Gold Price Analysis: XAU/USD on the edge of critical support at $1,857 – Confluence Detector

Will the Federal Reserve print less money? Will the new administration pump more funds into the economy? Gold traders are weighing in the rising prospects of less bond-buying from the Fed, but perhaps a generous package from President-elect Joe Biden, as Democrats are set to have full control of the Senate.

The precious metal has been stabilizing but that may not last for too long.

How is XAU/USD positioned on the technical graphs?

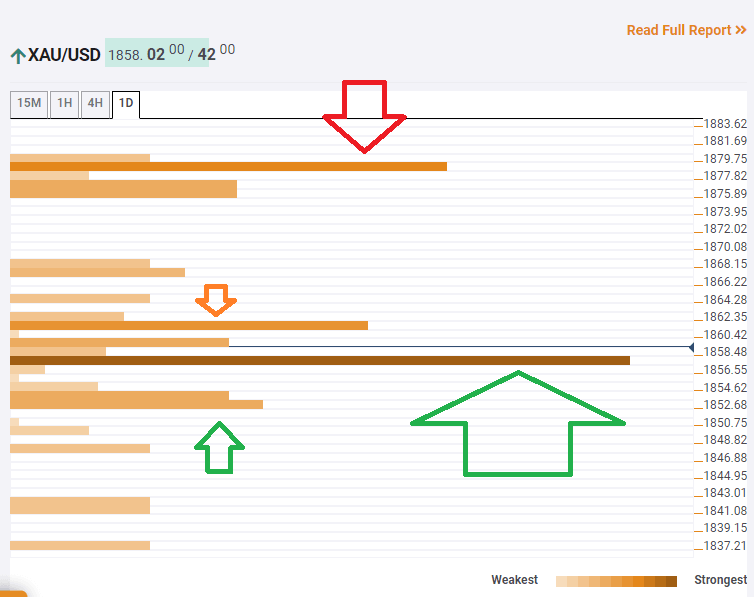

The Technical Confluences Indicator is showing that gold is approaching critical support at $1,857, which is the convergence of the Simple Moving Average 5-4h, the Fibonacci 38.2% one-month, the Bollinger Band 1h-Middle, the Fibonacci 23.6% one-day, and more.

Further down, the next cushion is $1,852, which is a juncture including t the SMA 200-15m, the SMA 50-1h, the Bollinger Band 1h-Lower, and more.

Weak resistance awaits at $1,861, which is the melting point of the BB 15min-Upper and the previous 1h-high.

The upside target is $1,878, which is the confluence of the of Fibonacci 38.2% one-week and the Pivot Point one-day R2.

XAU/USD resistance and support levels

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.