Gold Price Analysis: XAU/USD heads back towards key $1828 support ahead of Powell

- Gold’s rebound loses steam below $1850, bears take over.

- Rising channel breakdown on 1H chart points to more losses.

- A breach of key $1828 support remains likely ahead of Powell.

Gold (XAU/USD) remains vulnerable to deeper losses, as the US Treasury yields and the dollar continue to cheer the prospects of a bigger-than-expected fiscal stimulus plan, of about $2 trillion, likely to be announced by President-elect Joe Biden on Friday. Ahead of that, the Fed Chair Powell's speech will hold the key for fresh gold trades.

At the time of writing, gold trades at $1841, down 0.46% on the day, as the recovery ran into stiff offers just below the $1850 level.

Gold Price Chart: Hourly

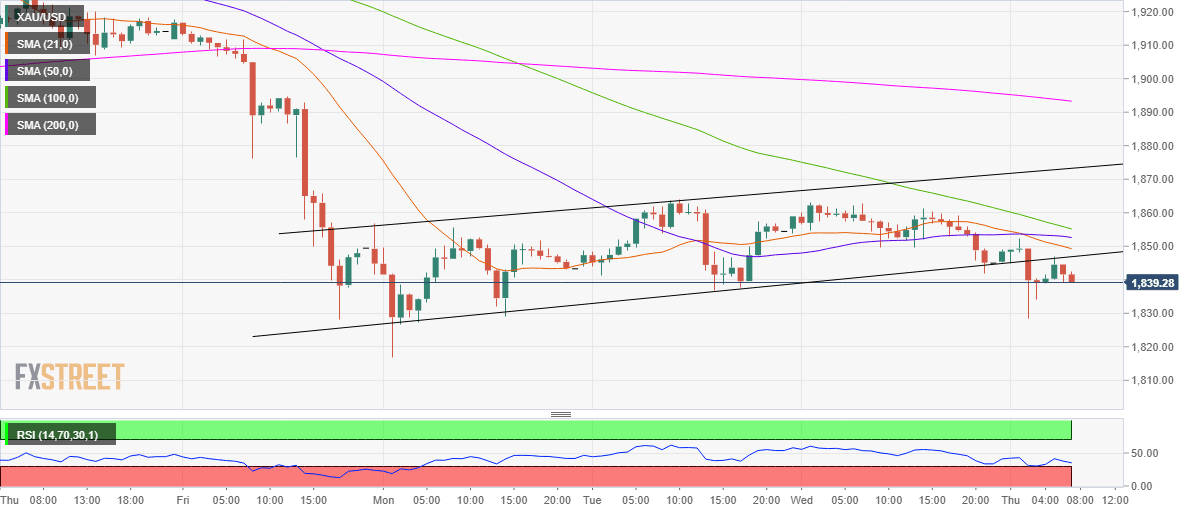

The downside bias in gold remains intact, especially after the price confirmed a rising channel breakdown on the hourly chart on Biden’s expected stimulus news.

The bearish crossover of the 21-hourly moving average (HMA) and 50-HMA added credence to the selling bias. The metal breached the pattern support, now at $1853, and spiraled down to hit daily lows at $1828.54.

Ever since the bulls are trying hard to stage a comeback but in vain, as the Relative Strength Index (RSI) points south below the midline while holding well above the oversold territory. The RSI is currently seen at 36.10.

The recovery attempts are capped below the pattern support now resistance at $1847. The next relevant hurdle awaits at the bearish 21-HMA at $1849. The 50-HMA at $1853 could offer further resistance.

Alternatively, the sellers could retest the daily lows, below which the January 11 low of $1817 would be on their radars.

Gold Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.