Gold Price Analysis: XAU/USD needs to crack $1,817 to unleash the upside – Confluence Detector

Gold has on a recovery path after nearly falling below $1,800. Dollar strength seen early in the week has made way for risky assets to move higher, allowing the precious metal to claw back some lost ground. As Americans get ready to gobble turkey for Thanksgiving, markets have calmed down but remain active.

How is XAU/USD positioned on the charts?

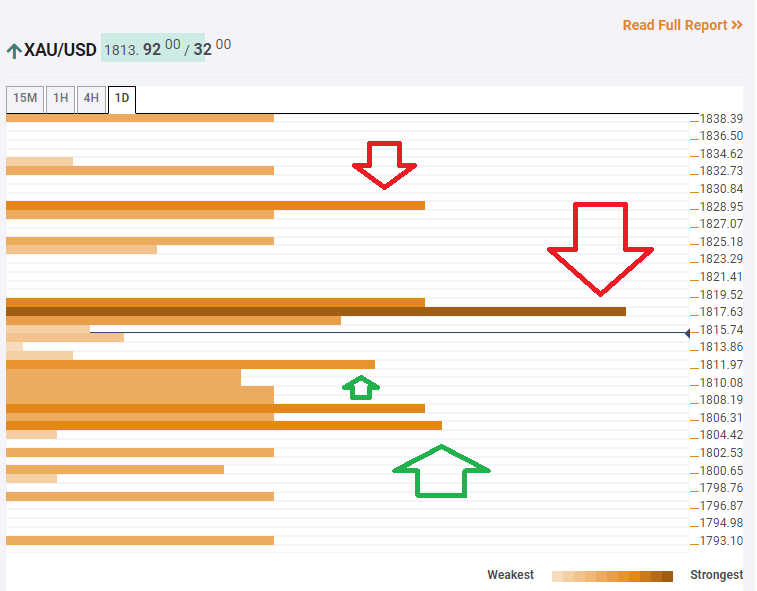

The Technical Confluences Indicator is showing that gold faces fierce resistance at around $1,817, which is the convergence of the Bollinger Band 15min-Upper, the Pivot Point one-month Support 2, the BB 1h-Upper, and the PP one-day R1.

Further above, the upside target is $1,828, which is the meeting point of the PP one-week S1 and the Fibonacci 161.8% one-day.

Some support is at $1,812, which is a juncture of lines including the BB 15min-Lower, the Fibonacci 61.8% one-day and the Simple Moving Average 501-5m.

A more substantial cushion is at $1,805, which is a confluence point including the PP one-week S3, the BB 1h-Lower and the Fibonacci 23.6% one-day.

Key XAU/USD resistances and supports

Confluence Detector

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.