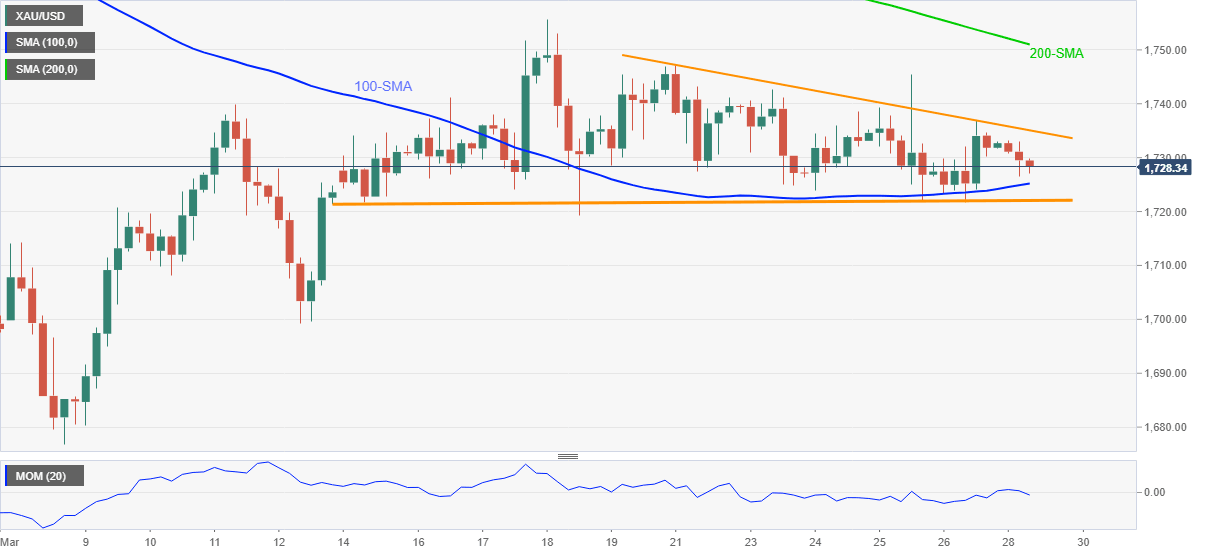

Gold Price Analysis: XAU/USD sellers eye 100-SMA inside immediate falling triangle

- Gold extends pullback from $1,733 towards intraday low.

- Downward sloping momentum line suggests further weakness but triangle formation will test the sellers.

- Bulls are less likely to enter below 200-SMA.

Gold takes offers around $1,727, down 0.32% intraday, while heading into Monday’s European session. In doing so, the yellow metal stays inside a short-term falling triangle bullish chart pattern.

Given the descending Momentum, 100-SMA around $1,725 can offer an intermediate halt during the fall targeting the triangle’s support line close to $1,722.

However, any further downside past-$1,722 becomes less likely and the same may not refrain from challenging the $1,700 if broken.

Alternatively, gold buyers will wait for a clear upside break of the stated triangle’s resistance line, at $1,735 by the press time, to confirm the bullish formation.

While November 2020 lows near $1,765 could lure the bullion buyers past-$1,735, 200-SMA around $1,751 may offer an intermediate halt during the rise.

To sum up, gold is weak but is near to the short-term supports and risks rebound.

Gold four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.