Gold Price Analysis: XAU/USD picked low hanging fruit, faces bigger test now – Confluence Detector

Gold is on the rise, emerging from the lows near $1.900 as the market mood improves ahead of a critical speech by Jerome Powell, Chairman of the Federal Reserve. Will the Fed allow for higher inflation and send investors toward the precious metal?

Another positive factor is an announcement by Moderna – a pharmaceutical firm – about elderly people responding well to its vaccine candidate. XAU/USD has swiftly skipped over low hurdles and is now facing fiercer resistance on the technical chart.

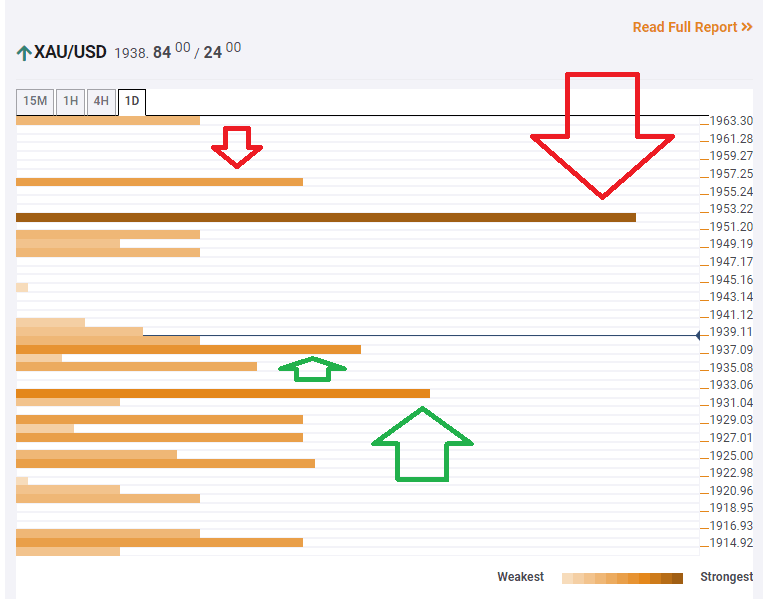

The Technical Confluences Indicator is showing that XAU/USD is trading above $1,937, a resistance line turned support. At that point, the Fibonacci 23.6% one-week, the previous 1h-high, and other lines converge.

A more considerable cushion is at $1,932, which is a confluence including the Bollinger Band 4h-Middle and the Fibonacci 23.6% one-week.

Looking up, the next target is $1,952, which is strong resistance. It is a cluster including the Fibonacci 38.2% one-week, the Simple Moving Average 50-4h, the SMA 200-1h, and the Fibonacci 161.8% one-day.

Further above, $1,956 is a soft cap, where the Pivot Point one-day Resistance 3 hits the price.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.