Gold Price Analysis: XAU/USD’s bearish bias intact while below $1706 – Confluence Detector

Gold (XAU/USD) bulls are trying hard to extend the recovery momentum from nine-month lows of $1676, finding some respite from the retreat in the US Treasury yields across the curve. The turnaround in the Asian equities, thanks to the Chinese intervention, has lifted the market mood, lifting the metal at the US dollar’s expense.

However, the greenback could likely regain the upside momentum if risk-aversion seeps back amid a resumption of the rally in the US Treasury yields, as the House of Representatives is due to vote the Senate’s $1.9 trillion stimulus bill on Wednesday. The price action around the yields will continue to remain the key driver for gold, in absence of relevant US economic data.

How is gold positioned on the technical graphs?

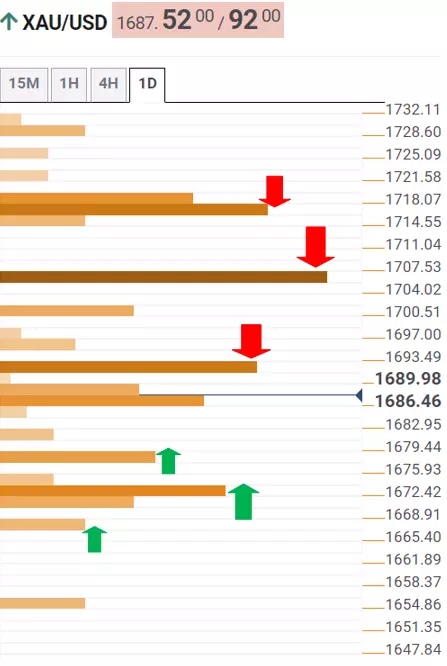

Gold Price Chart: Key resistance and support levels

The Technical Confluences Detector shows that gold is struggling to take out a major resistance at $1692, which is the convergence of the previous high four-hour and Fibonacci 38.2% one-day.

The buyers will then look to recapture the Fibonacci 61.8% level at $1700, above which powerful barrier at $1706 could challenge the bulls’ commitments.

Acceptance above the latter is critical to unleashing further recovery gains towards $1715-$1717 levels, which is the intersection of the previous month low and the Fibonacci 38.2% one-week.

To the downside, the convergence of the previous day low and Bollinger Band Four-hour lower at $1677 could be put to test once again.

The next downside target is aligned at $1672, the pivot point one-month S1.

Further south, the pivot point one-day S1 at $1666 could guard the additional downside.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.