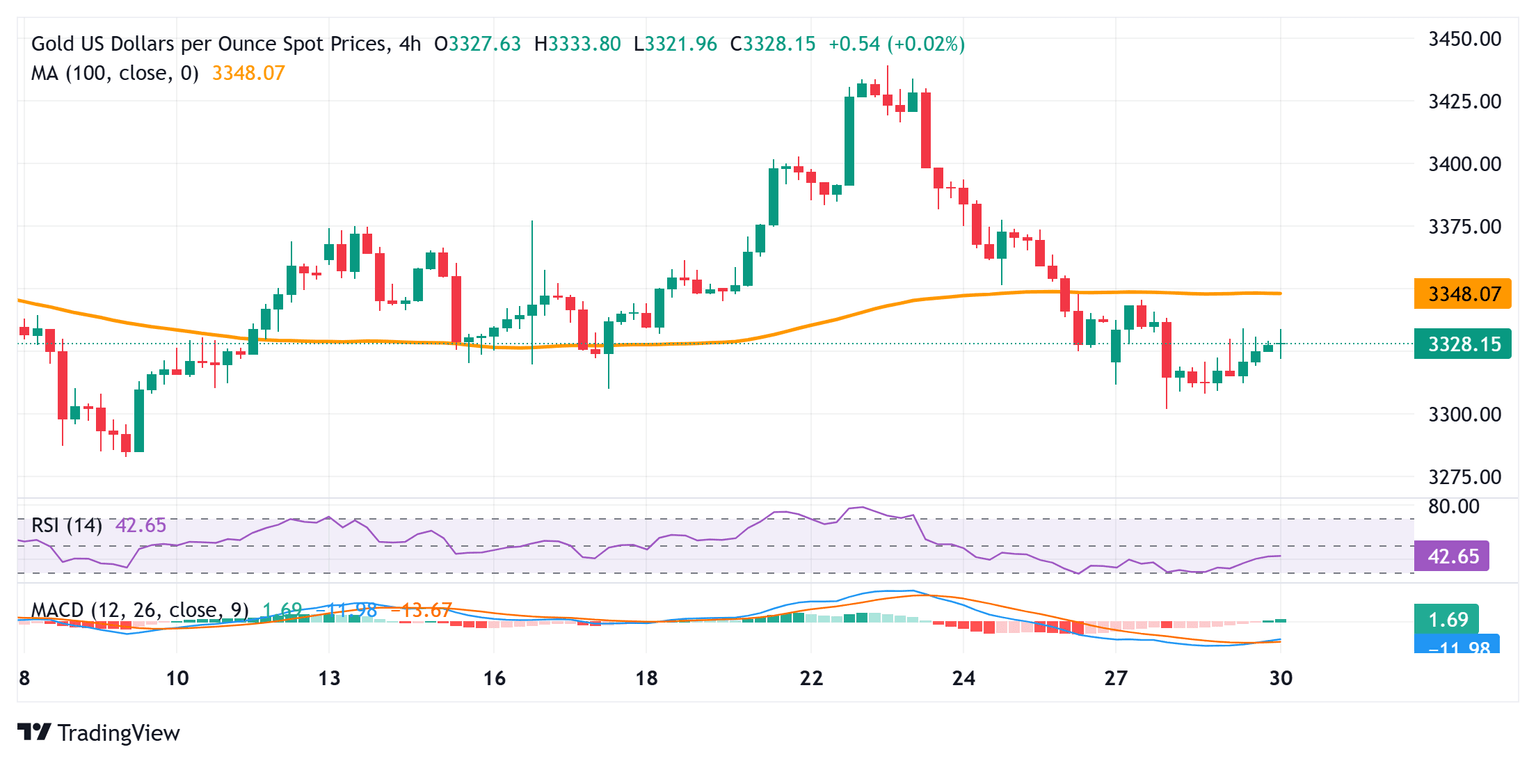

Gold price needs to surpass 100-SMA barrier on H4, around $3,340-3,345 to back the case for additional gains

From a technical perspective, the recent breakdown below the 100-period Simple Moving Average (SMA) on the 4-hour chart was seen as a key trigger for the XAU/USD bears. Moreover, negative oscillators on the said chart suggest that any subsequent move up might still be seen as a selling opportunity and remain capped. However, a modest bounce from the $3,300 neighborhood, or a nearly three-week low touched on Monday, warrants some caution for bearish traders. Hence, it will be prudent to wait for a convincing break below the said handle before positioning for any further losses towards the $3,260-3,255 support, representing the 100-day SMA.

On the flip side, the $3,345 area (100-period SMA on the 4-hour chart) could act as an immediate hurdle, above which the Gold price could climb to the $3,367-3,368 region. A sustained strength beyond the latter might trigger a short-covering rally and allow the XAU/USD pair to reclaim the $3,400 round figure. The momentum could extend further, though it is likely to face a stiff hurdle near the $3,434-3,435 region. Some follow-through buying, however, would negate any near-term negative bias and pave the way for a move towards challenging the all-time peak, around the $3,500 psychological mark touched in April.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.