Gold price flirts with weekly top despite firmer USD, reduced Fed rate cut bets

- Gold price attracts buyers for the third straight day and climbs closer to the weekly top.

- Rising trade tensions offset a broadly firmer USD and remain supportive of the move.

- Reduced Fed rate cut bets do little to hinder the XAU/USD pair's positive momentum.

Gold price (XAU/USD) retains its bullish bias and trades above the $3,340 level, closer to the weekly high during the first half of the European session on Friday. The global risk sentiment took a hit in reaction to US President Donald Trump's fresh tariff threats, which ramped up concerns about a global trade war. This turns out to be a key factor that continues to drive safe-haven flows towards the precious metal for the third consecutive day.

The upward momentum, meanwhile, seems unaffected by some follow-through US Dollar (USD) buying, which tends to undermine the Gold price. Traders have scaled back their bets for an immediate rate cut by the Federal Reserve (Fed) amid expectations that higher tariffs would boost inflation. This keeps the USD firm near a two-week top, though it does little to dent the bullish sentiment surrounding the non-yielding yellow metal.

Daily Digest Market Movers: Gold price bulls retain control as trade jitters continue to drive safe-haven flows

- US President Donald Trump announced a 35% tariff on Canadian imports, effective August 1. The decision was conveyed in a letter, which marks the latest in a string of over 20 similar tariff notices Trump has issued since Monday. This comes following Wednesday's announcement of a 50% tariff on US copper imports and continues to drive safe-haven flows towards the Gold price.

- Minutes from the Federal Reserve's June 17-18 policy meeting showed that most policymakers remain worried about the risk of rising inflationary pressure on the back of Trump's aggressive trade policies. The Minutes also revealed that only a couple of officials felt interest rates could be reduced as soon as this month, assisting the US Dollar to stand firm near a two-week top set on Thursday.

- On the economic data front, the US Department of Labor (DOL) reported that Initial Jobless Claims fell to 227K for the week ending July 5. This was less than the estimates and the previous month's downwardly revised reading of 232K. This, along with stronger US employment details released last Thursday, points to a resilient US labor market and signals no urgency for the Fed to cut rates.

- Meanwhile, San Francisco Fed President Mary Daly said that monetary policy is still restrictive, and it's time to think about adjusting the interest rate. Tariffs aren't as high as they were expected to be, and economic fundamentals support a move toward lower rates at some point, Daly added further.

- Separately, Fed Board of Governors member Christopher Waller noted that tariff inflation effects are likely to be short-lived and that a rate cut here would not be politically motivated. Waller – one of the possible favorites to replace Powell in 2026 – made another push for an early interest rate cut in July.

- In contrast, St. Louis Fed President Alberto Musalem said that it was too soon to tell if tariffs will have a one-off or a more persistent impact on inflation. The economy is in a good place, and it is critical for the Fed to keep long-term inflation expectations anchored, Musalem added further.

- There isn't any relevant market-moving economic data due for release from the US on Friday, leaving the USD at the mercy of comments from influential FOMC members. Apart from this, trade-related developments should contribute to providing some impetus to the XAU/USD pair on the last day of the week. At current levels, the commodity remains on track to end the week on a flattish note.

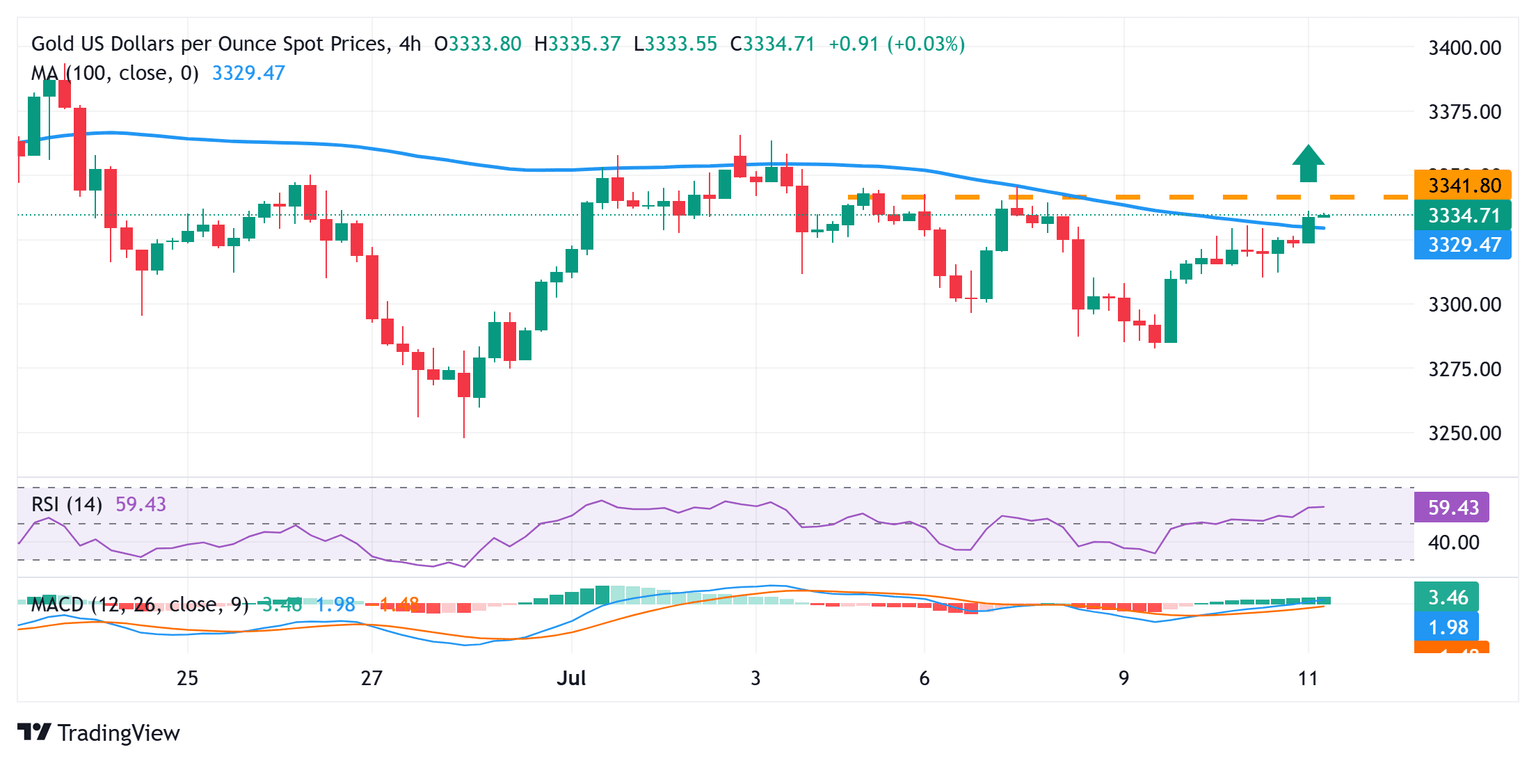

Gold price seems poised to extend the momentum further towards reclaiming the $3,400 mark

From a technical perspective, some follow-through buying beyond the $3,340-3,342 horizontal barrier will confirm a breakout through the 100-period Simple Moving Average (SMA) on the 4-hour chart. This, along with slightly positive oscillators on the said chart, should pave the way for a further near-term appreciating move and lift the Gold price to the next relevant hurdle near the $3,360-3,362 region. The momentum could extend further and allow the XAU/USD pair to reclaim the $3,400 mark.

On the flip side, weakness below the $3,326 immediate support could attract some dip-buyers and help limit the downside for the Gold price near the $3,300 round figure. This is followed by the $3,283-3,282 region, or over a one-week low touched on Tuesday. A convincing break below the latter would make the XAU/USD pair vulnerable to accelerate the fall towards the July swing low, around the $3,248-3,247 area.

US Dollar FAQs

The US Dollar (USD) is the official currency of the United States of America, and the ‘de facto’ currency of a significant number of other countries where it is found in circulation alongside local notes. It is the most heavily traded currency in the world, accounting for over 88% of all global foreign exchange turnover, or an average of $6.6 trillion in transactions per day, according to data from 2022. Following the second world war, the USD took over from the British Pound as the world’s reserve currency. For most of its history, the US Dollar was backed by Gold, until the Bretton Woods Agreement in 1971 when the Gold Standard went away.

The most important single factor impacting on the value of the US Dollar is monetary policy, which is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability (control inflation) and foster full employment. Its primary tool to achieve these two goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, the Fed will raise rates, which helps the USD value. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates, which weighs on the Greenback.

In extreme situations, the Federal Reserve can also print more Dollars and enact quantitative easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used when credit has dried up because banks will not lend to each other (out of the fear of counterparty default). It is a last resort when simply lowering interest rates is unlikely to achieve the necessary result. It was the Fed’s weapon of choice to combat the credit crunch that occurred during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy US government bonds predominantly from financial institutions. QE usually leads to a weaker US Dollar.

Quantitative tightening (QT) is the reverse process whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing in new purchases. It is usually positive for the US Dollar.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.